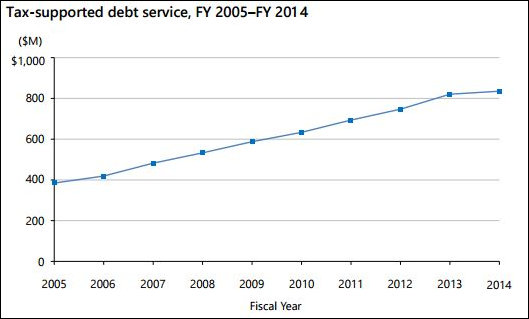

Debt service on bond issues, mainly for higher education and transportation, has been a major driver of state spending over the past 10 years. The repayment of interest and debt has increased in absolute numbers and as a percentage of total blended revenues — from $385 million (or 2.57% of revenues) in FY 2005 to $836 million (or 4.51% of revenue) in FY 2015.

Spending on debt service remains below the 5% cap recommended by the Debt Capacity Advisory Committee in order to protect Virginia’s AAA bond rating, according to the recently published “State Spending: 2015 Update.” But it still represents a long-term obligation that cannot be pared during economic downturns, thus limiting to some degree the state’s ability to respond to recessions.

Fortunately, Virginia’s debt bears no comparison to the federal ponzi scheme. The interest charges on state bonds are fixed. Payments will not increase unless state authorities choose to issue new debt. Uncle Sam is in a very different situation. Much of the $18+ trillion in federal debt consists of short-term notes (two years or less) that benefit from extremely low interest rates. However, should interest rates rise, a substantial portion of the federal debt will be rolled over at higher interest rates in short order. So even if the feds didn’t run annual deficits of $400+ billion a year for now until forever, the debt burden would increase.

Bond indebtedness does not account for other long-term obligations, such as real estate leases and, most worrisome, unfunded pension obligations. Virginia has made progress in bringing its pension obligations under control, although budget pressures could tempt the General Assembly to short-change budget contributions in the event of another recession.

— JAB