Pressure is intensifying to redevelop Richmond’s retail enclaves at greater densities. But locals love the Libbie & Grove shopping district just the way it is. Is there a way to accommodate both?

by James A. Bacon

The Libbie & Grove shopping district is little known outside the west end of Richmond but it is much beloved by the people who live nearby. There is nothing especially distinctive about the architecture of the shops and restaurants – indeed the styles are very much mix and match. Some of the buildings, like a 7 Eleven and BP gas station, are major eyesores. But the retail district has an indefinable aura that makes it a great place.

The Westhampton Theater, the only movie theater in Richmond that plays independent and foreign flicks, is a major draw for the city’s wine and brie crowd. Phil’s Continental Lounge, a neighborhood restaurant and bar from another era, draws more of a beer and bubba clientele. Peter-Blair displays what just be might the world’s gaudiest assortment of bright, preppy neckties. There are numerous eateries in the area, and they all provide sidewalk dining. It’s fun to walk around, windowshop and bump into people you know.

For a fleeting moment, one might say, the Libbie and Grove area has achieved a state of urban grace. Everybody loves it, and no one wants it to change. But, as former Beatle George Harrison once crooned, all things must pass.

Artist's rendering of the Highline Developments project at the corner of Libbie & Grove

The mixed-use building would replace a BP gas station.

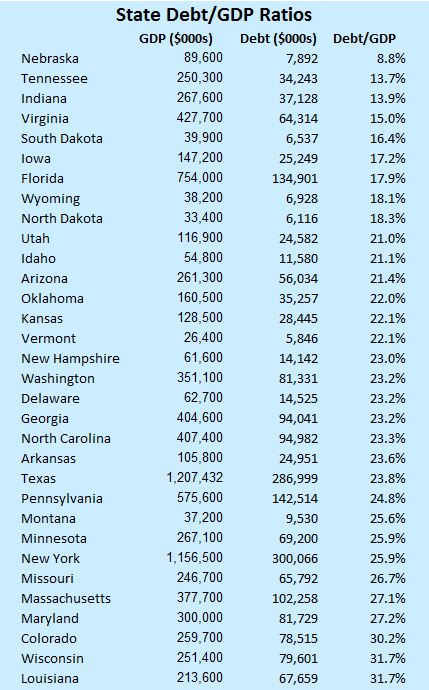

Highline Developments BP LLC has asked the city for a special use permit to build a four-story apartment and retail center where a BP gas station now stands. The project would offer several amenities, not the least of which is replacing the ugly gas station. Plans call for 24 parking spaces behind the building with another 53 underground, expanding the supply of desperately needed parking in the area. The ground floor would be devoted to shops and restaurants, while 22 apartments would reside in the upper floors. Perhaps most notably, the building would be architecturally striking. A cupola would provide a visual focal point the district now lacks.

There would be another big bonus for the city. The mixed-use building would generate roughly $150,000 in property tax revenue in place of a gas station that contributes only $11,000 in property taxes now. If the City of Richmond to wants to rebuild its tax base, it will have to encourage the higher-intensity development along its commercial corridors.

But the project has a major drawback – it’s big. The four-story structure will dwarf nearby buildings. The roof height would be 53 feet; the cupola would soar to 68 feet. That compares to 35 feet for the Westhampton Theater, the tallest existing building. By setting a precedent for developers to propose more tall, mixed-use buildings, it will forever change the character of the retail district.

The Richmond region is at a crossroads. The tide of development is shifting from the metropolitan periphery back toward the urban core. The new dynamic is most visible downtown, in Shockoe Bottom, the Canal district and the old Manchester neighborhood across the river. While a handful of downtown projects generated controversy because they would block the river views of established homeowners, redevelopment has been relatively free of conflict with adjacent neighborhoods. But not everyone who wants to move back into the city wants to live downtown. Developers are betting that there is pent-up demand for luxury condomium living in an affluent neighborhood like Libbie & Grove.

Pressure to re-develop traditional Richmond neighborhoods at greater density will only intensify. The question is, can the city accommodate the redevelopment, which is far more efficient from an infrastructure-utilization point of view than building in a green field on the metropolitan edge, or will resistance from neighbors limit the city’s evolution? Given the city’s status-quo vision for the city’s west end and outspoken community opposition, the answer is not at all clear.

You won’t find any grand mansions near Libbie & Grove, unless you cross River Road to the estates near the James River or travel a ways down Three Chopt Road. The houses are understated in the old Virginia manner but well-to-do. St. Catherine’s School, with its manicured grounds and stone school buildings, is within a short walking distance of the shops, while the Country Club of Virginia lies just beyond. St. Stephen’s, one of Virginia’s largest and wealthiest Episcopal churches, is only a block or two away, and the University of Richmond, St. Christopher’s School and Saint Mary’s Hospital are just down the road.

The red patch shows the location of the proposed mixed-use building. (Click for a more legible image.)

Though known as “Libbie & Grove,” the retail district technically follows Libbie all the way down to Patterson Ave. and encompasses several blocks of commercial activity there as well. The city’s Master Plan supports the status quo for the area, noting, “Opportunities for redevelopment or change in use … are extremely limited.” The plan’s guiding principles state that, in general, residential areas should be protected from commercial encroachment and that, in the specific case of Libbie/Grove, “the vitality of the commercial service centers … should be maintained by placing limitations on the extent and character of expansion to those areas.”

In 2010 the city embarked upon a review of the Master Plan for Libbie & Grove at the request of the area’s City Council representative Bruce Tyler. After a series of public hearings, stakeholders reaffirmed the Master Plan’s land use recommendations for the district. However, Scott Boyers, a CB Richard Ellis broker and investor in the Highline Developments project, says the review was a two-step process. The first phase, which is complete, created a “framework” for the area. A follow-up phase, which has not yet occurred, would address specific zoning densities, heights, sizes and setbacks. “My project was thoughtfully conceived in good faith with respect to the Master Plan and the process to complete the plan,” he told Bacon’s Rebellion. Read more.

By Peter Galuszka

By Peter Galuszka