by James C. Sherlock

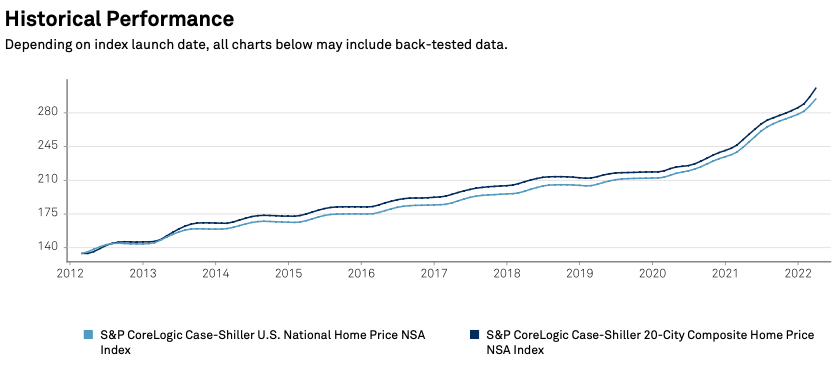

Housing prices have more than doubled since 2012, reflecting shortages of supply and the resulting speculation. The increasing slope of those curves above is not comforting.

Prices have soared over 20% in a year. Mortgage rates are up. What could possibly happen next? Most can figure that out.

But this article is about the effects on local government property taxes of what most predict will be extreme volatility in the housing market going forward.

How are Virginia real property taxes adjusted to mitigate the effects on both property owner tax bills and government receipts in this boom and very likely bust cycle?

We’ll look at the law.

The S&P CoreLogic Case-Schiller Home Price Index reported that home prices were 20.6% higher than they were in March 2021 across the country.

The baseline Virginia law on real estate taxes is Code of Virginia § 58.1-3201. What real estate to be taxed; amount of assessment; public service corporation property.

That law in part:

All real estate, except that exempted by law, shall be subject to such annual taxation as may be prescribed by law.

All general reassessments or annual assessments in those localities which have annual assessments of real estate, except as otherwise provided in § 58.1-2604, shall be made at 100 percent fair market value and, except as provided in § 58.1-2608, the State Corporation Commission and the Department of Taxation shall certify public service corporation property to such county or city, with the exception of the nonoperating (noncarrier) property of railroads, on the basis of the assessment ratio as most recently determined and published by the Department of Taxation. (emphasis added).

The last decade has certainly been good for the tax receipts of many of Virginia’s local governments. Not so good for property owners and those who pay them rents. But homeowners have been comforted by the paper gains on their investments. Until they had to sell and pay inflated prices for replacement properties.

Commercial real estate has suffered since COVID. It is not clear whether real estate assessments have caught up.

But if markets prove rational, the bubble in residential real estate will burst. Rising mortgage rates and prices portend a collapse in demand from buyers of residential real estate, especially at the first rung of the housing ladder, and an inability of renters to afford increased rents.

One outcome is that local government tax receipts are vulnerable.

To see median property taxes by county go here. Loudoun, of course, leads, at a nearly $5,000 median annual tax bill this year. The median bill in Buchanan County is $284. So, it is OK to call that a significant spread. The valuations and tax receipts have soared in Loudoun. Not so much in Buchanan County.

Most of the total is determined by assessed value of the property, the rest by the rate at which that value is taxed.

Local governments perceive “needs” for the taxes they are getting. Many of those are real, but some have been generated by the increasing tax receipts themselves. Local governments are, after all, run by politicians.

One analysis suggests that Virginia property taxes are assessed at only 74% of real value statewide. So, local tax assessors have room to increase assessed valuation without an increase in the rate.

They can also increase rates.

So, it is unwise for property owners to plan that their property tax bills will go down in a recession as quickly as they have risen in the last decade.

What to do? The next General Assembly may have to deal with this situation if the housing recession develops as many forecast. That will be a circus, but one which may prove necessary and which everyone will watch.

More immediately, citizens and their local governments may wish to work together to develop policy for the path ahead.

Leave a Reply

You must be logged in to post a comment.