by James A. Bacon

by James A. Bacon

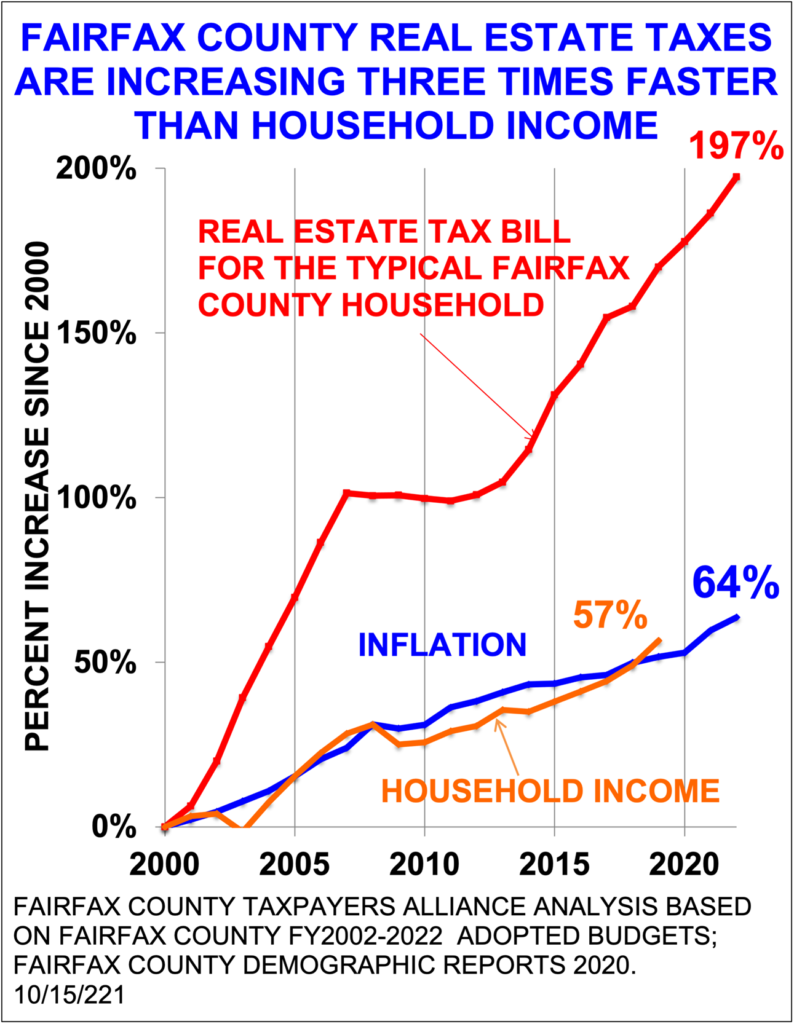

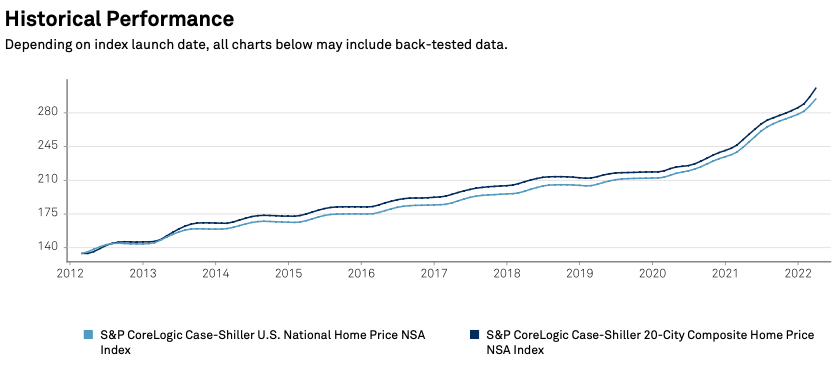

This past year saw one of the greatest redistributions of wealth in U.S. history. People are upset by the 8.5% increase in inflation, but they’re not nearly as upset as they should be.

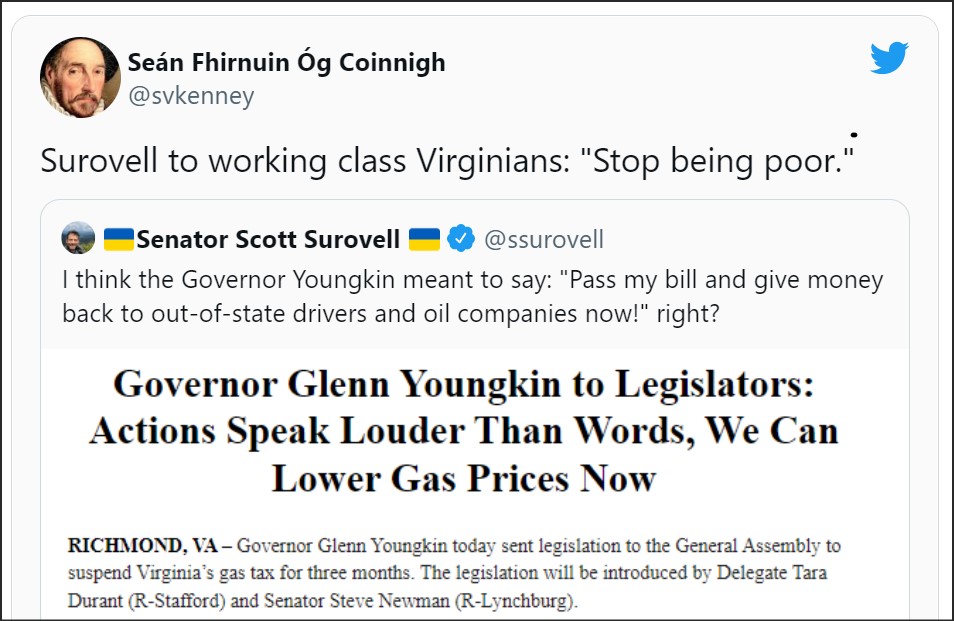

Wage earners, especially lower-income wage earners, have every right to be irate. Their hourly pay has increased, but not nearly as rapidly as the Consumer Price Index, and far less than those components of the CPI such as food, housing and gasoline that comprise a major share of their household budgets. Many were living paycheck to paycheck before the onset of inflation. Now they’re drowning.

Retirees ought to be enraged. Inflation is more devastating by far to their financial security than taxes. A retiree family with a middle-class standard of living might pay, say, $20,000 a year in federal taxes. But if they have a $1 million nest egg in 401(k), IRA and other investments, an 8.5% inflation rate pillages $85,000 from their net worth.

Who are the beneficiaries of inflation? Borrowers — homeowners with a mortgage, consumers with credit card debt, motorists paying off notes on their cars, corporations that have taken advantage of Federal Reserve Bank-engineered low interest rates to leverage their balance sheets, and, of course, the biggest borrower on the face of the planet… the U.S. federal government. Continue reading →

by Dick Hall-Sizemore

by Dick Hall-Sizemore

by Dick Hall-Sizemore

by Dick Hall-Sizemore