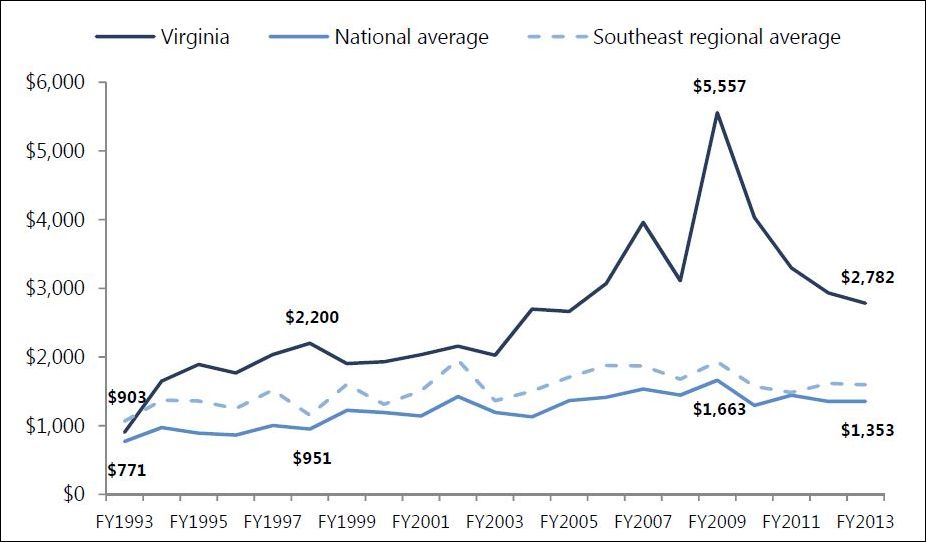

Higher education spending per student at Virginia public universities compared to regional and national averages. Graphic credit: JLARC

by James A. Bacon

Great minds think alike. The wonks at the Joint Legislative Audit and Review Commission (JLARC) apparently have been obsessing over the issue of college overindebtedness, just as I have here at Bacon’s Rebellion. In its newly issued report, “Addressing the Cost of Public Higher Education in Virginia,” JLARC has found that Virginia’s public colleges and universities have far outspent their peers nationally and regionally on buildings and other capital projects, with the result that they are saddled with major debt and interest payments.

“Total debt service for the state’s 15 four-year public institutions grew from $106.2 million in FY 2002 to $421.4 million in FY 2013,” writes JLARC in its executive summary. “Debt service on this institutional debt is equivalent to nine percent of E&G (Education & General) spending by the four-year public institutions in Virginia.”

Last year, Virginia spent almost $2,872 per student on capital projects more than twice the national average of $1,353. In FY 2009, Virginia institutions spent more than three times the national average. As JLARC observes, this spending occurred despite declines in state support and despite the increasing inability of students to afford higher education.

Meanwhile existing facilities have deteriorated. “As of FY 2011, the total deferred maintenance on E&G facilities was estimated at $1.4 billion, or approximately 19 percent of the replacement value of Virginia’s higher education E&G. … National research has found that every $1 of deferred maintenance results in $4 to $5 in long-term capital liabilities.”

Bacon’s bottom line: Building great facilities certainly adds to the allure of Virginia institutions. Handsome facilities are highly visible to prospect faculty and students, while deferred maintenance and other issues go unnoticed. And, as Peter G. observes in a post below, the impact on urban redevelopment can be striking. The City of Richmond has benefited enormously from the capital spending boom at Virginia Commonwealth University.

Indebtedness and leveraged balance sheets can work for enterprises when the market is expanding and new revenues can cover the cost. But it’s a recipe for disaster if the market tops out or, God forbid, enrollments start to shrink — as is actually happening in Virginia today. Colleges and universities cannot prune their debt burden without defaulting, an act that would effectively sign an institution’s debt warrant. System-wide, $400 million in annual debt service is baked into the cost structure. If higher ed institutions have to start cutting, that’s a big chunk that cannot be touched. Other line items must suffer all the more.

JLARC could have added considerable value to an already valuable report by compiling total indebtedness and debt-to-revenue ratios at each of Virginia’s 15 higher ed institutions. It would be nice to have some advance warning of which institutions are especially at risk. Who knows, maybe such data would encourage asleep-at-the-switch trustees on university boards to start asking tougher questions.