by Jon Baliles

by Jon Baliles

A reader alerted us this week that if you have not yet gotten your personal property tax bill (car tax) from the City of Richmond, you soon will — and it will be notably higher than last year unless you bought a newer model or drive a jalopy.

The city receives roughly $16.7 million per year from the state to provide for car tax relief originally established by the state in 1998 (which is a whole other topic for another day). During and after the pandemic, car values rose as the demand for used cars skyrocketed and higher tax bills followed accordingly. City Council first approved the Mayor’s “step-stair” approach to tax relief in 2022 — a policy in which owners pick up a bigger share of the tax over the course of a few years. Last year, the tax relief rate was 36.6% in the city.

In the city, you pay $3.70 tax per $100 assessed value. Under the relief program, a car valued at less than $1,000 owed no tax. If your vehicle was assessed between $1,000 and $20,000, you received the partial credit and owed the balance. If your vehicle was assessed at $20,000, you received the credit in relief up to $20,000 but then owed full freight on everything over $20,000.

So, a car assessed last year at $12,000 would owe $444 in personal property tax but got the 36.6% relief. That vehicle would have received a credit of $162.50 and the owner paid $281.50 in tax.

Two years ago, car (and truck) owners in the city received a 50% credit, but that credit declined to the 36.6% in 2023. This year, the credit declines again, down to just a 22% credit towards the assessed value. The owner of an $11,000 vehicle in 2024 would get a tax bill for $407; after a 22% credit of $89.50, the owner would pay $317.50. So, the value of the car went down, but the tax goes up.

In the example sent by our reader, they received a bill for both of their cars with a combined assessed value that was about $3,900 lower than it was in 2023; but their tax bill was about $36 higher.

Value goes down, tax goes up. Call it Stoney-nomics.

The reader pointed out that had the rebate percentage remained at 36.6%, their bill would have been about $60 lower; so they saw a total swing of about $96.

Last month, for comparison, Chesterfield’s Board of Supervisors increased their personnel property tax relief value from the 39% it provided in 2023 to 44% for 2024. Not only did they do that, they also lowered the assessed value rate for vehicles from $3.60 to $3.35 per $100 of assessed value, which is the lowest rate ever set by the county and the lowest rate among all Virginia localities with a population over 100,000.

Dale District Supervisor Jim Holland, chair of the Board of Supervisors, called it “a transformational opportunity.”

“We are positively impacting many more people than if we just gave a reduction on the real estate tax rate,” said Clover Hill District Supervisor Jessica Schneider. “There are a lot of people who rent and they would not see any of that rebate whatsoever. This way, anyone who has a car gets a rebate.”

“Doing it this way, we’re actually giving a true tax cut,” said Bermuda District Supervisor Jim Ingle. “We’re not just cutting the rate and people’s taxes still go up. We’re cutting the rate and they’re actually going to see a tax cut from this. I applaud this board for that.”

“I think this is a huge step in the right direction,” added Matoaca District Supervisor Kevin Carroll. “I would like to make sure this is a permanent tax cut. If we come back next year to raise it, I’m going to vote no.”

Similarly, Henrico is providing tax relief at a rate of 46% for 2024 assessments. Last year, the Henrico Citizen reported that the county lowered the tax rate for vehicles by 10 cents, from $3.50 to $3.40 per $100 of assessed value, which amounted to a total savings of roughly $3.6 million for car owners (about $102 each).

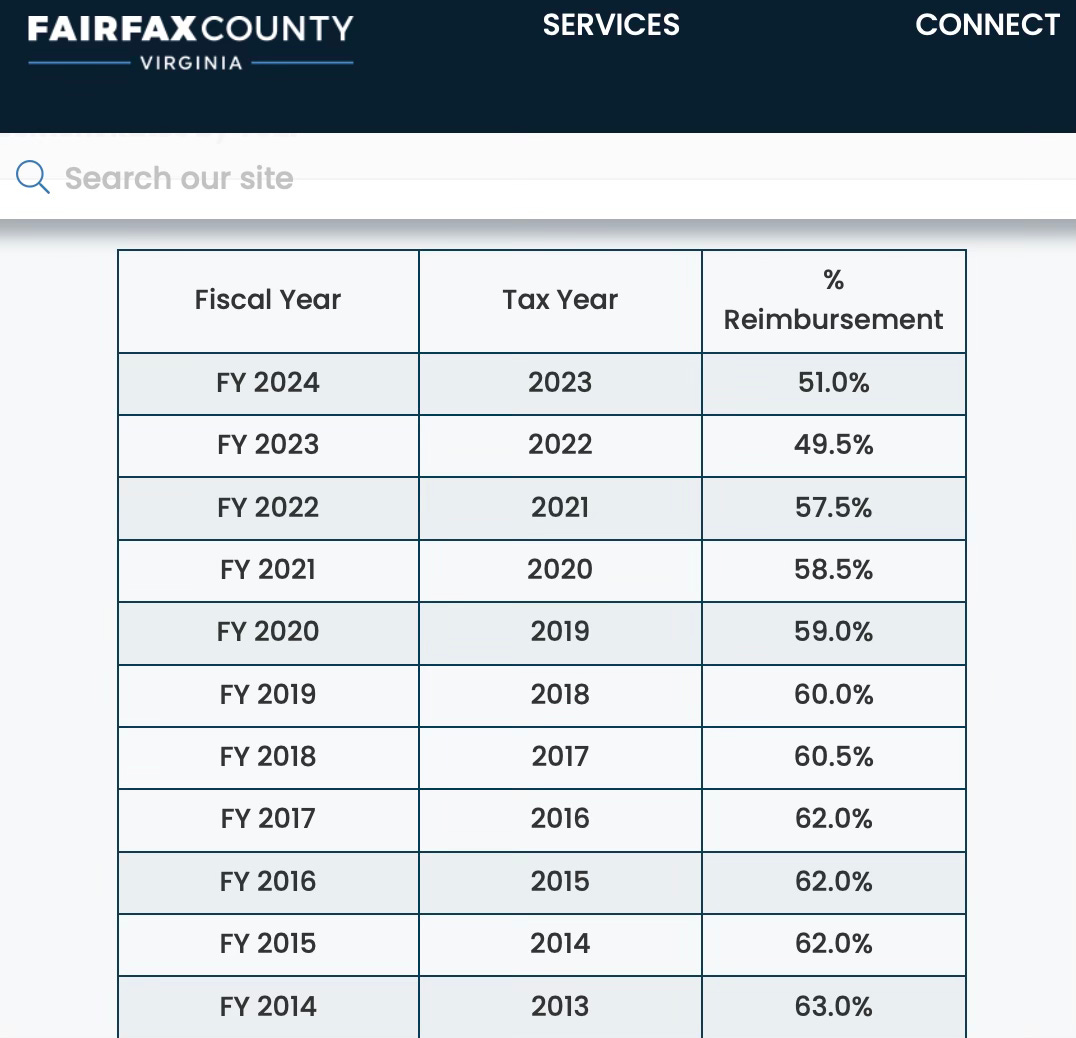

One other telling bit of data was a table from Fairfax County which showed that locality’s efforts to slowly reduce their tax credit over time and provide as much relief as possible for as long as possible.

Richmond, meanwhile, has gone from 50% relief in 2022 to 36.6% relief in 2023 to 22% this year. Who knows what the relief will be in 2025 — or if there will be any left at all.

Jon Baliles is a former Richmond city councilman. Republished with permission from RVA 5×5.