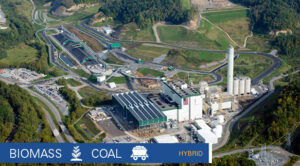

Virginia City Hybrid Energy Center in St. Paul, which burns both coal and wood biomass. It is the centerpiece of Dominion’s proposed 100% renewable service, infuriating environmental opponents. Dominion photo.

By Steve Haner

Is Governor Ralph Northam now on both sides of the electricity retail choice issue? Having sent a strong signal weeks ago that he would oppose 2020 legislation creating competition for all customers, his administration has now intervened in a regulatory dispute asking to protect competitive choice for 100% renewable electricity. You are only free to choose if you choose green?

In order to stop other companies from selling so-called 100% renewable electricity in the Dominion Energy Virginia territory, the utility needs its own version of this shell game approved by the State Corporation Commission. The next hurdle in that long road is a hearing at the SCC Thursday.

When we visited this saga in August, Dominion’s application for what it calls Rider TRG had been filed but few of the likely opponents had responded. A long list of complaints about the idea is now part of the case record, including objections from the Northam Administration filed Friday in the name of the Department of Mines, Minerals and Energy.

Under a Virginia law Dominion helped to frame, once it has an approved “green” tariff, any and all competitive service providers must cease taking customers seeking 100% renewable. That concerns John Warren, DMME’s director:

“The loss of competition means there will be only one renewable energy product available in Dominion’s service territory. As evidenced by consumer statements in this case, a number of customers are satisfied with the products offered by (competitors) and are opposed to the product offered through Rider TRG. Approval of Rider TRG would likely create a scenario where customers are unable to purchase satisfactory renewable products, refuse to pay for Rider TRG, and renewable investment will fall despite high market demand. This scenario would be highly detrimental to the state’s energy goals.”

Could a compromise outcome with the utility be forming in front of us? Warren’s boss, Northam, is on record opposed to legislation allowing electric retail competition in general, but here is his DMME fighting hard to preserve choice in this one narrow corridor – 100% renewable power. If this is the result, it is a compromise with nothing to offer to those not eager to pay more for green virtue.

And it is also a compromise that could fall apart if the SCC approves Rider TRG, which merely takes Dominion’s renewable generation already built or under contract and charges extra to customers seeking to claim those particular electrons serve them, ignoring how the grid works. A similar scheme has already been approved for the Appalachian Power Company by the SCC.

Recognizing that, perhaps the most effective counterattack comes from a witness hired by environmentalists, who seeks to differentiate the APCo and Dominion proposals.

“(APCo’s) Rider WWS portfolio of resources was cheaper than the rest of APCo’s generation portfolio. Dominion’s Rider TRG, on the other hand, bundles renewable resources that are more expensive than the rest of Dominion’s fleet and dedicates those more expensive resources solely for TRG customers. Since those more expensive resources will no longer serve non-participants, non-participants’ rates should go down. Here they do not. In this way, Rider TRG does not hold non-participants harmless.”

Adding another absurd element noted by all is Dominion’s reliance on the burning of coal and wood products in this proposal. The largest generator dedicated to Rider TRG is the 600-megawatt hybrid coal and wood plant in Southwest Virginia. And three other 51-megawatt pure biomass plants dwarf Dominion’s utility-owned solar facilities in the program (only 33 megawatts). The hybrid plant must burn coal and biomass together. In all, Dominion claims it could serve 50,000 residential customers with Rider TRG,

The State Corporation Commission staff in its comments did not oppose this proposal or how Dominion proposed to run the accounting, but it did propose eliminating the biomass projects from the mix. With them included, Dominion proposes to add an additional four-tenths of a cent per kilowatt hour for TRG customers ($4.21 on a 1000 kWh bill). Pull the biomass out and the surcharge would go to less than two-tenths of a cent per kWh ($1.78 per 1000 kWh). It also cuts the potential customer base by more than half, demonstrating just how dependent this idea is on burning coal and wood and emitting CO2.

Absent from the record is any analysis or comment from the official defenders of Virginia’s consumers, the Office of the Attorney General. Perhaps that group will show up at the hearing and take a stand.

The other opposition is adamant. Walmart has weighed in against this (its testimony was a focus of Virginia Mercury earlier), along with a coalition of large consumers billing itself as the Renewable Energy Buyers Alliance. Its brief is a good summary of the opposition points: This proposal 1) adds no new renewable energy, 2) is over-priced and 3) bars competitors offering better products at lower prices.

Expert witness John Hanger for Direct Energy Services picked up the same theme:

“(Dominion’s) purpose is not to save money for its customers. Its purpose is not to offer a viable or attractive renewable energy product. Instead, the purpose of proposed Rider TRG and this filing is to stop more customers from buying renewable energy at prices below VEPCO’s current utility rate.”

His testimony (see the summary) identified seven ways that the proposal is not in the public interest, a key issue if the SCC is to deny this application after approving APCo’s. A second witness for that company complains Dominion has not provided sufficient evidence on why the surcharge needs to be that high, much higher than the surcharge APCo is imposing. “Dominion’s Application presents a tariff that is artificially inflated at the outset, and that will be used to collect costs for all future generation investments, whether or not they are from renewable resources,” Frank Lacey writes.

If some of these companies and individuals seem familiar, they are many of the same players from the drama earlier this year, when Dominion unilaterally shut down customer transfers to competitive service providers and forced them to fight for life in the SCC. This is another existential battle for them.

Dominion had sought to hold Thursday’s hearing in front of the full SCC, not just a hearing examiner, but the time saved by that compression of the process could mean less time for its competitors to sign up new customers, which they can keep even if DEV wins. They opposed the request, it was denied, and Thursday’s debate is before a hearing examiner.