by James C. Sherlock

People learn — and relearn- – things over time about investing.

One of the things they have learned over the past three years about investing in municipal bonds, as with all bonds, is that, having experienced the effects of inflation risk for the first time in decades, they will want a higher coupon next time.

Issuing new ones, especially revenue bonds, is likely to prove significantly more expensive than in the past few decades.

Tough market.

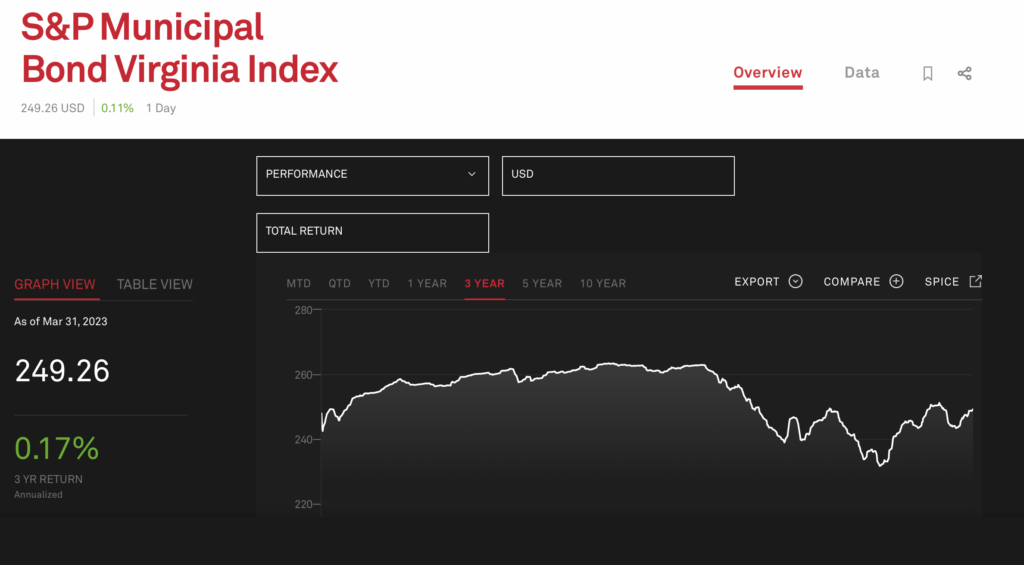

That chart is a little tough to read, but it shows that the annualized return on Virginia municipal bonds over the past three-year period is 0.17%.

Total return, tax adjusted, was down 7.36% in calendar year 2022. If you were a seller, the market price was down 36%.

Using the muni market to fund local government projects and even non-governmental projects like hospital expansions that have access to the muni market will be more expensive, at least for a while.

So, of course, will labor, land, construction-equipment leasing, and construction products and materials.

Reflecting the higher costs to issuers, U.S. municipal securities issuance dropped 20%, from $483 billion in FY 21 to $387 billion in FY 22, while trading volume, reflecting nervous investors, nearly doubled over the same period.

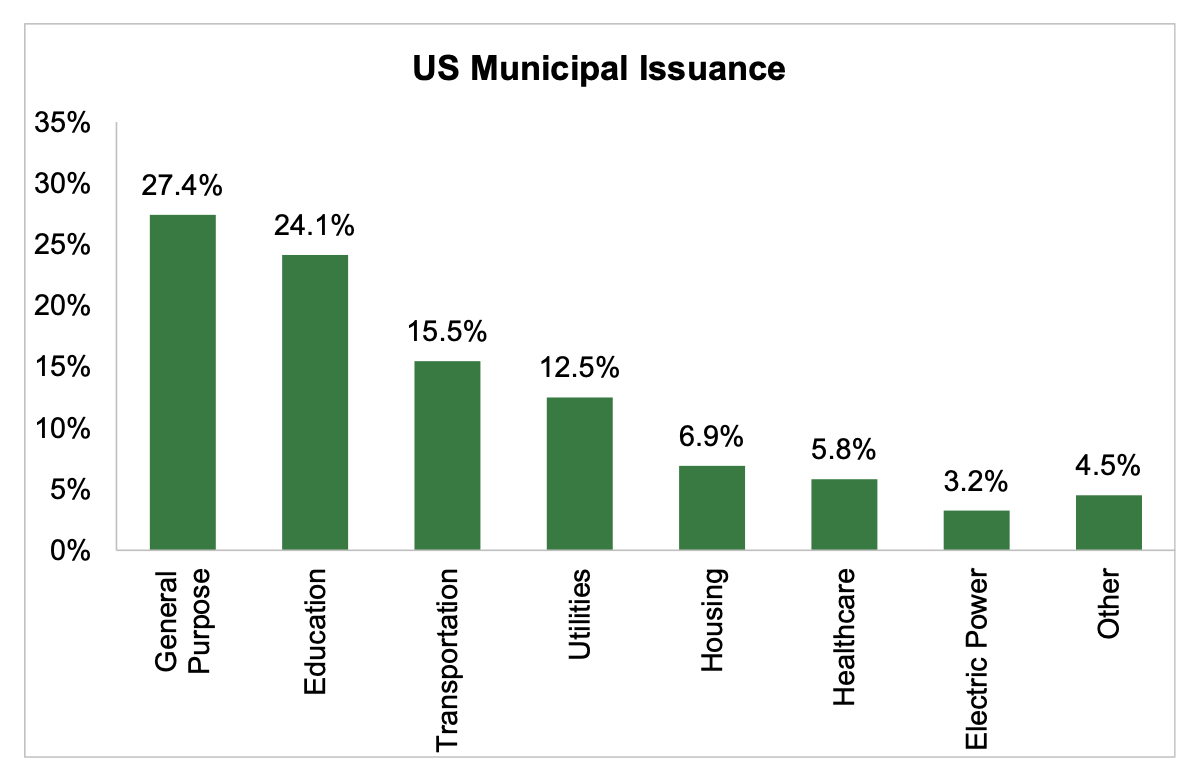

Nationally, here is where the money goes.

Bottom line. Revenue bonds issued in the poorer areas of the state will be hardest hit by higher rates even absent credit downgrades.

Citizens hope this more challenging bond market is reflected in the plans and budgets of government and non-government organizations with exposure to it.