by James A. Bacon

In the world of surface transportation, self-driving cars are generating a tremendous amount of excitement. While such vehicles undoubtedly will transform the driving experience, I question whether they will alter the underlying economics of transportation. Yes, they will be safer, and they even may allow a passenger to stream Netflix or answer emails instead of keeping his eyes on the road. But there is little in the nature of autonomous cars that will alter an individual’s calculation whether to drive solo, carpool, walk, bike or take mass transit to work.

What could change the underlying calculus of transportation decisions is the concept of Mobility As a Service. I highlighted one of the world’s first experiments a year-and-a-half ago in “Car-Lite Burbs,” describing a project by Daimler AG (owner of Mercedes Benz) that bundled access to scooters, cars, circulator buses, destination shuttles and Car2Share carpooling in a monthly subscription service for residents of the Rancho Mission Viejo development in California.

Now comes news that Ford Motor Co. and General Motors Co. also are thinking beyond the sale of automobiles to individuals and in terms of providing mobility as a service. This trend, if it takes off, could result in people purchasing fewer cars and riding more vans and buses, thus cannibalizing automobile sales. But the big auto companies see growth opportunities in the transportation market outside cars.

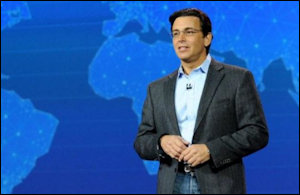

At the Consumer Electronics Show Monday, Ford CEO Mark Fields said the company plans to diversity into “transportation services” beginning in 2016. The transportation services sector, which includes buses, cabs and passenger rail, is a $5.4 trillion market, reports the Wall Street Journal. (I presume that is the global market, not the U.S. market.) “Ford and all industry competitors receive virtually no revenue today” from that sector, he said.

Ford has experimented with mobility services, such as ride-sharing and pay-by-mile rental vehicles but has yet to launch a full-scale effort. Apparently, that will change in 2016. When asked if Ford might form a new subsidiary to make a strategic investment in ride-sharing, Fields said “We are open to all possibilities.”

The previous day, General Motors announced a $500 million investment in Lyft, Inc., the ride-sharing competitor to Uber Technologies. “We see the future of personal mobility as connected, seamless and autonomous,” said GM President Dan Ammann in a statement. “With GM and Lyft working together, we believe we can successfully implement this vision more rapidly.”

Much of the buzz focuses on the move of Ford and GM into driverless cars. Just imagine how much less it would cost to provide Uber- or Lyft-style service if there weren’t a driver to compensate. But the looming transportation revolution is much bigger. While the top 20% or 30% income earners might choose to stick with solo cars (whether self-driving or not), a far larger share of the market is looking for affordable transportation services, and that could include riding on vans, jitneys, buses or mass transit as well as access to a car as needed. The really big play is integrating these transportation modes and bundling them into a unified mobility service.

Bacon’s bottom line: Policy makers in Virginia need to understand that the future of transportation demand will not be a straight-line projection of past trends. The shape of the transportation future in 2035, twenty years from now, will look nothing like transportation today. Yes, driverless cars are likely to be part of the mix. But that’s only part of the equation. There is a good chance, in the major metros at least, that hundreds of thousands of Virginians will be subscribing to mobility-as-a-service packages.

How will that affect the demand for new roads and mass transit services? I have no earthly idea. But I think it would be prudent to begin thinking about these things before plowing billions of dollars more into transportation infrastructure that very well could become obsolete in a couple of decades.

And how will private-sector mobility-as-a-service competition affect entities like the Washington metro, plagued as it is by poor governance, poor finances, poor management, union featherbedding, huge maintenance backlogs, declining ridership and other ills too numerous to describe? Or smaller bus-and-rail services in smaller metros, for that matter? It could well put them out of their misery.