There is an interesting juxtaposition of stories today. On the one hand, Forbes Magazine has published its 2012 ranking of the Best States for Business, and Virginia ranks No. 2 for the third year in a row behind Utah. Aside from its general, all-around positive business climate, Forbes singles out the Old Dominion for having the nation’s “best financial incentive programs” in the country.

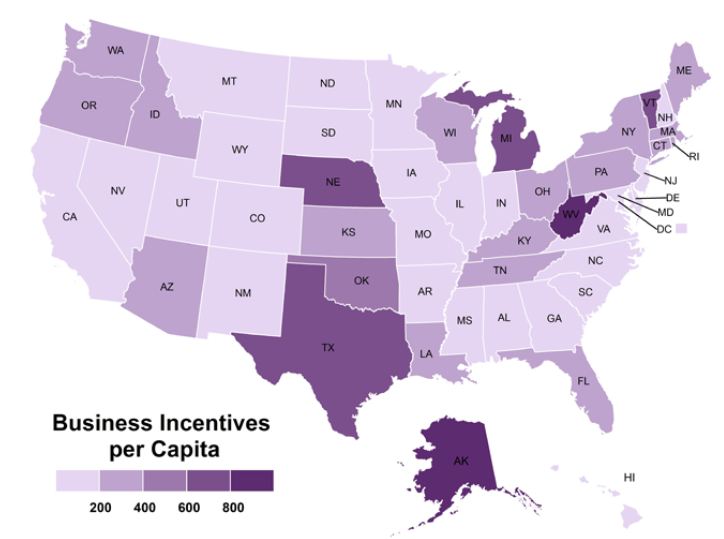

On the other hand, economic geographer Richard Florida has posted on the Atlantic Cities blog the map displayed above, based on New York Times data, indicating that Virginia’s incentives are relatively modest at $161 per capita. We are pikers compared to Alaska ($991 per capita), West Virginia ($845), Nebraska ($763), Texas ($759), Michigan ($672), and Vermont ($650).

“There is virtually no association between economic development incentives and any measure of economic performance,” writes Florida. “We found no statistically significant association between economic development incentives per capita and average wages or incomes; none between incentives and college grads or knowledge workers; and none between incentives and the state unemployment rate.”

Governor Bob McDonnell has not hesitated to use existing incentive programs but he has not aggressively expanded them. Instead, he has reoriented traditional government spending on education, transportation and the like to support job creation. For example, the governor has dedicated much of the $3 billion he has borrowed for transportation spending to projects with an explicit economic-development justification — the Charlottesville Bypass, the Midtown-Downtown tunnels in Norfolk and the U.S. 460 Connector.

While I have raised numerous questions about those investments — particularly the Charlottesville Bypass — they are a vastly preferable to incentives gifted to individual corporations. Upgrading the state’s transportation capacity lowers shipping costs and benefits entire regions and industries. The same logic applies to investments in knowledge creation, such as the Commonwealth Center for Advanced Manufacturing in the Richmond region.

While Virginia spends more on incentives than many states — Missouri, the “show me” state, is particularly tight-fisted with $16 per capita — the sums are not outrageous. Moreover, deals often contain provisions that claw back subsidies and tax breaks if corporations fail to deliver the promised jobs and investment.

According to the NYTimes, Virginia spent $79.9 million in cash grants, loans or loan guarantees and $50.3 million in corporate income tax credits, rebates and reductions. (The Times also alludes to $1.14 billion in sales tax deductions but I’m not sure how its researchers construe those as “incentives.”) I would like to know why Forbes deems Virginia’s incentives the best in the country. Unfortunately, the magazine draws from Pollina Corporate Real Estate, which does not publish its research online. But I feel safe in drawing at least one conclusion: Being the best doesn’t mean being the biggest.

— JAB