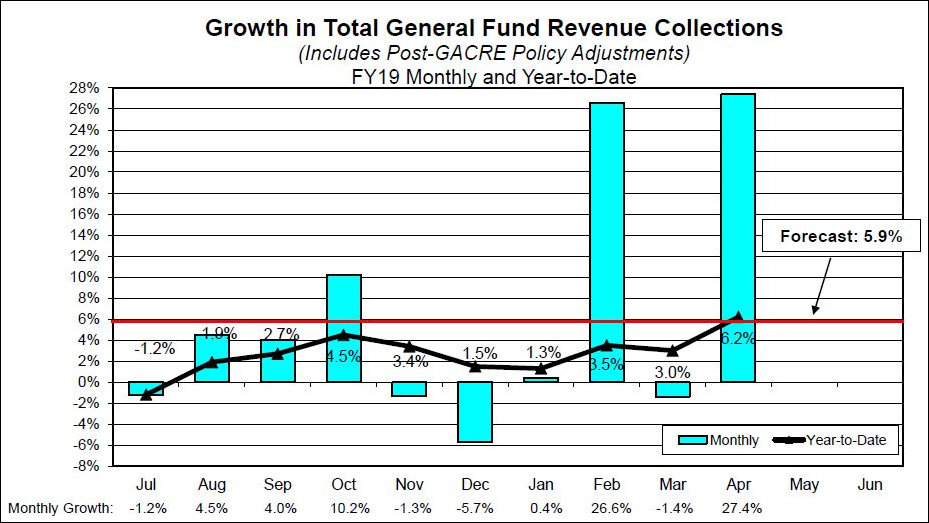

The good news in Secretary of Finance Aubrey Layne’s presentation to the House Appropriations Committee this morning is that General Fund revenues, after a below-forecast start to the fiscal year, surged 27.4% in April. On a year-to-date basis, total revenues are 6.2% ahead of last year, beating the 5.9% forecast for Fiscal 2019.

The bad news is that U.S. economic prosperity is built on a mountain of consumer, corporate, and government debt. The national debt stands at $22 trillion, and the Congressional Budget Office says that debt as a percentage of GDP could increase from 78% this year to 96% by 2028. Plus, student debt exceeds $1.5 trillion, and credit card debt has surpassed $1 trillion, both record highs. And corporations are carrying a $9 trillion debt load, almost double the level of the Great Recession. At 46% of GDP, corporate debt is the highest on record.

Layne, a traditional fiscal conservative, is not predicting an imminent recession. Rather, he is saying that the U.S. economy and, by extension, the Virginia economy and state budget, are highly vulnerable to a downturn, should one occur.

As the old saying goes, poop rolls downhill. Virginia cannot count on the federal government to bail out the national economy with fiscal and monetary stimulus like it did in the past recession. As Layne pointed out, discretionary spending (defense and domestic) account for only one-third of the federal budget. Meanwhile, years of quantitative easing have kept interest rates artificially low, leaving the Federal Reserve Bank with less firepower than in the last recession to reinflate the economy. According to Layne, the “federal government is not in a position to bail out states in the next economic downturn.”

In the past Layne has warned that a repeat of the 2008 recession could blow a Remember-the-Maine-sized hole in the General Fund budget, while an accompanying decline in portfolio earnings could add billions of dollars to Virginia Retirement System liabilities. Today, he alluded to other risks.

The tariff war with China could have a significant impact on foreign trade… which would have a significant impact on the Virginia Port Authority. The VPA has been enjoying a great couple of years, with operating income reaching $46.8 million in 2018. But the authority borrowed heavily to finance the capacity expansion that enabled it to grow. Long-term liabilities amount to $2.8 billion. It’s not clear what would happen if import/export volumes decline as the China trade war escalates, or if the economy sinks into another recession.

From my perspective, the lesson here isn’t that the VPA shouldn’t borrow, it’s that Virginia — like U.S. consumers, corporations, and federal government — has ramped up borrowing over the past decade. While Virginia’s General Obligation debt is highly transparent and well protected, we have no idea how much debt lurks in quasi-independent authorities like the VPA, the Metropolitan Washington Airports Authority, the Washington Metropolitan Area Transit Authority, and a multitude of smaller industrial and economic development authorities. While the Commonwealth and local governments may not be legally obligated to stand behind this debt, they may be politically obligated in order to maintain the financial integrity of critical economic institutions. We just don’t know how bad the situation is because no one has taken stock…. just like no one has taken stock of hidden deficit spending by under-investing in road-and-highway maintenance.

Layne is more concerned about these big-picture questions than any other finance secretary I can remember. His office and the Joint Legislative Audit and Review Commission (JLARC), which answers to the legislature, are the only two institutions in Virginia with the expertise and resources to put numbers on these hidden liabilities and risks. Hopefully, at some point they will feel motivated to do so.