by Steve Haner

A state court in Pennsylvania has ruled that the regulatory decision to enroll that state in the Regional Greenhouse Gas Initiative (RGGI) exceeded the authority of state regulators. It ruled RGGI is a tax that could only be lawfully imposed by the legislature.

It was the Republican majority in one of the state’s legislative chambers that brought the legal challenge, so unless or until the political balance changes in that state, a vote to join the interstate carbon dioxide capping program is unlikely.

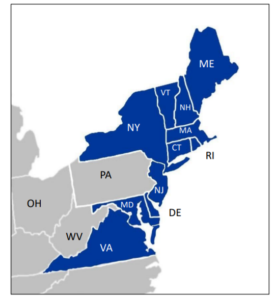

Adding Pennsylvania would have been a major expansion of the 11-state RGGI compact. Its many fossil fuel power plants would need to buy $400 million or more worth of CO2 allowance credits per year, a third or more than Virginia’s power plants are being taxed.

It is also one of the larger states in the PJM Interconnect regional power marketplace (it is the P) where the power plants do not pay into RGGI, lowering the relative cost of its power when it flows into other PJM states. Virginia electric customers are often using electrons from elsewhere in PJM.

That the money the utilities must pay for operating their fossil fuel plants is a tax is something most RGGI proponents, including those in Virginia, vehemently deny. That was one of the key disputes in the challenge in Pennsylvania, where joining RGGI was a regulatory step initiated by its then-Governor Tom Wolf (D).

The court majority wrote in its opinion:

Upon further review and consideration, we reaffirm our determination in this regard, and now hold that the Rulemaking constitutes a tax that has been imposed by (Department of Environmental Protection) and (Environmental Quality Board) in violation of the Pennsylvania Constitution. Indeed, as the Pennsylvania Supreme Court explained long ago:

No principle is more firmly established in the law of Pennsylvania than the principle that a revenue tax cannot be constitutionally imposed upon a business under the guise of a police regulation, and that if the amount of a “license fee” is grossly disproportionate to the sum required to pay the cost of the due regulation of the business the “license fee” act will be struck down.

As is usually the case, an appeal to a higher court is possible. The decision from the Pennsylvania Commonwealth Court, an intermediate appellate court dedicated to administrative issues, was not unanimous.

There are parallels with the situation in Virginia, and major differences.

Virginia is leaving RGGI as of December 31. The Virginia Air Pollution Control Board made the decision, with the support of Governor Glenn Youngkin (R). But private plaintiffs – who are not legislators – are asking the Circuit Court of Fairfax County to void the Air Board’s action.

In Virginia, membership in RGGI also started as a regulatory effort under then-Governor Terry McAuliffe (D). And that regulatory effort was stalled when Republicans in the General Assembly, in 2019 and 2020, asserted it was a legislative prerogative and put language in the state budget to that effect.

Then when Democrats took full control of the Virginia General Assembly, they passed legislation reinstating the regulation. The Air Board under Governor Ralph Northam imposed the regulations three years ago and Virginia has collected more than $730 million from power producers since. It should reach about $800 million with December’s auction.

The largest Virginia RGGI payer, Dominion Energy Virginia, is directly collecting the tax from its customers through an addition on monthly bills. It costs them (us) almost $5 for every 1,000 kilowatt-hours of use. Dominion has run up enough costs through RGGI that the rate charge will continue into 2024 even if the withdrawal happens on time.

So, unlike in Pennsylvania, in Virginia the legislature acted. The question before the Virginia court is: was the bill that passed a mandate imposed on the Air Board or simply a grant of authority? The language used – probably because there was a reluctance to make it clear this was a new tax – has allowed different interpretations. Youngkin and the Air Board assert it had authority to withdraw.

As reported by Virginia Mercury, a hearing on the case was held late last week, focused on the narrow issue of whether the parties who brought it had standing to sue. The parties bringing the petition are programs and contracting entities which would stand to lose funding from RGGI proceeds.

Imagine, if you will, a suit brought by a highway contractor after the state lawfully decided to cut the gas tax. The judge is facing a very important question, a very scary precedent indeed. He is being asked to make RGGI an entitlement program.

Leave a Reply

You must be logged in to post a comment.