by James A. Bacon

Republicans and Democrats alike are focusing on tax expenditures — exemptions, credits, deductions and other tax loopholes — in the federal government. It’s about time that someone took at comprehensive look at tax expenditures in the state budget. Thanks to the Joint Legislative Audit and Review Commission, we now know that tax preferences in the state tax code reduced taxpayer liabilities by $12.5 billion — equivalent to roughly 90% of the state tax revenues actually collected.

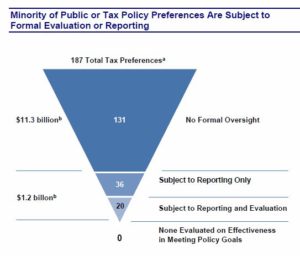

“Like most states, Virginia uses tax preferences to achieve specific policy goals,” write the authors of “Review of the Effectiveness of Virginia Tax Preferences.” Because tax preferences are not subject to the State budgetary process, they often remain in effect, sometimes indefinitely, without any evaluation of their effectiveness. Little information is available about tax preferences, including which ones should be continued because they are effective, and which ones could be revised to improve their effectiveness or eliminated altogether.”

Some tax preferences achieve their goals, others do not. JLARC recommends that the General Assembly set up mechanisms to give tax preferences regular scrutiny and review.

Three large preferences account for half of the reduction in tax liability, the report states: (1) the exemption of services from the retail sales and use tax, (2) the exemption of manufacturing materials and equipment from the same tax, and (3) the treatment of federal itemized deductions on individual income tax

returns. Five other preferences, aimed at helping the poor, account for $2.2 billion in reduced liabilities: the tiered income tax rate, special breaks for social security income and an age deduction from the income tax, and exemptions for food, drugs and medical products from the sales tax.

Among the more controversial recommendations, JLARC recommended extending the sales tax to services. “Services now represent approximately two-thirds of the national economy, and Virginia could significantly broaden the retail sales and use tax base and improve the reliability of collections by taxing some or all services. Service exemptions represent the largest group of tax preferences in Virginia, reducing taxpayer liability by over $3.5 billion in 2008.”

As for the tax breaks that are justified by helping the poor, JLARC notes, they don’t accomplish that goal very efficiently. “While taxpayers

with incomes of $20,000 or less comprised 14 percent of Virginia households, they received only seven percent of the reduction in tax liability associated with the partial exemption on food purchases available to all taxpayers.”

Some breaks were given for purposes of administrative efficiency. The exemption from the sales tax on prisoner artwork, for instance, was granted on the grounds that it would be impractical to try to collect the tax. Other tax breaks seem to accomplish their goals. The tax credit for conservation easements, for example, has put significant acreage under protection. But others apparently are too meager to be effective. As an example, JLARC writes, “the Worker Retraining Tax Credit has been historically underutilized because, according to businesses interviewed by JLARC staff, the $100 credit for non-community college retraining is not large enough to encourage companies to retrain workers.”

My philosophy on tax policy is simple: We should strive for the broadest tax base and the lowest rates possible. We should balance those concerns with ease of administration, both for those who collect the taxes and those who pay them. Taxes should be equitable, as in, no carve-outs for small groups. Finally, taxes should be transparent: Taxpayers should know what they’re paying. If lawmakers want to help the poor, fine, create a line item in the budget and review it every year. If lawmakers want to stimulate economic development, great, set up a fund for dispensing grants so the costs and benefits can be measured. But don’t create tax exemptions, put them on auto-pilot and forget about them. That is simply bad governance.