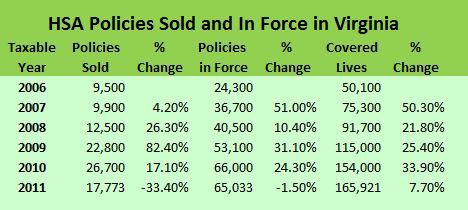

After surging for several years, sales of Health Savings Account policies in Virginia dipped sharply in 2012, according to a new report by the Department of Taxation. However, the number of policies in force eroded only slightly and the number of individuals covered by those policies continued to grow, albeit more slowly.

The report offered no explanation for the sudden fall-off in new policies. The Affordable Care Act (Obamacare), enacted in 2010, ordered the creation of state-run insurance exchanges, expanded Medicaid and allowed parents to keep children on their policies until age 26. But, according to the authors of the state report, “It is unclear at this time what impact this legislation will have on HSAs.”

The report concluded that no change in state tax policy is indicated at this time. HSAs combine high-deductible tax plans with accounts funded by employee and employer contributions. A key incentive consists of allowing employees to contribute to their accounts with pre-tax dollars. Virginia already conforms to the federal treatment of contributions, earnings and distributions.

Bacon’s bottom line: Conservatives have long touted HSAs as a pillar of consumer-directed health care, a market-based alternative to America’s health care ills. The big question, which the Department of Taxation did not address, is this: Is the sudden reversal in the sale of new policies a function of market forces or political forces? Put more exactly, have sales plummeted because the policies are unpopular in the marketplace or because the looming implementation of Obamacare is rendering them less desirable?

The logic behind HSAs is that if people have to pay for medical bills out of their own pockets, they are more likely to pay attention to price and quality, thus to shop around for better deals. HSAs vary widely in how they are implemented. Some are simple plans that let employees fend for themselves, while other plans back them up with access to telephone counseling, wellness programs and online marketplace data. In practice, however, much of the price and quality data needed to make a rational decision is unavailable or too complex for many people to understand. While HSAs probably do discourage people from frivolous use of the health care system, there is not much evidence to suggest that consumers are exerting significant pressure on health care providers.

Though a promising idea, HSAs do not appear to be sufficient on their own to alter the dynamic of ever-rising health care costs. One necessary step, which Virginia is undertaking, is to make more price and quality data available to consumers. I am not sure how rapidly that initiative is progressing nor how effective it will be when implemented. Another necessary step is for insurers to adopt the role of consumer counselor and advisor, acquainting consumers with cost and quality data and helping them interpret it. A third step is abolishing the fee-for-service method of reimbursing health care costs and encouraging innovation in how insurers compensate hospitals and physicians for providing services.

The Obamacare juggernaut may well put HSAs out of business before private players can figure out how to make consumer-directed health care work. Whether administered by the state or the federal government, Virginia will have a health-care insurance exchange beginning in 2014. My sense is that many of the companies using HSAs are small businesses that cannot afford conventional, high-dollar medical plans. Many will find it easier simply to default to the health exchange — or let lower-income employees enroll in Medicaid — rather than deal with the hassle of shopping around and negotiating deals with private insurers.

I fear that Obamacare will snuff out the free-market alternative before it has a chance to take root. Big Government ideologues will score a big victory in the never-ending campaign against private health care.