by James A. Bacon

It is well documented that African-Americans and Hispanics lost a higher percentage of their net worth since the Great Recession of 2007 than did whites and Asians. The pressing question is why?

The dominant explanation is that racism and discrimination — or at least the after-effects of overt racism and discrimination reflected in practices embedded in major U.S. institutions such as schools, universities, banks, real estate markets and the like — is to blame. But there is a hardy dissenting viewpoint that, while private U.S. institutions may fall short of the ideal, the greatest threat to minority well being is activist government: In the effort to fix inequality, social justice advocates exercising the levers of government power unwittingly do more harm than good. The effects of the real estate crash and ensuing recession are a perfect illustration of that principle.

William R. Emmons and Bryan J. Noeth don’t frame the issue that way in a paper published last year, “Why Didn’t Higher Education Protect Hispanic and Black Wealth?” The two economists, working for the Federal Reserve Board of St. Louis, were preoccupied with the question of why college–educated Hispanics and blacks fared so poorly during and after the recession. Given that higher education is associated strongly with higher income and greater household wealth, it seemed anomalous that college-educated blacks and Hispanics saw much greater plunges in net worth than whites and Asians. But the data the authors provide is entirely consistent with the idea that social-justice activism combined with blundering government efforts to right past wrongs is a recipe for minority disaster.

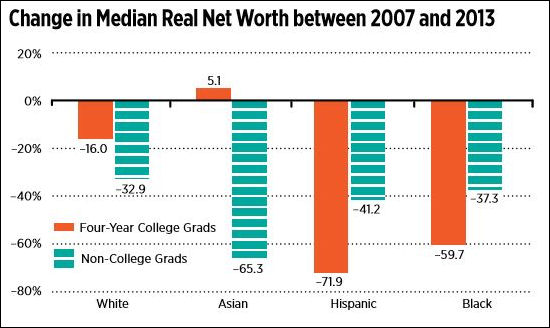

Look at the chart atop the post. The thing that will stand out to social-justice warriors, always alert for any sign of inequality, is that the percentage loss in net worth between 2007 and 2013 was far greater for college-educated blacks and Hispanics than for college-educated whites and Asians — the very points that caught the attention of Emmons and Noeth. But at least two things will stand out to those who don’t embrace the presumption of racism.

First, the percentage loss in net worth for less-educated whites is in the same ballpark as that for less-educated blacks and Hispanics. If racism/ discrimination were a decisive factor, why did non-college-educated whites fare nearly as badly?

Second, educated Asians actually gained wealth during the time period, the only group to do so, while their less-educated peers suffered more disastrous losses (expressed as a percentage of net worth) than any other ethnic racial group. How does the racism explanation fit here? Do the forces of institutional racism disproportionately favor educated Asians and punish less-educated Asians?

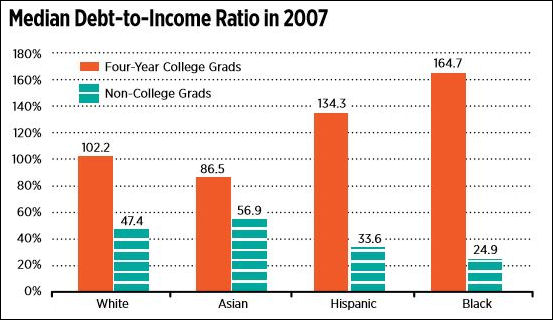

As it turns out, Emmons and Noeth provide data that account for much of the disparity. The key variable was indebtedness, or more precisely, the median debt-to-income ratio in 2007. Some racial-ethnic groups had piled up more debt, much of it mortgage debt, than others. Consequently, when the real estate market tanked, the economy crashed, and people started losing their jobs, some were more vulnerable to the downturn than others.

Let’s take a closer look.

It turns out that not only did college-educated Americans in 2007 take on more debt in absolute terms than did their less-educated peers, they took on more debt in comparison to their incomes. College-educated blacks and Hispanics took on the highest debt levels of all — up to 164.7% in the case of blacks. When real estate markets crashed, they were the most exposed, and they suffered the greatest losses. It is not coincidence that the group taking on the least debt, educated Asians, was the one group that saw an increase in net worth.

Conversely, less-educated Asians were the most highly leveraged of their racial-ethnic peers. Not surprisingly, they saw the greatest percentage losses in net worth.

Why did educated Hispanics suffer even greater net-worth losses than educated blacks? Is America’s real estate-financial system more rigged against Hispanics than blacks? No. A better explanation for the disparity between Hispanics and blacks is that Hispanics predominated in California, Florida, Arizona, Nevada and other real estate markets that suffered the worst crashes.

Social justice and government activism, a deadly combination

So, the real question is how blacks and Hispanics came to be so highly leveraged? Was it a rapacious capitalist system that preyed upon the poor and ignorant by loading them up with debt? No. Poor blacks and Hispanics took on the least debt (as a ratio of their income) of any group. It was the educated blacks and Hispanics who loaded up on debt and got clobbered the worst by the recession.

Now let’s take a little journey back through time. Does anyone remember the political climate of 2006? Everyone, Republicans and Democrats alike, was supporting programs to promote home ownership. And no one was targeted for this feel-good initiative more than blacks and Hispanics — minorities who were deemed to be the victims of past discrimination, thus denied the wealth-creating opportunities of home ownership. No one was more aggressive than the social justice warriors who agitated endlessly to remove the “barriers” to home ownership — in other words, to lower lending standards. Private-sector “greed” did not lower lending standards. Social justice advocates dismantled the lending standards that “greedy, uncaring banks” supposedly had erected to unfairly limit access minorities to mortgage markets. (I refer you to Gretchen Morgenson’s book, “Reckless Endangerment,” for the details of the sordid story.)

As a consequence of this disastrous policy, millions of Americans of all races and ethnicities were suckered into taking out mortgages in the most over-heated real estate market in U.S. history. The devastating loss of wealth experienced by blacks and Hispanics was the direct result of misguided social activism and government meddling in mortgage markets during a time when sane people (like me) were warning that consumer debt generally, and real estate prices particularly, were unsustainable.

But being a social-justice warrior is never having to say you’re sorry. Just cloak yourself in moral superiority, wave the bloody flag of racism and move on to the next fiasco.