Melt down

by James A. Bacon

The City of Petersburg’s fiscal meltdown is reaching a new crisis stage as an Oct. 1 deadline nears to make a $1.4 million payment to the Virginia Resources Authority (VRA), a state funding source for local infrastructure financing.

In remarks to the Richmond Times-Dispatch following a House of Delegates Appropriations Committee hearing yesterday, Secretary of Finance Richard D. “Ric” Brown said that the state might have to “intercept” state aid to Petersburg in order to meet principal and interest payments on VRA bonds backed by the moral authority of the state.

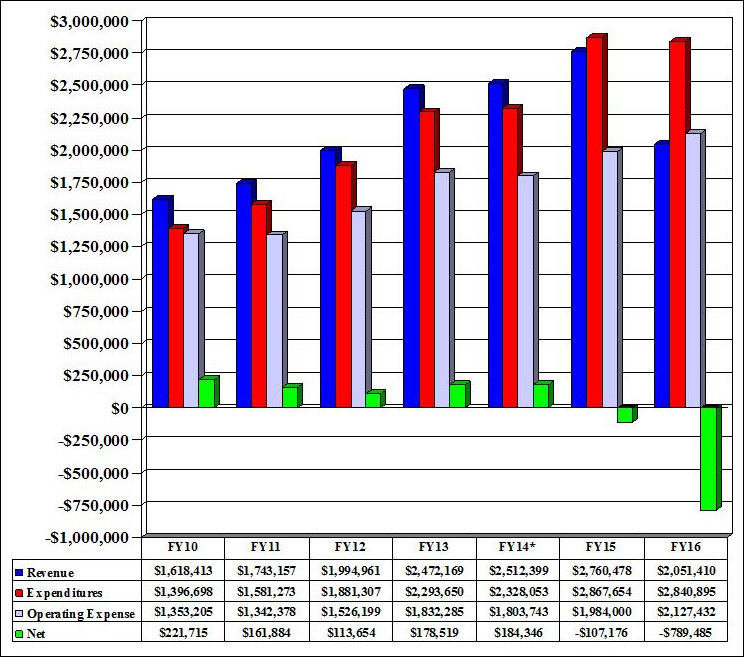

The General Assembly had convened the session to discuss how to build a firewall between Petersburg and the rest of the state. The city faces a $12 million budget deficit this year as well as estimated backlog of $19 million in unpaid bills.

“I just hope we are not heading down this road where we are digging the state into a hole,” said Del. R. Steven Landes, R-Augusta, chairman of a task force formed to study the impact of fiscally stressed localities on the state.

“We’ve got to figure out what change we need to make from a state’s perspective; we need to protect ourselves,” said Committee Chairman Chris Jones, R-Suffolk, as reported by the Richmond Times-Dispatch. “VRA debt can be an issue that can affect our bottom line. We cannot allow [a default] to occur. It’s very distressing when you see what has occurred, and hopefully [the city] will continue to try — in a very straightforward way — to deal with the issues.”

So far, Petersburg officials have yet to ask for state bail-outs. Secretary of Finance Richard D. “Ric” Brown and his office have lent considerable “technical assistance” in disentangling the city’s finances. But other than shaking loose some funds to help the city’s school system, the McAuliffe administration has taken no concrete measure to ease the city’s burden — and it likely would meet considerable resistance if it tried to do so.

City Council has been enacting draconian cuts to the budget in a desperate effort to stem the red ink. Whether it can find $1.4 million to pay the VRA is an open question. The state has a lot at stake.

Created by the General Assembly in 1984, the VRA has funded more than $7 billion in investment in 1,000 projects across the Commonwealth. According to the VRA website, this is how the program works:

VRA sells bonds and then loans the proceeds to local governments to finance eligible infrastructure projects. The borrowers’ interest rates are based on the rates that VRA obtains in the public bond market. Based in part on the use of the Commonwealth’s moral obligation, VRA’s high credit ratings typically result in interest rate savings for localities. This translates to reduced rates, taxes and user fees for borrowers’ constituents.

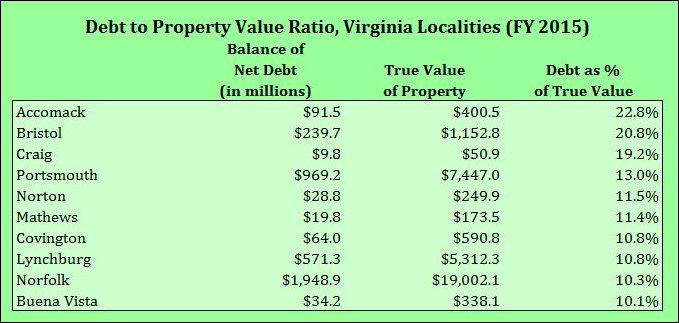

Come Oct. 1, if Petersburg fails to make its $1.4 million payment to VRA, absent state intervention, the authority will be unable to make the interest and principal on the bonds sold to investors on Petersburg’s behalf. Those bonds are backed by the “moral authority” of the state, which does not legally obligate the state to made good, as it would if the bonds were backed by the full faith and credit of the state. But a failure to back Petersburg’s payment would damage the state’s moral authority, thus undermining the entire premise of the VRA, harming other localities who might wish to borrow from it, and perhaps even calling into question the creditworthiness of other categories of bonds backed by the state’s moral authority.

Allowing a default on the VRA bonds is, in a word, unthinkable. But bailing out Petersburg would create a moral hazard. If the state bails out Petersburg once, then why not twice? If the state bails out Petersburg, then why not some other hard-pressed locality? Fiscal discipline could unravel.

Brown clearly understands the state’s quandary. Speaking to reporter Markus Schmidt after the hearing, the finance director said he might have to “take certain steps to intercept aid” from the state to Petersburg to make sure the payments are made. He acknowledged the hardship such an action would create: “In many cases for the city, that would make matters a lot worse for them.”

As creditors close in and the City of Petersburg struggles to avoid default, it is spending large sums on legal and consulting fees. In the latest litigation, the city has hired the Richmond-based law firm Sands Anderson to fight an Oct. 4 order by a Petersburg Circuit Court Judge appointing a special receiver to ensure that city residents’ wastewater payments are forwarded to the regional sewage treatment agency.

As creditors close in and the City of Petersburg struggles to avoid default, it is spending large sums on legal and consulting fees. In the latest litigation, the city has hired the Richmond-based law firm Sands Anderson to fight an Oct. 4 order by a Petersburg Circuit Court Judge appointing a special receiver to ensure that city residents’ wastewater payments are forwarded to the regional sewage treatment agency.