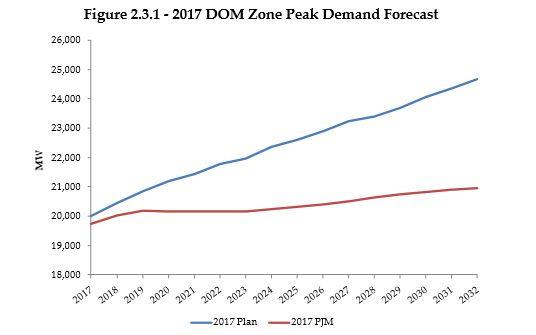

Comparison of Dominion and PJM growth forecasts in peak load. Source: Dominion 2017 Integrated Resource Plan.

Billions of investment dollars ride on the long-range forecast of Dominion’s peak load electricity demand. But whose projections do we believe — Dominion’s or PJM’s?

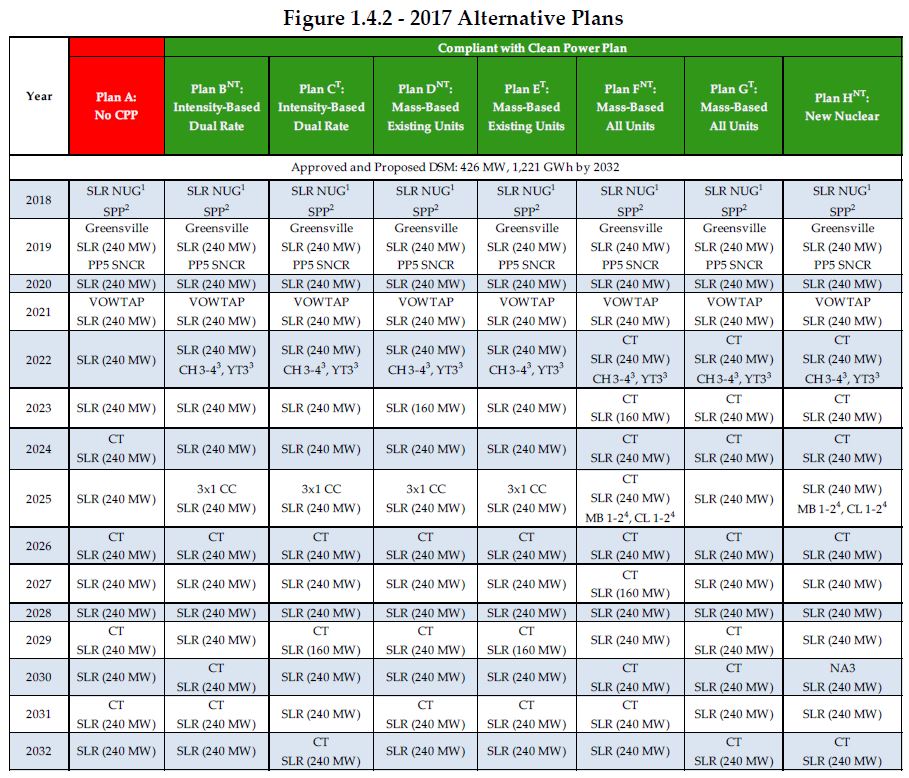

In its 2017 Integrated Resource Plan (IRP), Dominion Energy forecasts the increase in its peak electric load and anticipates what combination of new gas, solar and nuclear facilities it will take to meet that demand. Although the IRP is a highly technical document, against the backdrop of the debate over the future of Virginia’s electric grid, it has major political implications. Environmentalists argue that Dominion overstates future electric load and, consequently, it overestimates the number of new combustion turbines (gas-fired turbines designed to generate electricity on call) or the amount of new nuclear capacity that it will need to add.

As evidence, Dominion’s opponents point to the 2017 peak load forecast by PJM Interconnection, the regional transmission organization of which Dominion is a part. Where Dominion’s IRP projects an average annual increase in summer peak load of 1.4%, PJM projects an increase of only 0.4%. Projected over the 15-year planning horizon of the IRP, that amounts to a tremendous difference in peak electric load, as can be seen in the graph above.

Needless to say, Dominion defends its forecast, and offers detailed reasoning in the IRP to support its position.

Which forecast is correct? That of Dominion, which has a more intimate, granular knowledge of its service territory, of that of PJM, which has no profit-maximizing agenda?

It might come as a surprise to outsiders, given the big gap between their projections, but Dominion and PJM coordinate their planning and forecasts very closely. In most ways, the two forecasts are closely aligned. In PJM’s estimation, the difference boils down to two main factors: (1) the assumptions that Dominion and PJM make about the growth in demand from energy-intensive data centers beyond 2021, and (2) assumptions about how to account for rapidly “behind-the-meter” electric generation by homeowners and businesses. To those two issues, Dominion adds two more arcane issues of methodology.

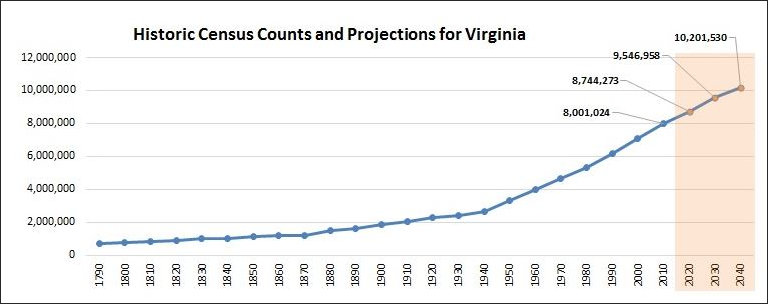

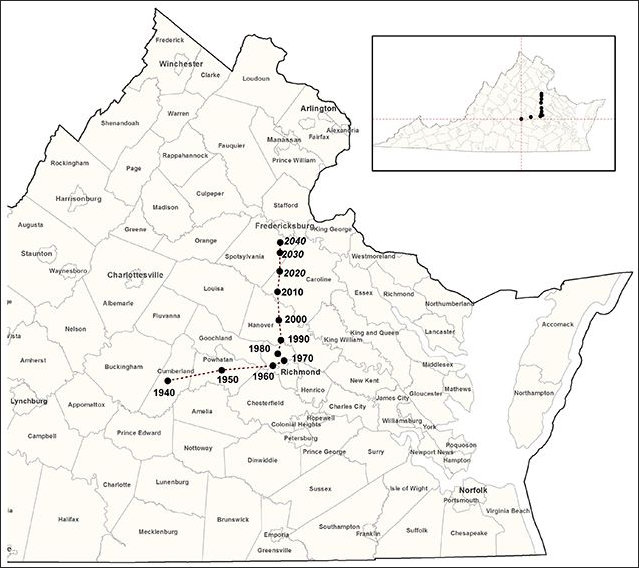

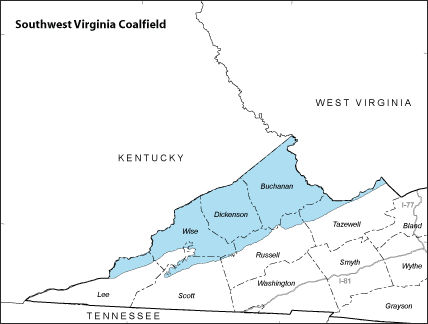

Data centers. Data centers figure largely in Dominion’s forecasts because Northern Virginia has emerged as one of the world’s leading clusters of energy-intensive server farms, drawing upon the region’s rich network of high-capacity fiber-optic cable, low-cost electricity, tech-savvy workforce, and friendly state-local policies. Having observed the success of Loudoun County, other Virginia localities from Virginia Beach to Wise County in far Southwest Virginia, are getting into the act.

Data centers are an anomaly for economic and electric-load forecasters. Because they are such big consumers of electricity to run thousands of servers and cool the heat they throw off, they skew the normal relationship between economic growth and energy consumption. Accordingly, Dominion and PJM have to make special adjustments to their economic models to take them into account.

“Each year Dominion comes to us with information about their projections of data center growth,” says Tom Falin, director of resource adequacy planning for PJM. “We do analysis to see if that growth is already embedded in our forecast. In general, it isn’t. [Data centers] put a drain on the energy grid that’s not normally associated with economic growth — there’s not a lot of employment and housing associated with it.”

Data-center loads reached more than 800 megawatts by 2016 and are projected to amount to 1,500 megawatts by 2021. That compares to a total peak load of about 20,000 megawatts for Dominion. PJM estimated that it needs to adjust Dominion’s peak load forecast upward by 500 megawatts by 2021 to account for the data centers. At that point, says Falin, PJM assumes that the growth in energy demand will be embedded in the historical load history and won’t require further adjustment. “Perhaps Dominion is assuming stronger growth in these data centers than we are.”

Indeed it is. As Dominion explains in its 2017 IRP:

PJM has eliminated new data center growth in the DOM Zone beginning in 2021 – in other words, it excluded incremental data center growth beyond what is captured in historic trends. This is a significant change from PJM’s 2016 peak demand forecast, which included new data center growth continuing for the balance of the forecast. In comparison, the Company utilizes historical trend data center load coupled with interconnect data from new and existing data center customers to forecast data center growth within its service territory. Over the longer term, the Company relies on data center forecasts that are included in a 2015 study prepared for the Company by Quanta Technology, LLC, entitled “Dominion Northern Virginia Load Forecast.”

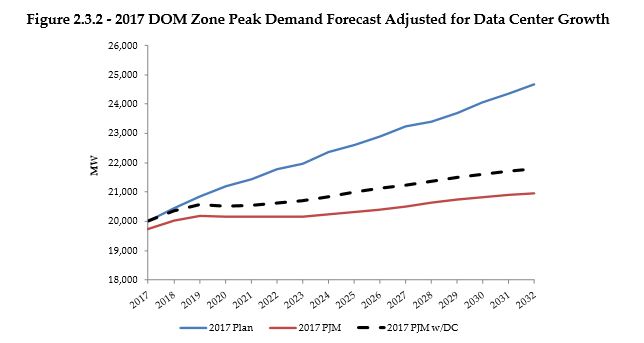

The difference between the Dominion and PJM forecasts can be seen in this graph taken from the 2017 IRP:

Source: Dominion 2017 IRP.

The dotted line shows what PJM’s peak demand forecast would look like if adjusted for data-center growth. Continue reading

by Dave LaRock

by Dave LaRock

The political economy of energy in Virginia used to be simple. Three main interest groups contended to formulate energy policy in the state: environmentalists, consumers, and electric utilities. Consumers, both homeowners and businesses, pressed for lower electric rates. Environmentalists fought for cleaner air and, more recently, lower CO2 emissions. And utilities — the only parties responsible for keeping the lights on — lobbied for reliability at a reasonable cost (within a framework that preserved profits).

The political economy of energy in Virginia used to be simple. Three main interest groups contended to formulate energy policy in the state: environmentalists, consumers, and electric utilities. Consumers, both homeowners and businesses, pressed for lower electric rates. Environmentalists fought for cleaner air and, more recently, lower CO2 emissions. And utilities — the only parties responsible for keeping the lights on — lobbied for reliability at a reasonable cost (within a framework that preserved profits).

An alliance of Washington-region business groups is calling for a fix for the Washington Metropolitan Area Transit Authority (WMATA) that would create dedicated funding streams for the Metro rail system and a restructuring of the authority’s board.

An alliance of Washington-region business groups is calling for a fix for the Washington Metropolitan Area Transit Authority (WMATA) that would create dedicated funding streams for the Metro rail system and a restructuring of the authority’s board.