It was quite a sight: During the transportation debate in the House of Delegates yesterday, Democrats waved personal credit cards over their heads to mock Republican proposals to borrow $1.5 billion in order to pay for new road projects.

Kaine administration spokesman Kevin Hall dissed the legislative package, telling Hardy/Schapiro with the Richmond Times-Dispatch:

I’m not sure that a proposal to simply incur more debt is the way Virginia wants to plan, build and maintain its transportation network. … That’s like using your Visa card to pay your MasterCard bill.

Someone better tell the backers of the $4 billion (before cost overruns) Metro-to-Dulles heavy rail project! Now that Gov. Kaine opposes the use of debt for building Virginia’s transportation network, there is no way the project will ever be built! Oh, wait… You’re telling me that Gov. Kaine favors borrowing money for that transportation project? … I’m confused.

My point here is not to defend the Republican proposal — I haven’t examined the list of projects to be funded under the plan, and might well disagree with the priorities if I did. My point is to query the Democrats: Since when did the old Byrd Machine “pay as you go” philosophy become the guiding philosophy of the party?

A decade ago, as I recall, Democrats were bashing “pay as you go” as a relic of a past age and were touting the idea of borrowing to build roads. Of course, that was when Jim Gilmore was governor and the prospects of passing a tax hike were precisely zero. The only way to spend more money on roads, it was perceived, was to borrow it. I can’t help suspecting that the underlying principle is not an aversion to debt but a fixation on extracting the maximum amount of cash, whatever the source, to build more roads.

The putative aversion to debt comes, incidentally, from the very same people who raised taxes in 2004 in order to preserve Virginia’s AAA bond rating. The reason the bond rating is so important, we were assured, is that a downgrade would make it more expensive to… borrow money. But now that we’ve preserved the AAA, the Commonwealth has yet to approve any new general obligation bond issues.

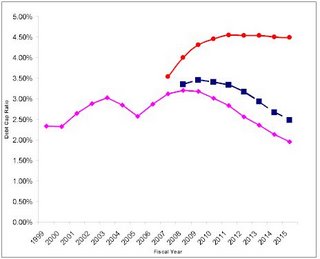

I draw the reader’s attention to the chart above, which I extracted from a House Appropriations Committee PowerPoint presentation. The red line shows Virginia’s maximum debt capacity. The pink line shows projected debt levels under existing legislation. The gap is large and growing. Looking forward, Virginia has enormous unused debt capacity. The blue line shows what debt levels would be under the House plan that Democrats want to skewer — still loads of debt capacity.

One final point: Roads are exactly the kind of long-term asset that should be funded with long-term bonds. When an asset is to be used and enjoyed by future generations of taxpayers, those future generations should help pay for it.