by James A. Bacon

The Virginia Education Improvement Scholarship Tax Credit Program, which provides state tax credits for charitable donations to approved foundations, saves the Commonwealth $1.78 for every $1.00 in lost tax revenue, concludes a study by Richmond-based Mangum Economics.

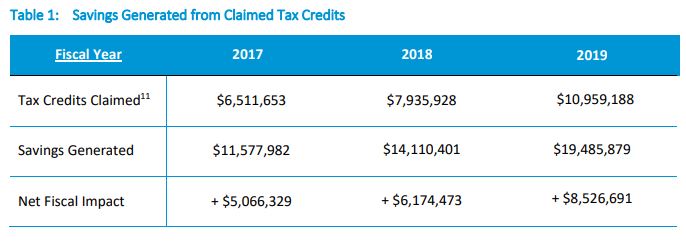

In tax year 2019, reduced public school enrollment generated $19.5 million in state savings with a net positive fiscal impact of $8.5 million after accounting for the lost tax revenue, according to the study, “Scholarship Tax Credits in Virginia.”

The study was sponsored by the Thomas Jefferson Institute for Public Policy (TJI), Virginia Council for Private Education, McMahon Parater Scholarship Foundation, Catholic Diocese of Arlington, Virginia Catholic Conference, Anna Julia Cooper School, Virginia Jewish Day Schools, Association of Christian Schools International, and Renewanation.

Not only does the tax credit create educational opportunities for children from lower-income families — beneficiaries must have family household incomes below 300% of the federal poverty guidelines — the program is “good for the bottom line of the state treasury,” says TJI President Chris Braunlich.

Individuals or businesses making monetary or marketable securities donations to approved Scholarship Foundations may claim a state tax credit equal to 65% of the donation. The state caps the credits at $25 million for each fiscal year.

In calculating the fiscal impact, however, the study make some significant assumptions: 90% of the scholarship recipients decided to attend private schools as a direct result of the scholarships while 10% would have attended anyway; and 90% of the donations are allocated to scholarships, with only 10% going to administrative costs. The study did not provide an estimate of local tax revenues saved by the reduced enrollment or lost federal dollars for schools.

The tax credits have increased in recent years — reaching almost $11 million in Fiscal Year 2019. That year, 4,381 students received scholarships. Localities making the greatest use of the tax credit were:

Richmond — 390 students

Norfolk — 347 students

Virginia Beach — 339 students

Roanoke – 311 students

Henrico County — 235 students

Fairfax County — 190 students

Chesterfield County — 176 students

Chesapeake — 159 students

Bedford County — 154 students

Prince William County — 152 students

Albemarle County — 112 students

Lynchburg — 107 students

Bacon’s bottom line: The scholarship tax credit program is a win for everyone — well, everyone except teachers unions and educators who want to preserve the public school monopoly. The state comes out ahead financially, as the study documents. Scholarship recipients come out ahead. Local school districts, which are able to spread local financial commitments over a smaller number of students, come out ahead. Insofar as per-pupil spending is correlated with academic achievement (admittedly a very small correlation), even public school students come out ahead.

At present the tax credit is running far short of the $25 million cap. Given the atrocious performance of many school districts — implementation of reverse-racism ideologies (let’s call “anti-racism” what it really is) and COVID-related school closings — thousands of families are likely desperate to put their children in private schools. I expect demand for the scholarships to continue surging, even as the COVID epidemic recedes.

If Bacon’s Rebellion readers want to support a worthy educational cause, they should consider rechanneling their donations from effete, elite and uber-woke private schools, colleges and universities to provide freedom of choice to Virginians in the bottom half of the income spectrum.