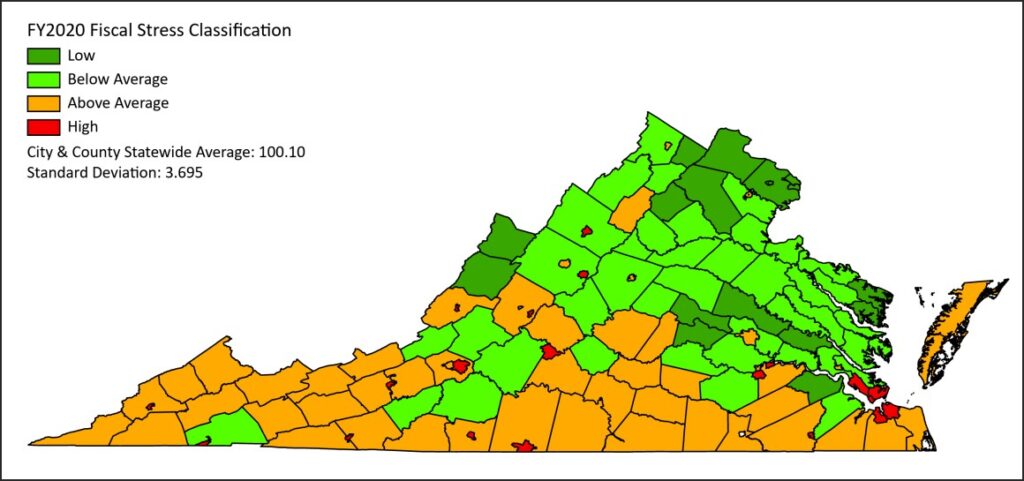

The Commission on Local Government has published its 2022 update on the fiscal condition of Virginia localities. No surprises here — the same geographical patterns hold as in the past. The most stressed localities are uniformly cities, and the most stressed are small cities. The least stressed are counties in Northern Virginia and on the metropolitan fringe of Richmond. Two remarkable outliers, Bath and Highland counties, seem to be in great shape relatively speaking. View the report for details of your jurisdiction.

Of greatest interest is the change in revenue capacity between 2019 and 2020, the latest year covered. The biggest winner: Sussex County, with a gain of 14.5%. The biggest loser: Prince George County, with a loss of 4.o%. Continue reading

by Dick Hall-Sizemore

by Dick Hall-Sizemore

by Dick Hall-Sizemore

by Dick Hall-Sizemore