by James A. Bacon

Congress is floundering over what to do about the Highway Trust Fund, which collects the federal gasoline tax and plows it back to the states to finance a smorgasbord of transportation projects. The original justification for the gas tax was to build the Interstate Highway System, but the program has morphed over the years into a piggy bank for all manner of Interstate, highway, transit and miscellaneous projects that must be supplemented with General Fund appropriations. Congress persons are loathe to relinquish the perk of doling out money to constituents, but fiscal pressures make it impractical to continue the General Fund subsidies, while raising the gas tax is a political killer. What’s a Congress person to do? What he or she does best — dither.

Meanwhile, in the wake of Amtrak’s deadly derailment last week, we hear the usual wailing and gnashing of teeth that America isn’t investing enough in infrastructure.

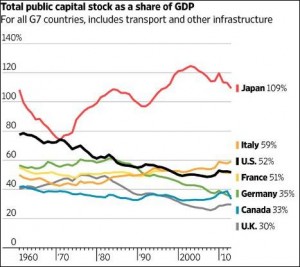

The idea that the United States is significantly under-investing in infrastructure is nonsense — the kind of special pleading you hear from big construction and engineering firms who grow fat on infrastructure spending. Among the G-7 countries (Japan, Germany, France, the United Kingdom, Italy, Canada and the U.S.), the total capital stock of the U.S. (transportation and other infrastructure) is the third highest, equivalent to 52% of the Gross Domestic Product, as seen in the graphic above, published today in the Wall Street Journal. While Japan is off-the-charts higher, that country arguably has way over-invested in transportation, creating a system that it cannot afford to maintain over the long run.

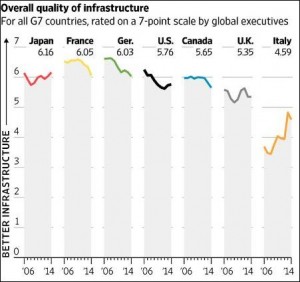

Likewise, the quality of infrastructure (the general state of repair) is also in the middle of the pack, as seen at left.

The problem isn’t the level of spending, it’s the mis-allocation of spending. As WSJ columnist Greg IP writes (sounding a long-time theme here at Bacon’s Rebellion), the economic Return on Investment of federally funded projects varies widely; indeed the feds have no mechanism for ascertaining ROI. “It’s nobody’s job in Washington to figure out which roads or bridges we should invest in,” Ip quotes Aaron Klein with the Bipartisan Policy Center as saying.

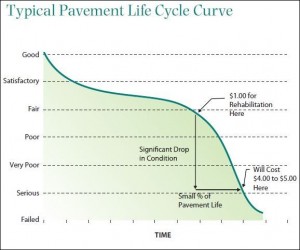

It’s time for Congress to get out of the business of building new transportation infrastructure. Having constructed the Interstate Highway System, Uncle Sam should commit to maintaining it and devolve responsibility for other projects to the states. That means adjusting the gas tax to whatever level it takes to maintain that system at an optimal level, and no higher. By optimum, I mean at a reasonably high state of quality and repair and with sufficient spending to undertake deep repairs at the most economically advantageous point on the life-cycle curve. Presumably, that level would require a much lower federal gas tax than the one in place now. A reduction in the federal gas tax would free the states to increase their own gas taxes by a like amount, more, or less, depending upon their circumstances.

It’s time for Congress to get out of the business of building new transportation infrastructure. Having constructed the Interstate Highway System, Uncle Sam should commit to maintaining it and devolve responsibility for other projects to the states. That means adjusting the gas tax to whatever level it takes to maintain that system at an optimal level, and no higher. By optimum, I mean at a reasonably high state of quality and repair and with sufficient spending to undertake deep repairs at the most economically advantageous point on the life-cycle curve. Presumably, that level would require a much lower federal gas tax than the one in place now. A reduction in the federal gas tax would free the states to increase their own gas taxes by a like amount, more, or less, depending upon their circumstances.

A bedrock principle for maintaining an optimum level of infrastructure investment is to put each component — roads, highways, mass transit, ports, airports, railroads — on a user-pays basis. When users pay for the transportation amenities they want, they are more careful about what they ask for. Any other system results in a political free-for-all in which every interest group seeks to get its favored projects funded at the expense of everyone else, in which case ideology and politics prevail over economic rationality.