by Arthur Purves

by Arthur Purves

(Editor’s note: Arthur Purves, president of the Fairfax County Taxpayers Alliance, addressed the Fairfax County School Board on Feb. 13, 2024. His remarks, with updated numbers, are posted below.)

At church I get to ask students and parents around Vienna about our schools. The feedback is positive, and we appreciate your dedicated teachers and administrators.

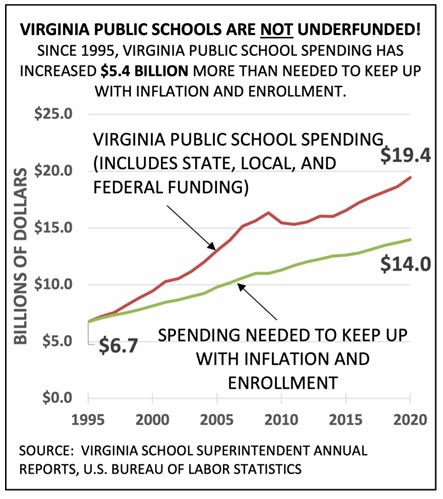

However, as FCPS spending goes up, achievement goes down. Over the past 5 years, per-student cost has increased, from $16K to $21K, while SAT scores fell, from 1212 to 1181. Never in half a century have FCPS SAT scores seen such a precipitous decline.

Your crucial failure is in teaching minority students mastery of reading and arithmetic by third grade. Most of our crime is committed by individuals whom the public schools failed to teach reading. The fault is the curriculum and unaccountable administrators,not the students, their race, nor their families. Your budget does not even mention Equal Access to Literacy, which was supposed to replace whole word reading instruction with phonics. Continue reading