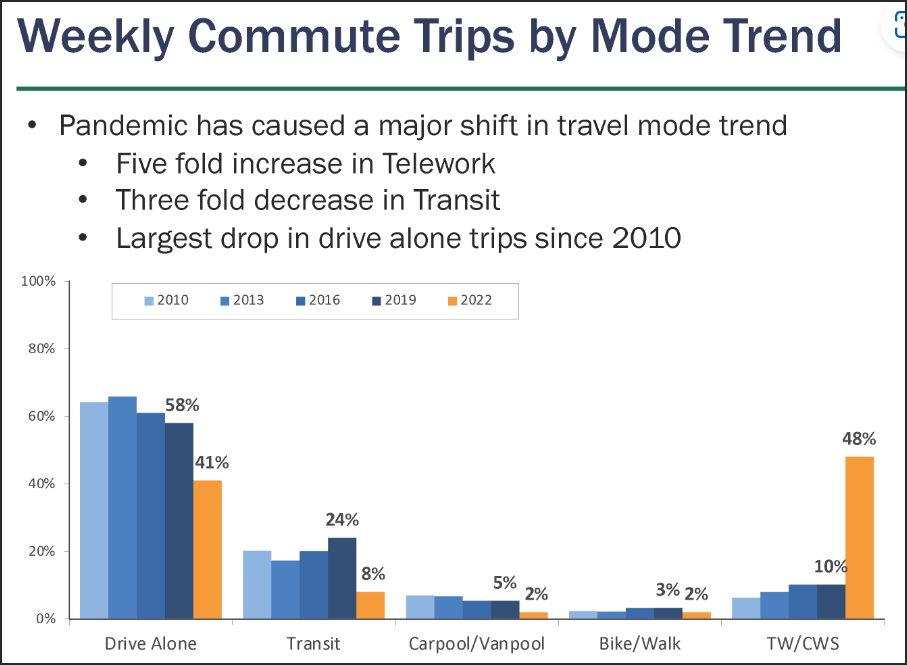

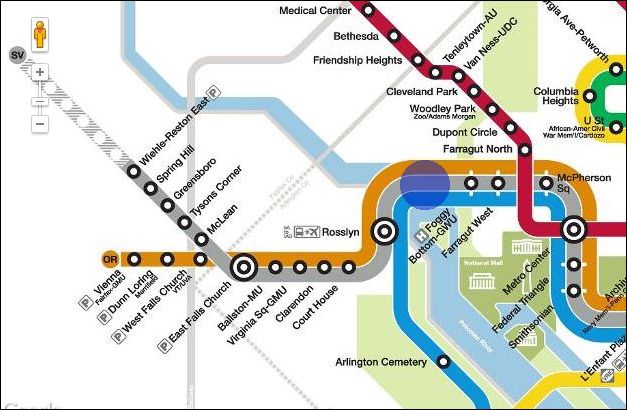

How much is a location near a Metro station worth? In a fall 2013 study examining the economic impact of the Silver line on Tysons, researchers Cushman & Wakefield took a look at rents paid for commercial real estate and multifamily residences in Arlington County’s Rosslyn-Ballston corridor. The answer: Office tenants pay as much as a 30% premium for Metro access, while renters pay as much as 23% more.

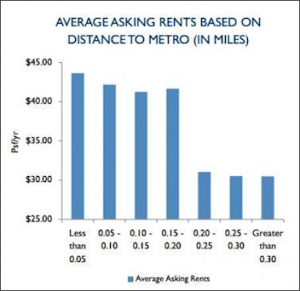

Commercial rents per square foot. Graphic credit: Cushman & Wakefield

Of the 101 office properties along the corridor, rents were highest for buildings located within one-twentieth of a mile from a Metro station. The price per square foot declined slightly for offices at a greater distance to one-fifth of a mile, then dropped sharply for offices at greater distances. The findings dramatically confirmed the old planning rule of thumb that people are willing to walk a quarter mile to avail themselves of mass transit but not much more.

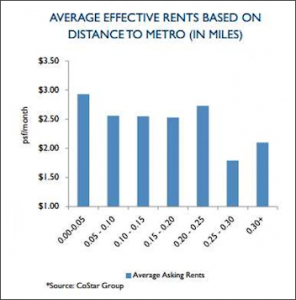

Multifamily rents. Graphic credit: Cushman & Wakefield.

A similar pattern prevailed for multifamily apartments, although the preferences aren’t quite as stark. States the report: “Properties within 0.05 miles of a Metro stop were able to command up to a 23% premium over average effective rents.”

Fairfax County is adopting a similar strategy to Arlington County for redeveloping property along its new, Silver Line metro stations: planning for walkable, mixed-use development and encouraging residents and workers to walk, not drive, to the Metro. Fairfax hopes to reap comparable gains as employers and renters pay a premium to enjoy the Metro access. Tysons enjoys a big advantage over Rosslyn-Ballston in re-development, states Cushman & Wakefield: While Rosslyn-Ballston commenced its great experiment as a dreary and declining retail strip, Tysons starts out as home to the largest concentration of office space in Northern Virginia.

On the other hand, the price differential for Metro versus non-Metro space in Arlington comes after 40 years of painstaking attention to creating walkable urban spaces. When it comes to creating a walkable urban grid, Fairfax planners expect Tysons to take decades to get to where Arlington is today. Until the urban fabric of Tysons resembles that of Arlington, proximity to the Metro is not likely to command the same price premium.

The good news here is that new Metro lines can create an extraordinary amount of economic value. The study provides concrete evidence that, if the surrounding land uses and the quality of urban design meet Arlington standards, heavy rail can bolster the tax base. The bad news is that commercial property owners appear to reaping the windfall gains, not the taxpayer chumps who pay for the rail line.

A digression into a Bacon obsession: Here at the Bacon’s Rebellion command bunker in lovely western Henrico County, we’re always asking how growth can pay its own way. I’m a big believer in “value capture” as a tool to finance construction of projects like Rail-to-Dulles, as an alternative to pillaging unrelated parties like Dulles Toll Road commuters and Virginia taxpayers.

While I love free markets and making profits, I have a huge problem with crony capitalism and rent seeking. And I have a sneaking suspicion that the big property owners in Tysons, though they are paying a sliver of the cost of building the Silver Line through a special tax assessment, are making out like bandits.

Tysons property owners get a double windfall from the Silver Line: (1) the rent premium from access to the Metro, and (2) permission to build at higher densities. The Silver Line will cost $5 billion to $7 billion to build (depending on what you include in the project cost). Fares paid by riders will not cover one dime of that amount. Could more of that value have been extracted from property owners?

Commercial properties make up about 83% of the Tysons district’s almost $11.5 billion in total assessed value, according to this county document. For purposes of argument, let’s say one-third of that commercial assessed value is located within a quarter-mile radius of one of the four Metro stops. That would represent about $3.2 billion worth of property.

A 30% increase in rents due to Metro access would increase property values by about $1 billion, to a total of $4.2 billion. Now, let’s say the Fairfax board allowed property owners to double density. That would add another $4.2 billion in value for a total net value creation for property owners of $5.2 billion. In January, the Fairfax County Board of Supervisors set up a Tysons service district to pay for $3.1 billion for a new street grid, sidewalks and bike paths, expanded transit, and improved roads. Two funds are expected to collect a total of $557 million over the next 40 years (over and above what property owners will pay through normal property taxes) — or about 18% of the cost of the improvements.

By my rough calculations Tysons property owners will contribute only one ninth or tenth of their windfall gains in property value toward the public improvements that make those gains possible. (And I’m not even including the cost of building the Metro itself!) Now, I’m the first to admit that my numbers are the roughest of rough estimates, and all figures and assumptions need to be validated. But this is the kind of exercise, using validated numbers, that we need to engage in.

If it turns out that property owners are reaping billion-dollar windfalls while taxpayers get stuck with most of the bill, well, I have a problem with that. And so, I surmise, would a lot of taxpayers.

Loudoun County doesn’t even have service on the Metro Silver Line yet, but potential liabilities are escalating beyond levels county officials ever imagined when they signed up to participate.

Loudoun County doesn’t even have service on the Metro Silver Line yet, but potential liabilities are escalating beyond levels county officials ever imagined when they signed up to participate.

Phase 1 of the Rail-to-Dulles project was supposed to be the good phase. For quite a while, it appeared to be running on budget and on time, providing reason to be optimistic that the highly controversial Phase 2 of the project might do so as well. But it hasn’t worked out that way. The story has been chronicled in the Northern Virginia press but has gotten little attention downstate, even though Virginia taxpayers are helping to foot the bill for the mega-project.

Phase 1 of the Rail-to-Dulles project was supposed to be the good phase. For quite a while, it appeared to be running on budget and on time, providing reason to be optimistic that the highly controversial Phase 2 of the project might do so as well. But it hasn’t worked out that way. The story has been chronicled in the Northern Virginia press but has gotten little attention downstate, even though Virginia taxpayers are helping to foot the bill for the mega-project.