Aggregated debt for the 50 states exceeds $4.19 trillion, according to a new report issued by State Budget Solutions. That may pale in comparison to the federal government’s nearly $16 trillion in debt but, then, states have more limited fiscal resources than Uncle Sam. Among other things, they can’t print their own money.

“These budget numbers should serve as a wake up call for every state legislature around the country. Our states are in trouble and no amount of budget gimmicks, political posturing or hiding bills will fix the massive debt that they face,” said Bob Williams, president of State Budget Solutions. “There is no option for status quo or incremental adjustments. Drastic reforms, innovations and political courage are needed to put our states back on the road to fiscal survival.”

The $4.19 trillion figure does represent an incremental improvement from $4.24 trillion the previous year, but the progress in debt reduction is discouraging given the fact that the nation is in its third year of economic expansion and state finances should be improving. SBB’s definition of debt includes bonds, leases, unfunded pension liabilities, post-employment benefits and unemployment trust fund loans.

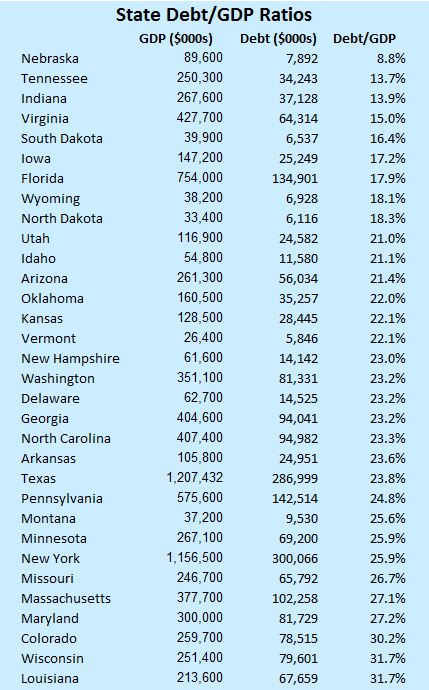

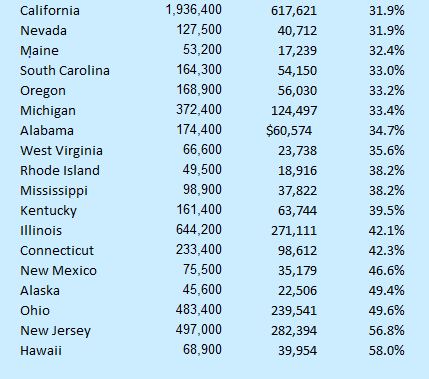

California is famously the most indebted state measured by absolute dollars, $617 billion. But it also has the largest economy, so the debt burden isn’t as heavy as it is for many other states. Likewise, Virginia, with $64 billion in debt, ranks fairly high in absolute dollars of debt. Yet the Old Dominion’s debt burden, measured as a percentage of the state economy, is one of the lowest in the nation.

In the chart below, I have taken SBB’s debt numbers, aligned them with 2011 state GDP numbers, and shown the debt as a percentage of GDP. States at the top of the list have the lowest debt burden. Nebraska, home of tightwad billionaire Warren Buffett, has the lowest debt/GDP ratio in the country. As for the states at the bottom of the list, Hawaii may be paradise but I wouldn’t want to be a taxpayer there.

Watching its debt and long-term budget obligations is one of the things that Virginia does really well. But that’s no excuse to get complacent. Our economy remains extremely vulnerable to a downturn in federal spending, especially defense spending, and our budget picture could deteriorate in a big hurry. Moreover, we remain mired in institutional dysfunction. There is no serious movement to reform K-12, high ed, health care, transportation or human settlement patterns. The fuse is still burning.