Virginia’s gasoline and diesel taxes will rise 7% on July 1, about three more cents per gallon when all the elements of the tax are combined. This is the inflation-driven cost of living adjustment which Governor Glenn Youngkin (R) and most legislative Republicans tried to short circuit, but which was preserved by a vote in the Virginia Senate last week.

The new gasoline tax will be 28 cents retail, 8.2 cents wholesale plus another 0.6 cents per gallon to fund a program for removing old underground tanks safely. That’s a combined tax of 36.8 cents per gallon. The taxes on diesel will be 28.9 cents retail, 8.3 cents wholesale plus the same tank fee, a total of 37.8 cents per gallon.

Most of the attention on Youngkin’s proposal focused on his effort to suspend the retail (but not the wholesale or underground tank) portion of the tax for 90 days. But both his regular session bill and the version he offered as a late budget amendment also reduced the coming inflation adjustment, or indexing, of the tax as of July 1. The version rejected last week capped the increase at 2%, well below the current levels of inflation.

When opponents complained of major financial impacts from the change, they were really talking about the revenue that would disappear without the indexing provision, which will be cumulative over the years. Inflation and then compounded inflation are powerful revenue enhancers for government at all levels, a tax all by itself. Many in the Assembly refused to give it up (just as they refuse to index income tax provisions and lose that revenue growth.)

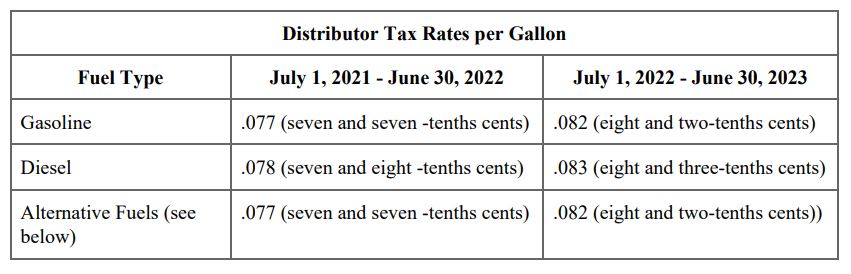

The new gas tax numbers were shared with Bacon’s Rebellion by the Virginia Petroleum and Convenience Marketing Association, which just notified its members and encouraged them to be sure customers got the word. The tax is actually collected from the wholesale distributors who bring the fuels to the gas stations and convenience stores, not imposed at the pump.

The tables reproduced in its announcement and here came from the Division of Motor Vehicles, which has nothing about this on its website yet.

The DMV, up to its old tricks, is still playing games with the numbers. A chart on the retail tax is presented in cents per gallon, but the wholesale tax table is presented in dollars per gallon. That moves the decimal two places and makes it look like the wholesale tax is way smaller than the retail tax. The illusion is probably not an accident.

And it is probably not an accident that no effort is made inform motorists of the total tax, which has been a subject of deception for years now. Democrats playing these games was one thing. For Republicans to be keeping it up is very disappointing.

Nor is it an accident that if you go to the legislative website and seek to find the roll call on Friday’s Senate vote to kill Youngkin’s amendment, it is still not posted. Bacon’s Rebellion will continue to check and provide that link when available. Here is how the House voted, with a few Democrats supporting the Governor’s proposal.

Come election season, those nays will be (correctly) portrayed as votes to raise the gas tax in the middle of a gasoline price inflation storm.

Leave a Reply

You must be logged in to post a comment.