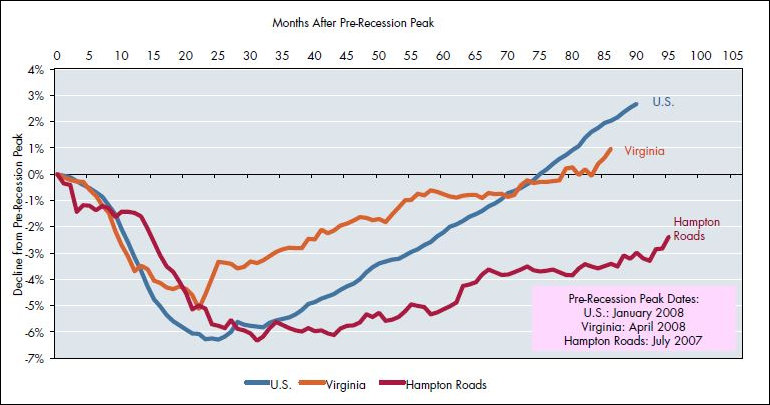

Recession recovery in the U.S., Virginia and Hampton Roads, measured by total jobs restored, 2007-2015. Source: “The State of the Region: Hampton Roads 2015.”

Hampton Roads didn’t have a bad year in 2014 — its economy grew 1.34%, higher than its growth rate in five of the previous six years. But that growth still didn’t come close to getting the economy back to pre-2007 recession levels, according to the 2015 “State of the Region” report published by Old Dominion University’s Center for Economic Analysis. The region still employs 15,000 fewer employees than in 2007.

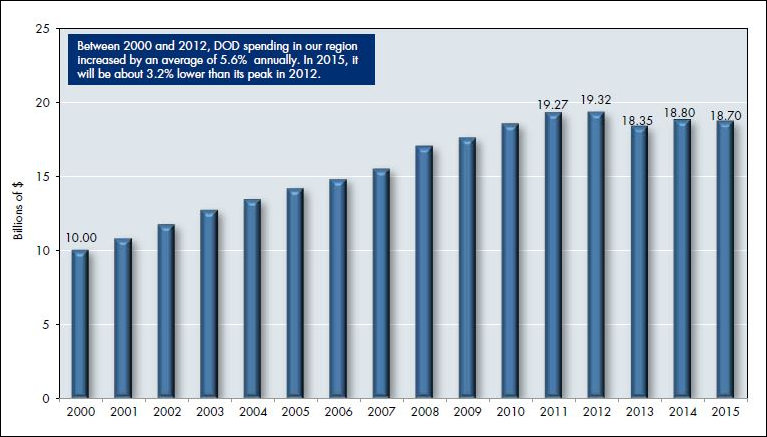

The recent decline in defense spending — 3.2% below its 2011 peak — hasn’t helped (although it’s worth noting that defense spending is higher than in 2007).

Writes lead author James V. Koch, ODU president emeritus:

The upshot of declining DOD spending is that it has forcibly diversified the Hampton Roads economy. We estimate that only 39.3 percent of our regional economic activity could be attributed directly and indirectly to defense spending in 2014. This is down from 44.9 percent in 2011 and our all-time high of 49.5 percent in 1984.

The region’s three other main industries are tourism, shipbuilding and ports. Tourism, as measured by hotel revenues, had yet to recover to 2007 levels by 2014 (although they may do so this year). Within the tourism sector, Virginia Beach has gained market share while the Historic Triangle has lost. Shipbuilding has been a bright spot; industry employment exceeds 2007 levels by 4,600 jobs.

Direct port-related activities account for 6% of the Hampton Roads regional economy. Cargo shipments reached a record level in 2015 at 210,000 twenty-foot equivalent units (TEUs). Despite important advantages such as deep channels, cargo growth lagged that of East Coast ports as a whole. But the ports may represent the region’s best best for diversification from the military, the report suggests. It is well situated to handle the giant super-ships dominating the sea lanes. If the ports can deal with some off-terminal productivity issues, the could see continued growth.

— JAB