by James A. Bacon

With apologies to Wayne and Garth, the residents of many Virginia  communities are not credit worthy, especially downstate. The low scores suggest major weaknesses in the ability of consumers to sustain spending and prop up local economies.

communities are not credit worthy, especially downstate. The low scores suggest major weaknesses in the ability of consumers to sustain spending and prop up local economies.

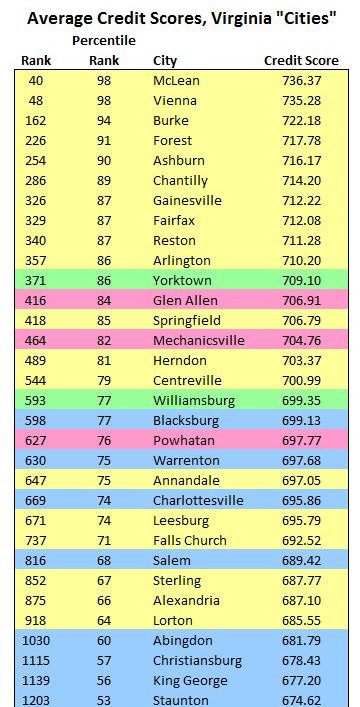

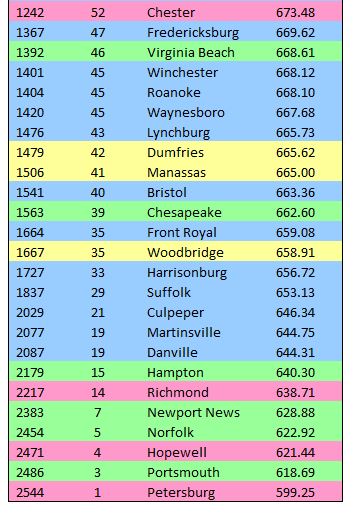

The numbers come from WalletHub, which has ranked U.S. “cities” by the average credit score of their residents. Credit score is a pretty good proxy for a household’s financial health, which makes aggregate numbers a reasonable proxy for consumer health.

I have extracted the credit scores for all Virginia “cities” (I’m not sure how WalletHub defines “city.” The definition certainly does not coincide with Virginia municipal boundaries.) Yellow indicates areas in Northern Virginia, green Hampton Roads, rose Richmond-Petersburg, and blue smaller cities and metro areas.

I note a few striking patterns. The first is that the consumer health of Northern Virginia remains remarkably strong despite cutbacks in federal spending and the slowdown of the regional economy. Perhaps that should come as no surprise given the high incomes and education levels of the area. There is one noteworthy exception, however: Dumfries, Manassas and Woodbridge — all centered around Prince William County — rank below the national average.

The second pattern is the weakness of the Hampton Roads consumer economy. Outside of the affluent Williamsburg-Yorktown area, the picture is dismal — every area, even Virginia Beach, is below the national average, with some jurisdictions scraping bottom.

The third is the abysmal consumer weakness of Virginia’s older core cities. The residents of Petersburg have nearly the lowest average credit score in the country, ranking in the bottom 1 percentile. Portsmouth, Norfolk, Newport News, Hampton and Richmond all look grim.

But there is a silver lining for Hokie fans: Blacksburg has higher average credit-worthiness than Wahoo-dominated Charlottesville!