by James A. Bacon

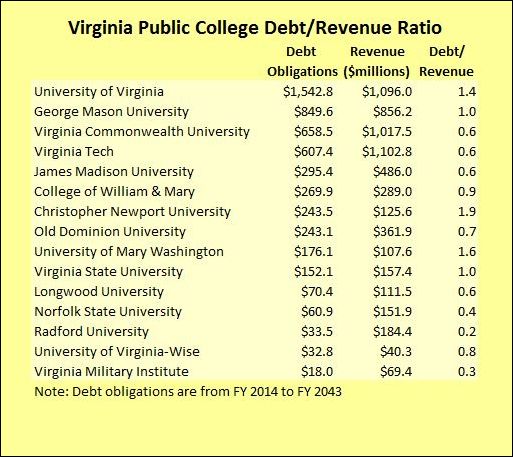

Above, readers will find the chart I called for in yesterdays blog post: the debt burden of Virginia colleges and universities as a percentage of their budgeted revenues. The higher the debt-to-revenue ratio, the more leveraged the institution and, hence, the greater the risk of financial difficulties if and when student enrollments decline. This chart is useful because it suggests that we should start paying closer attention to Christopher Newport University and the University of Mary Washington, both of which have borrowed heavily to fund their building expansions.

Having a high debt/revenue ratio is not necessarily a worrisome sign. The University of Virginia also appears to have borrowed heavily, but (a) it has a multi-billion dollar endowment and a wealthy alumni base to fall back upon in times of trouble, and (b) there is such a high demand to attend the university that there is a negligible chance that it will see an involuntary decline in enrollment. By contrast, Norfolk State University, in the news recently for its eroding financial condition, has a modest debt load. Still, all other things being equal, a high debt-to-revenue ratio puts an institution at greater financial risk.

The debt figures, by the way, I took from the Joint Legislative Audit and Review Commission’s latest report on higher education. The figure denotes the outstanding principal and interest payments due over the next thirty years (FY 2014 to FY 2043). The revenue numbers come from the Virginia state budget “operating budget summary” combining both General Fund and Nongeneral Fund revenues.

Virginia State University and Norfolk State University are widely reported to be experiencing major financial difficulties, in large part reflecting their status as Historically Black Colleges and Universities fifty years after the formal end of racial segregation in America and the lower incomes of their student populations.

But, as Bacon’s Rebellion has been warning and the JLARC report confirms, rising tuition, fees and other expenses are outpacing the ability of students and their families to pay for colleges across the board, with the result that enrollment in Virginia colleges and universities declined last year. Declining enrollment translates into falling revenue, which can be especially devastating to institutions with high debt burdens.

My analysis suggests that Christopher Newport and Mary Washington, the two most highly leveraged public higher ed institutions in the state, could be among the most vulnerable. Neither is a prestige institution with strong pricing power and a large backlog of students clamoring to get in. In a positive sign, however, Christopher Newport’s enrollment did increase by 75 FTE students in 2013-2014 compared to the year before, according to State Council for Higher Education in Virginia data. On the other hand, Mary Washington’s enrollment declined by 138. I don’t want to make too much of one year’s enrollment data but if I were a board trustee at Mary Washington, I’d set a very high hurdle for any additional borrowing.

By contrast, Radford University serves a similar market niche, as a small/medium-sized liberal arts university appealing mainly to in-state students. Radford’s board has kept a very tight lid on debt, and the institution has the lowest debt/revenue ratio of all the colleges.

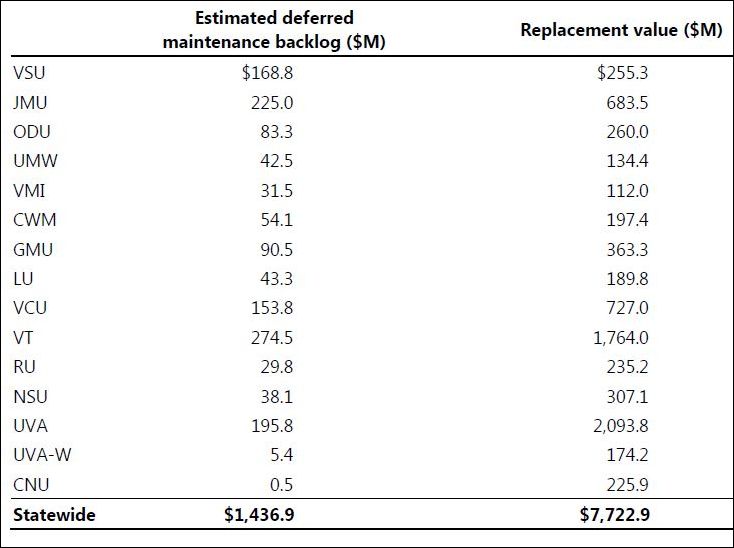

One more factor should should be considered in our analysis — deferred maintenance. Christopher Newport’s campus is so new that it has a negligible deferred maintenance backlog — about $0.5 million, according to JLARC. That contrasts to Virginia Tech’s $274.5 million backlog, the largest of any higher ed institution in Virginia. In theory, Christopher Newport won’t have major maintenance issues until it has paid off most of its 30-year debt. Mary Washington, by contrast, has racked up $42.5 million in deferred maintenance.