http://www.bradycampaign.org/xshare/pdf/major-shootings.pdf

— PAG

Intellectuals love to hate Wal-Mart. A vast cottage industry exists for the sole purpose of criticizing and thwarting the the opening of new stores. I suppose you could call me a fellow traveler. While I respect the retail giant for pioneering a logistical revolution that has squeezed tremendous costs out the distribution system to the benefit of us all, I find its big box stores an abomination. Wal-Mart’s massive, hulking buildings surrounded by acres of parking lot are desolate and soulless. You go to Wal-Mart for one reason, to shop, and you usually get there by bypassing neighborhood stores and driving long distances. Wal-Marts and other big boxes are pillars of the auto-centric society and the antithesis of the vibrant and walkable communities where I enjoy hanging out.

My attitude, I concede, is snobbish. Not everyone shares my predilections. Wal-Mart appeals to lower-income (but not so low-income they can’t afford a car to reach a superstore) consumers who need to stretch a dollar. And, it turns out, many people who live near Wal-Marts don’t share my aesthetic sense.

A recent analysis published by the National Bureau of Economic Research concluded that Wal-Marts actually raise property values of surrounding houses, though only modestly. Write Devin G. Pope and Jaren C. Pope:

The results … suggest that a new Walmart store actually increases housing prices by between 2 and 3 percent for houses located within a half mile of the store and by 1 to 2 percent for houses located between a half and one mile from the store. For the average priced home in these areas this translates into an approximate $7,000 increase in housing price for homes within a half mile of a newly opened Walmart and a $4,000 increase for homes between a half and one mile.

The authors acknowledge that the Wal-Mart effect might combine both positive and negative influences. If households value the convenient access to Wal-Mart’s goods and services, as well as those of other merchants that might choose to locate nearby, the impact would be positive. If Walmart brings pollution, crime and traffic to a neighborhood, the impact could be negative. There is no way to know a priori which effect is the stronger.

Pope and Pope compiled a data set of 159 Wal-Marts that opened in the United States between 2000 and 2006 and then analyzed the impact on housing sales prices within one and a half miles from the stores. Their results show that Wal-Mart lovers prevail over Wal-Mart haters.

That’s fine as far as it goes. But I wonder if it might be possible to refine the analysis. Not all Wal-Mart stores are the same. The stereotyped big box is a 140,000-square-foot behemoth in a free-standing building. But having largely saturated the market for those monstrosities, the retailer has been building considerably smaller stores, in the range of 40,000 square feet, in recent years. There is one three miles from where I live in Henrico County, and it’s not so bad. Wal-Mart plugged it into an an existing shopping center, so it did not diminish the surroundings. Visually, it’s a marginal improvement over the failing K-Mart that had stood there. While I never patronize the behemoth Wal-Mart 20 minutes away, I find this one convenient and relatively inoffensive. Meanwhile, the company is experimenting with even smaller stores, around 16,000 square feet in size, in urban areas under the “Marketside” brand.

Just as McDonald’s has learned to succeed in urban environments by foresaking its tacky golden arches, is it too much to hope that Wal-Mart might one day learn to do the same? Is there any way to integrate Wal-Mart’s hyper-efficient, low-cost supply chain into a compact, walkable, fiscally sustainable setting? If Wal-Mart wants to continue growing market share, it may have no choice but to adapt.

By Peter Galuszka

By Peter Galuszka

Despite the “existential threat” involving online education at the University of Virginia, Mr. Jefferson’s school certainly seems to be at the forefront of the debate.

You have President Tereaa Sullivan being fired and then reinstated, the curious fact that the school actually was involved with online advacements after all, criticism from the Darden School of Business and now this New York Times opinion piece by English Professor Mark Edmundson.

He notes the drumbeat for putting courses online, but says there really is something to be said for actually having a real professor in a real class with real students. Sticking knowledge in digital doses kills dialogue that is the absolutely best way for students to learn.

As he says: “Learning at its best is a collective exercise, something we’ve known since Socrates.”

In-class courses allow for a precious back and forth between teacher and students. You just don’t get that when you have a professor, even a very good one, reciting material into a camera, even if it is juiced up with clever videos, interactive media and a few students about as props. The Web professor, however, is little more than a figure on a tube. For all you know, he could be Sponge Bob Squarepants. Professors can’t tailor their teaching t0 the classes.

“Every memorable class,” writes Edmundson, “is a bit like a jazz composition. There is a basic melody that you work with. It is defined by the syllabus. But there is also a considerable measure of improvisation against that disciplining background.”

True, Edmunson teaches courses on authors such as Shakespeare that our go-go digitizers see as frivolous and not in keeping with the hot world of STEM so we can grow engineers like the Tiger Mothers of Asia.

Sure, there is a place for exploiting the reach and convenience of the Web and other electronics. Some archaeologists, for instance, put lectures on Ipods that students can listen to as they actually travel to the places being discussed and let the invisible professor lead them on the ruins step-by-step.

Technology cannot substitute for true content overall. It sounds so 1960s, “the Medium is the Message.” Edmundson is spot on in his analysis and another reason why the folks who thought the Hoo-ville Board of Visitors “gets it” are so dead wrong.

Posted in Education (higher ed), Education (K-12), Science & Technology

Tagged Peter Galuszka

Regarding my recent post on UVa partnering with Coursera (“Yes, Hybrid Online Learning Delivers“), I came across this blog post by the dean of the Darden School of Business, Robert F. Bruner. The dean, who was instrumental in forging the technology partnership, sounds less than convinced that MOOCs (massively open online courses) represents the future of business school pedagogy. But he can’t let Darden miss a chance to stay at the leading edge of business education.

Writes Bruner: “This partnership is a relatively little bet that can help Darden understand whether and how purely online instruction can serve the interests of our students.” He doesn’t see online learning as a big money maker. Indeed, his question is, “Is this sustainable?”

“I don’t know,” he answers. “An important aim is to get some experience and then decide. In my previous blog post, I argued, ‘online is more likely to spawn losses for the traditional not-for-profit colleges and universities — this stems from the cost of creating digital content and reinventing programs.’ … I’ve been mugged by reality enough times on projects involving educational technology that I want to take a hard look at the resource requirements.”

Production of online courses is expensive, and the job is never done. Courses and materials need to be continually updated. A lot of trial-and-error will be required, and much of that effort will have to be written off. MOOCs are a winning proposition for Coursera, which doesn’t bear the expense and risk of creating content. The logic is very different for uUniversities, which will end up competing with one another and bearing the risk of failure. Writes Bruner:

Venture capitalists and other “smart money” are pouring into the online aggregators because higher ed looks like a replay of what happened in the music and filmed entertainment industries: disintermediate the incumbent distributors and gain rights to distribute the content that someone else paid to develop. … you don’t see venture capitalists or other ‘”smart money” pouring into colleges and universities mainly because they see only big outlays ahead to develop content. The “smart money” is voting with its feet: the flow of funds toward the online aggregators, to the neglect of universities is consistent with my argument that online ed will be costly to colleges and universities.

Bacon’s bottom line: Higher ed is conflicted. Prestigious institutions like Darden are more focused on the downside than the upside. They are getting involved for strategically defensive reasons: because they have to.

Bruner sees Darden’s rivals being other top-rated universities. But the competition won’t stop there. I disagree that venture capitalists will steer clear of content creation. At some point — whether a year from now or a decade — entrepreneurs will figure out how to get into the business, and some will succeed because they won’t lug around all the overhead that universities do. Content entrepreneurs will raid universities for their star teachers (not necessarily the biggest names, but the most popular teachers), leverage their teaching power a hundred-fold through MOOCs and pay them more than they could ever make in a university.

These interlopers will offer a threefold value proposition: (1) access to the best teachers, (2) at a lower price than traditional institutions can offer, and (3) certification that students have mastered the subject matter.

If I were running an institution trying to maintain $20,000- to $50,000-a-year tuition-and-fee cost structures, I would be very worried. With its brand name, endowment and roster of star faculty, of course, Darden should fare better than generic state universities. At least it will be producing the courses most in demand — until their faculty are spirited away, at least. And its highly interactive, case-study pedagogy will be far more difficult to replicate online than standard introductory courses are. Even so, the pressure will be relentless.

— JAB

Amazing facts about asphalt… The petroleum byproduct was used as a preservative in mummy wrappings in ancient Egypt. Pennsylvania Ave. in Washington, D.C., was the first street in the United States to paved with asphalt; the year was 1876.

These days, as the Commonwealth Transportation Board learned Wednesday from Richard Schreck, executive vice president of the Virginia Asphalt Association, 97% percent of all Virginia primary roads are paved with the material. The 122 asphalt plants in the state employ 6,500 workers and generate $238 million in payroll. Including all of the products and services it purchases — aggregates to mix with the asphalt, trucks to haul it — industry revenues exceed $1 billion a year.

Yet the asphalt industry has fallen on hard times, Schreck said in his presentation. The private sector, which uses asphalt to pave parking lots and private roads, remains in a deep slump. Asphalt plants are operating at only 35% capacity. State road spending, which currently accounts for 58% of revenues, is keeping the industry afloat.

Asphalt is advantageous as a road-paving material because it can be finely engineered to achieve specific performance characteristics, Schreck said. Among its many virtues, he added, asphalt is in theory 100% recyclable. In actual practice, about 80% of the asphalt applied to Virginia roads is recycled. The industry works closely with the Virginia Department of Transportation’s research center in Charlottesville to develop innovative applications such as road surfaces that make less noise when vehicles drive over them to “cold,” on-site recycling of asphalt on repaving jobs.

But the industry sounded less than progressive under questioning from CTB members. “Are you taking advantage of the materials revolution” to develop better products, asked Douglas Koelemay, Northern Virginia district represenative.

“We haven’t begun to scratch the surface” of asphalt’s potential, responded Schreck. But asphalt companies don’t do much research themselves, and universities are cutting back their asphalt labs.

Roger Cole, Richmond district representative, asked if asphalt companies used financial hedging techniques to guard against price fluctuations in commodities such as petroleum. Not really, said Schreck. “There are too many external factors.”

Asphalt’s main competition as a road-building material is concrete. Concrete is rarely used as a surface material anymore but VDOT still relies upon it as a foundational material for high-performance roads.

— JAB

By Peter Galuszka

By Peter Galuszka

Reforming health care is perhaps the most important issue confronting Virginia and the country today and also one of the most contentious.

One hears opinions and solutions of every ilk anywhere — on blogs like this one, television, newspapers and private conversations. One important turn came when the U.S. Supreme Court upheld most of the Patient Protection and Affordability Act, otherwise known as Obamacare.

But the controversial law still fails to address the vast majority of the issues confronting health care, such as the strange oligarchy of faceless bureaucrats at Medicare and their counterparts at for-profit commercial insurers setting prices in a way that completely takes the consumer out of the equation. The “fee for service” system encourages doctors to order uneeded tests while the demanding paperwork for the gatekeepers forces them to see more and more patients.

For a birds-eye view, I spent a day with a Richmond-area family practioner for Style Weekly. My photographer and I signed privacy agreements and were allowed to sit on a number of sessions with patients and Dr. Rick Gergoudis, of Commonwealth Primary Care. The highly-regarded doctor was very hospitable and let us take the story where we wished. The article shows a number of unresolved questions:

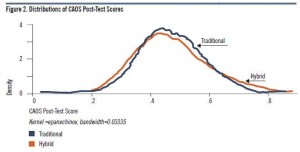

Test scores for statistics class comparing conventional and hybrid-online classes. (Click for more legible image.)

The University of Virginia, it seems, is one of more than a dozen prestigious universities to have signed a partnership with Coursera, a company that provides hosting services for massively open online courses (MOOCs). The deal was in the works even as UVa was roiled by controversy over the forced resignation of President Teresa Sullivan, one of whose alleged offenses was insufficient enthusiasm for online learning. Writes the Chronicle of Higher Education:

Ironically, at the time the board was plotting the Sullivan ouster, delegations of deans and faculty members from Virginia’s undergraduate college of arts and sciences and its graduate school of business were both talking to Coursera about collaborations that would put the university on the crest of the MOOC wave, along with Stanford and the others.

UVa wouldn’t be joining company with Stanford, Princeton and Duke if there weren’t compelling evidence to support the idea that MOOCs can, for some courses, help students master the subject matter as well as they could in a traditional classroom setting.

The latest evidence comes from a report, “Interactive Learning Online at Public Universities: Evidence from Randomized Trials,” published by Ithaka S+R, a nonprofit, higher-education think tank. In a trial of 605 undergraduates at six universities in New York and Maryland, half of the students were assigned to a traditional class on introductory statistics while the other took a hybrid course that supplemented online content created by Carnegie Mellon University with weekly meetings with instructors.

The findings: “Our main results provide compelling evidence that, on average, students learned just as much in the hybrid format as they would have had they instead taken the course in the traditional format—with “learning” measured in traditional ways, in terms of course completion, course grades, and performance on a national test of statistical literacy.”

Hybrid courses have higher up-front costs associated with preparing the online content. However, the smaller instructor-student ratio would permit significant savings over the long run. Using admittedly crude simulations, the authors estimated that compensation cost savings could run from 19% to 57%, depending on the teaching model employed.

Conclude the authors: “Vigorous efforts should be made to aggressively explore uses of both the relatively simple systems that are proliferating all around us, often to good effect, and more sophisticated systems that are still in their infancy. There is every reason to expect these systems to improve over time, perhaps dramatically, and thus it is not foolish to believe that learning outcomes will also improve.”

The Commonwealth Transportation Board (CTB) formally authorized today the Virginia Department of Transportation (VDOT) to set up a 63-20 corporation capable of issuing bonds for construction of the U.S. 460 Connector between Suffolk and Petersburg.

VDOT chose the quasi-state entity as the vehicle for building the interstate-grade highway, estimated to cost about $1.8 billion, because the project was untenable as a public-private partnership. Even with more than $800 million in financial support from the state and the Virginia Port Authority, the project would be hard pressed to generate sufficient revenues in its early stages to both support bond payments and give a private-sector partner a favorable return on its equity investment.

The McDonnell administration justifies the project on economic development grounds, arguing that the highway will stimulate container shipments through Virginia Ports upon the completion of the Panama Canal widening as well as to attract top-tier manufacturing investment to Southeastern Virginia.

Smart Growth advocates question whether the state should take on so much financial exposure based on projected economic growth that may or may not materialize. Virginia has many other pressing transportation priorities that could be funded with all that public money. Even many Hampton Roads government officials say they have higher priority projects locally that would relieve traffic congestion at choke points like the Hampton Roads Bridge Tunnel. However, no organized resistance to the project has emerged, and no one on the CTB spoke against it.

For a detailed discussion of the project finances, see “VDOT Restructures U.S. 460 Financing.

— JAB

by James A. Bacon

Virginia’s Department of Rail and Public Transit (DRPT) dishes out roughly $190 million a year in financial support to some 24 transit operations around the state, and that doesn’t include $50 million that goes to the Washington Metro system. Mark Aesch, CEO of the TransPro consulting firm, thinks that money can be spent more efficiently.

The current funding formula, which is based upon ridership and operating expenses, does not reward efficiency, Aesch told the Commonwealth Transportation Board (CTB) earlier today. “The discussion is about how to get more money rather than how to get better.”

But a soon-to-be-published report ordered by the General Assembly will propose creating a new framework for distributing state funds, Aesch said. Under a proposed hybrid formula, 50% of state funds will be allocated by the old formula while the other 50% will be distributed on the basis of performance criteria, such as:

The idea behind performance measures, said Aesch, is “to provide a public sector service with a private-sector mindset. Today, increased funding is tied to increased spending. There is no link to goals or performance.”

The preliminary report classifies transit companies — which vary from the massive Washington Metropolitan Area Transit Authority to the tiny Pulaski Area Transit — into six peer groups. State funds will be divvied up between peer groups and then distributed to agencies based on performance. There will be a three-year transition period to allow agencies to make the shift.

“For the first time, this introduces the concepts of quality and performance into the equation,” said Aesch. Other states are moving in the same direction but the enactment of the recommendations into law would put Virginia “at the forefront of the conversation.”

Among CTB members, Allen Louderback, a rural, at-large member, spoke in favor of the new direction. Many transit routes have low ridership that local governing bodies find difficult to cut for political reasons. “This will allow localities to make those changes and justify them. [It will] reduce the politics.”

However, the transit companies are less enthusiastic. Demand for transit services is increasing even as local governments are struggling fiscally, said Linda McMinimy, executive director of the Virginia Transit Association. “There’s a lot of concern about transit companies competing against one another for funds, creating new winners and losers.”

Formulas are beneficial, McMinimy said. They provide the predictability and reliability that transit enterprises need to plan their services going forward. Setting up an incentive pot is fine, she added, but the prospect of allocating half of all state funds according to performance is concerning to transit agencies.

The study doesn’t touch upon one of the biggest problems facing transit today, the unwillingness of some suburban localities to participate. In many locales, said McMinimy, residents of urban jurisdictions have no way to reach jobs in suburban counties located far from bus lines. Perhaps incentives could be created to spur participation, she suggested.

The final version of the report, along with draft legislation, will be submitted to the General Assembly September.

Posted in Uncategorized

by James A. Bacon

Computer-operated vehicles are coming, and they offer the potential to create dramatically safer, less congested roads, asserts Clifford Winston, a Brookings Institution scholar writing in the Wall Street Journal today. “The driverless car represents one of the most amazing breakthroughs in safety and quality of life in recent history.”

The greatest barrier to reaping phenomenal benefits in mobility, suggests Winston, is not the automobile manufacturers, “who have made one technological improvement after another since the car was introduced to consumers more than a century ago,” but the ability of roads, streets and highways to accommodate the new generation of super car.

“Unfortunately, the paved systems on which cars travel have not advanced much in comparison,” he writes. “Without reimagining the way we design and maintain highways, the driverless car will achieve little of its potential.”

With current technology, driverless cars are operated by computer that obtain information on surrounding cars 10 times per second from short-range transmitters, allowing them to respond exponentially faster than human drivers can to changing conditions. The technology will drastically reduce accidents caused by human error, and it will reduce delays by creating smoother traffic flow and rerouting drivers away from congestion.

The technology can vastly expand the capacity of existing roads. Writes Winston:

Driverless cars don’t need the same wide lanes, which would allow highway authorities to reconfigure roads to allow travel speeds to be raised during peak travel periods. All that is needed would be illuminated lane dividers that can increase the number of lanes available. Driverless cars could take advantage of the extra lane capacity to reduce congestion and delays. …

The smaller volume of trucks could be handled with one or two wide lanes with a road surface about a foot thick, to withstand trucks’ weight and axle pressure. But the much larger volume of cars — which apply much less axle pressure that damages pavement — need more and narrower lanes that are only a few inches thick. Building highways that separate cars and trucks by directing them to lanes with the appropriate thickness would save taxpayers a bundle.

While highways need to be reconfigured, streets and roads would need to become smarter. “On local streets, signal timing contributes to hundreds of millions of vehicle hours of annual delay because it is based on out-of-date historical data that inaccurately measure relative traffic volumes at intersections. Without signals based on real-time traffic flows, driverless vehicles may not be able to accurately align their speeds with them.”

Winston foresees using electronic tolls to charge motorists for their contribution to congestion and to motivate them to travel during off-peak periods, use alternate routes or shift to public transit. Artificial intelligence in driveless cars could balance the cost of tolls with travel time savings to optimize motorists’ route choices.

Bacon’s spin: OK, that’s all very exciting. Let’s assume for a moment that these technological marvels really are coming. (Given the extraordinary gains in affordability of computer chips, sensors and wireless technology, I don’t doubt it for a moment.) What do we do about it?

If roads and highways are the limiting factor, not automobiles, then state policies will drive the transition to the better world that Winston envisions. That creates an opportunity for states, such as Virginia, that might want to take the lead in addressing their intractable safety and congestion problems. But making the kind of changes that Winston discusses will take a drastic change in culture and skill sets at the Virginia Department of Transportation.

I would argue that Virginia has woefully under-invested in traffic signalling technology. In the one instance with which I am familiar, it has worked spectacularly successfully on U.S. 29 north of Charlottesville, reducing congestion to the point that there is no longer any justification for building a roughly $240 million bypass. Rather than learning from its success, the political system lumbers onward, pushing through the project in blind denial of the reality that congestion is much diminished. (Stop light synchronization has been applied in Northern Virginia as well, but I do not know how successful it has been.)

Right now, the big technological initiatives in Virginia highways focus on asphalt. One project is studying how novel asphalt mixtures can reduce noise. Another seeks to reduce costs by recycling asphalt in repaving jobs. Those are useful (and I have written about both). But the big strategic gains will come from building smart roads and highways that can interact with the next generation of smart cars.

VDOT needs to start building the skill sets that will allow the department to start thinking intelligently about smart roads. The states needs to begin experimenting more aggressively with smart sensors, signals and traffic algorithms. We need to think how we might transition from our current dumb highways to Winston’s radically redesigned highways without causing mayhem all the way, and how to do so within tight budgetary constraints. We also need to think about unforeseen complications — such as a blown tire that causes a wreck that cascades into a 100-car pile-up. And we need to examine the laws, regulations and policies arising from a century of asphalt-centric roads to see how they might be updated.

The automobile manufacturers will be ready long before state highway departments will be. Let’s ensure that Virginia is one of the first states to exploit the new possibilities.

by James A. Bacon

It looks like Virginia will get its first serious debate about Medicaid in decades. In its recent ruling on Obamacare, the Supreme Court made it optional for the states to participate in the law’s massive Medicaid expansion. After an initial phase-in period covered by the federal government, in which coverage will be extended to individuals 38% above the poverty line, states would be responsible for paying 10% of the cost.

The center-left Commonwealth Institute has weighed in with a pro-expansion paper, “Making the Right Choice on Medicaid,” arguing that the program “would be a lifesaver for hundreds of thousands of Virginians, a real bargain for the Commonwealth, and a much needed boost to our economy.” The paper articulates the main line of argument that the pro-Obamacare forces will likely reprise as the debate intensifies.

There’s more, but you get the idea. Foes object that Virginia can ill afford even $2.2 billion over the next 1o years. They also argue that Medicaid is broken. Provider payments are so low that 28% of doctors say they do not accept new Medicaid patients. “Instead of vastly expanding the rolls and subjecting residents to this failed insurance plan, policymakers should force Washington to pass real reforms to Medicaid,” write Audrey Jackson and Nicole Kaeding with the Virginia branch of Americans for Prosperity in the Times-Dispatch.

My concern is even more fundamental. Obamacare is erecting a fiscally unsustainable model of health care. Facing trillion-dollar deficits as far as the eye can see, the United States is hurtling toward Boomergeddon, a catastrophe that will result either in fiscal collapse or, if the Federal Reserve Board sops up federal deficits by printing money, hyper-inflation and economic collapse. Either way, the federal government will face extraordinary pressure to curtail entitlement payments, and the Medicaid expansion, as the most recently enacted entitlement, will be the most vulnerable. Virginia needs to insulate itself from the coming fiscal disaster, which is the most foreseeable and inevitable economic catastrophe in U.S. history.

But it’s not enough to “just say no.” If we choose not to expand a failed healthcare model, Virginia needs to dedicate itself, insofar it is possible with an intrusive federal government, to (a) creating a functioning health care marketplace with transparent price and quality data, (2) encouraging innovation among health care providers, and (3) redefining the relationship between insurer and patient. When the national system collapses, with luck, Virginia will have a health system still standing.

The good news: The McDonnell administration has discovered $5.4 billion in “surplus” bond proceeds to help pay for Dulles Rail. The bad news: Money dribbles in slowly and it’s all there is to pay for Dulles Toll Road improvements over the next four decades.

by James A. Bacon

The General Assembly faces a major policy decision regarding the financing of Dulles Rail — what to do with a projected $5.4 billion in surplus Dulles Toll Road revenues to be collected over nearly four decades to provide security for the project’s bond holders, Virginia Highway Commissioner Gregory A. Whirley told members of the Joint Commission on Transportation Accountability Monday.

To obtain affordable interest rates on the bonds it issues, the Metropolitan Washington Airports Authority (MWAA) is required to maintain minimum debt service ratios set by the terms of its bond agreements. Toll revenues must cover two times the debt service for senior (AA-rated) debt, 1.35 times for intermediate debt, 1.2 times for lower-rated debt and 1.0 time for the most subordinated debt. The excess revenues will be set aside in a separate fund.

The state has three broad options on what to do with the money: Use it to pay for improvements to the toll road, one of Northern Virginia’s critical transportation arteries; renegotiate bonds to lessen the burden on toll road users, who could wind up paying as much as $8.75 per trip in 2025 and $18.75 by 2048; or return the money to the state. Initially, the surplus will be small, Whirley explained, but enough money could accumulate within a decade to help out toll road users by renegotiating some of the project’s more expensive debt.

The escalation of Dulles Toll Road tariffs has become a heated issue in Northern Virginia, where tens of thousands of commuters rely upon the limited access highway to get to and from work. Under the final financing agreement, revenues from the toll roads will cover about half the$6 billion cost of building both phases of the heavy rail project.

The state allocated $150 million this year to cover interest payments in the early years of bond payments, making it possible for MWAA to slow the rate of fare increases on the toll road. The surplus funds identified by Whirley would dwarf that sum, although they would have to cover far more years of interest payments. In April, Transportation Secretary Sean Connaughton said that tapping the surplus funds could reduce tolls by $.90 per rider in the early years.

MWAA has issued $1.3 billion in toll-backed bonds so far to finance Phase 1 of the project, which is nearing completion, and anticipates selling approximately $2 billion more over the next five to six years. The bonds will be sold in four tranches, each offering a different level of security for investors and paying a different interest rate. The top-rated, “flagship” bonds will bear low interest rates of 2.5% to 3%. Investors will regard them as having minimal risk because they will be first in line, after operating and maintenance costs, to receive toll road revenues and they will have a 2.0-to-one coverage ratio. Other tranches will stand behind the senior bonds in line and have lower debt-service coverage. A key component of MWAA’s financing strategy is to reduce the risk on the lowest-rated bonds by getting the federal government to back them under the Transportation Infrastructure Finance and Innovation Act (TIFIA).

MWAA’s interest rate projects are conservative, said Andrew Rountree, MWAA’s chief financial officer. Projections assume an average cost of capital of 6.5%, which is considerably higher than interest rates today. MWAA’s AA bond rating for senior debt places it among the top 11% of all airport authorities in the country. MWAA runs Dulles International Airport and Reagan National Airport, and has been entrusted with managing construction of the Dulles Rail project, which will run along MWAA-owned right-of-way.

Under a new transportation bill agreed to by Congress, the federal government will expand its TIFIA loan program substantially, Rountree said. By converting the project’s expensive, subordinated debt to TIFIA-backed debt, MWAA could bring down toll road fares considerably. “We’ll be doing everything we can to access that program.”

Otherwise, Whirley’s idea of tapping the surplus debt-coverage funds offers the only realistic prospect of ameliorating the plight of toll road commuters. Rountree cautioned that it will take years before the funds could be accessed. “The opportunity to tap the surplus won’t come about for quite a while,” he said. A big chunk doesn’t become available until the very last two years. Read more.

by James A. Bacon

Virginia’s revenue problems run much deeper than the Great Recession, argues the Commonwealth Institute in a new report, “Frozen in Time: Virginia’s Revenue System Can’t Pull Its Weight.” Chronic revenue shortfalls are the fault of the Old Dominion’s antiquated tax structure.

Virginia has grappled with budget shortfalls in 10 of the last 12 years, note authors Sara Okos, Sookyung Oh and Michael Cassidy. Reliance on “deep cuts, one-time budget-balancing tools, and gimmicks” got the state through the recession. But structural problems persist.

The report cites costly tax breaks for favored industries that get “baked into the tax code but are not subject to the same regular scrutiny or evaluation as other types of state spending”; an income tax structure that has not been touched since 1987 despite a market shift in income distribution to higher-income households; and policies that enabled 60% of Virginia corporations to pay no income tax in 2008.

Concludes the report:

Virginia’s general fund revenues have fallen short of the levels needed to fund education, public safety, transportation, health and human services, and other public obligations that contribute to a strong economy for over a decade. And they will continue to do so because a maze of obsolete and narrow policies, set between 25 and nearly 100 years ago – and for the most part not updated since – have Virginia frozen in time. Holding fast to a state tax system that was designed for yesterday’s economy, not the Virginia of today, is starving the needs of our modern state and jeopardizing our ability to create good jobs and ensure a better future for the next generation. It is time for Virginia to engage in a serious conversation about revenue modernization. It is time to talk taxes.

If there is one thing that liberals and conservatives can agree upon, it is that Virginia’s tax code desperately needs an overhaul. It is indeed time to talk taxes. The big question is which reforms to enact.

I would submit the following principles should guide any discussion: (1) We should aspire to create as level a playing field as possible by eliminating special deductions, loopholes and credits; (2) we should seek the broadest possible tax base so as to keep tax rates as low as possible, thus reducing economic distortions and tax-avoidance behavior; (3) we should strive for simplicity and ease of compliance; and (4) we should balance the goal of making the tax system progressive, in which wealthier Virginians pay more than poorer Virginians, with the goal of stimulating economic growth and job creation.

The Commonwealth Institute does not recommend specific policy changes. But in April the Jefferson Institute for Public Policy pitched a proposal for restructuring the tax code that, it argued, would stimulate economic growth. If it’s time to talk taxes, perhaps the Commonwealth Institute and the Thomas Jefferson Institute should sit down and see if they can find common ground.

By Peter Galuszka

Virginia Gov. Robert F. McDonnell sure seems to love lobbyists. When it came time select someone to be co-chairman of a “summit” on education in August, he chose James W. Dyke Jr., a former state secretary of education who is now a registered lobbyist for the big-time online, for-profit companies as The Apollo Groups, which runs the University of Phoenix.

Online education is indeed the buzz for months, especially among would-be education reformers many of them conservative, who see the for-profit, techie approach as a way to get more bang for the school bucks, cut costs, bypass teachers’ unions in K-12 and get rid of the leftover 1960s leftie element in the state’s public university system. For them, it is a win, win, win, win while keeping true to the Goddess of Budget Cuts.

The approach is gaining power so fast it nearly pushed out Teresa Sullivan, a highly-acclaimed college administrator as the president of the University of Virginia last month.

Sullivan’s alleged reluctance to blindly embrace online education completely, was one reason Board of Visitors Rector Helen Dragas, who apparently just heard of the concept despite a couple of decades of distance learning experimentation, was one of her major criticisms of Sullivan Somehow, Dragas assumed, Sullivan didn’t get the “existential” threat to her school wrought by changes in technology. Thousands of Sullivan fans at U.Va. and elsewhere turned the tide and had the firing reversed.

But that hasn’t stopped the march to online education as Dyke’s appointment shows. It doesn’t matter if it is uranium mining or classroom instruction, McDonnell seems to have a knee-jerk thing for lobbyists.

Questions abound about online education. In a look at the system, Karin Kapsidelis the Richmond Times Dispatch shows that some college professors

are excited about the idea of making university courses available more or less

for free through such programs as Coursera, edX, and Udacity. Backing them are some big name schools such as Stanford, the University of California at Berkeley, Massachusetts Institute of Technology and Harvard.

The upside of such courses is that plenty of people can register for classes – up to 94,000. They tend to work better for hands-on technology or science, such as how to create a computer search engine or take a basic class in physics.

The not so good news is that you don’t credit college credit for the classes but pay for a test and a certificate if you pass. It doesn’t mean you get an MIT sheepskin to hang in your office. Drop out rates are extreme. According to the TD, of the 94,000 students who signed up for a Computer Science 101 class, only 10,000 completed it in the two-month timeframe. In another course, 75,000 enrolled in the same class that was extended beyond the two months but only 12,000 were actively participating at any time.

Experts say that such course may work for science and engineering where the answers are typically right or wrong, but not for liberal arts, which the Dragas putsch tried hard to de-emphasize at U.Va., not eliminate. As one online

professor told the RTD about handling essays and book reviews, “It’s not

immediately clear how you’re going to grade 30,000 submissions automatically.”

Alas, there are far bigger problems, especially when the online fad gets into Grades 12 and below. The state of Colorado has been undergoing a thorough reassessment of its commitment to online secondary school education. A 2010 state report showed that online students showed below-average test scores, dropout rates of 50 percent or more and teacher-student teaching ratios of a stunning 317-1.

As Colorado gets sucker-punched by the for-profit, online craze, it is having to spend more, not less, state education money retraining and re-educating students hurt by the online experiment.

In Virginia, we are being told that this is a “revolution” and we’d better get onboard or face the “existential threat.”

The bigger threat, however, is jumping in and cheating children and college students of an education. How are we going to know the risks when the co-chairman of the governor’s education “summit” is a bought and paid for and registered lobbyist for the biggest for-profit online education firm?

The face of a disadvantaged business enterprise: Buhpinder Sohi. Sohi studied engineering at Government Engineering College Rewa in India and has been CEO of EPCM, Inc. Consulting Engineers since 1999. (Nothing personal, Mr. Sohi, I picked your name at random from the list of Dulles Transit Partner DBEs.)

by James A. Bacon

The Dulles Rail project plods inexorably forward. The Metropolitan Washington Airports Authority has issued a Request for Qualifications Information (RFQI) to solicit qualifications statements from potential bidders on the 11.5-mile rail line. Companies who submit applications will be narrowed down to a short list of five firms. The contract will be awarded to the team that meets the technical requirements at the lowest price.

While MWAA has abandoned its pro-Project Labor Agreement methodology for selecting bidders, it does set a goal of sub-contracting at least 14% of the total contract value to Disadvantaged Business Enterprises (DBEs). DBEs are defined as firms that are at least 51% owned and controlled by “one or more socially and economically disadvantaged individuals.” (See the DBE goal here.)

Here’s the question of the day: How many of the DBEs who participated in Phase 1 were truly “disadvantaged”? Dulles Transit Partners published a list of its DBE firms here (go to page 8).

While DBE putatively is aimed at socially and economically disadvantaged individuals, it has evolved into a racial/gender spoils system. You will not find any “socially and economically disadvantaged” white people — someone who grew up in an Appalachian trailer park, say — qualifying as a DBE.

To my mind, the only group in a Virginia context that can be reasonably thought of as disadvantaged is African-Americans. Their ancestors were slaves, many of them lived through the Jim Crow era and many today remain disadvantaged by discrimination against their forebears. That’s not the case for all African-Americans living here in Virginia — clearly there is a strong and growing African-American middle and professional class — but enough of them can be considered disadvantaged that I’m willing to go along.

I don’t think of Hispanics as disadvantaged. Poor, perhaps. Disadvantaged, no. Maybe Hispanics were subject to vile laws and discrimination in other states but their arrival in Virginia in meaningful numbers dates back only 20 or 30 years. I’m sorry, but migrating to Virginia as a poor Hispanic person within the past generation does not make you any more disadvantaged than being born as a poor white person. (If you think speaking with a Hispanic accent subjects you to invidious stereotypes, try speaking with an Appalachian twang.)

It is absurd to think of South Asians, Koreans or Chinese as disadvantaged. If anything, these ethnic groups are privileged. Here in Virginia, they tend to be better educated and to enjoy higher incomes than whites.

As for women, we can argue about the corporate glass ceiling all day long. But can anyone seriously make a case that women are disadvantaged as small business persons? In a related question, how many of the “woman owned” enterprises designated as DBEs are owned by husband-wife teams in which the wife owns 51% and the husband owns 49%?

From eyeballing the Dulles Transit Partners list, I would guesstimate that half the DBE enterprises are Hispanic, with a significant number of Asians like Mr. Sohi pictured above. Are we expected to buy into the fiction that Mr. Sohi, who apparently emigrated from India to the U.S. with an engineering degree, qualifies as “disadvantaged”? C’mon. Of the rest of the DBEs on the list, a majority are women. Some of those women may be African-American, but I’d be willing to wager that most are white.

The DBE program is a farce, a racial-gender spoils system that is only marginally effective at creating opportunities for the one group — native-born African-Americans — that has a legitimate claim in Virginia to being socially and economically disadvantaged. But the DBE program is so deeply rooted that no one ever questions it. To do is is to risk being branded a racist or misogynist.

Post script. I’m not ragging on MWAA here. MWAA is following the law. All state and federally funded projects require DBE participation.