by James A. Bacon

The Commonwealth Institute has criticized Commonwealth Attorney Ken Cuccinelli’s proposal to stimulate economic development by cutting the corporate tax rate from 6% to 4%. The corporate income tax generated $860 million in General Fund revenue in 2012, equivalent to what the state spends on law enforcement, states CI in a new white paper, “Would a Corporate Income Tax Cut Hurt Virginia’s Ability to Invest in the Future?“.

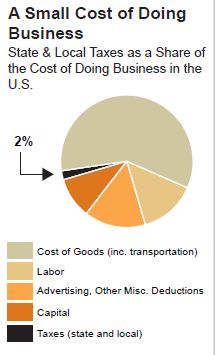

CI argues that a lower corporate tax rate would do little to improve Virginia’s already-positive business climate because corporate taxes are not a “make or break” proposition for business. Corporations base investment decisions upon a range of factors, most notably the quality of the workforce, the quality of the transportation system and access to markets. Because the corporate income tax is paid primarily by big, multi-state entities, 75% of a Virginia tax reduction would be retained outside the state.

“Without the corporate income tax,” says CI, “out-of-state investors and shareholders would benefit from Virginia’s strong business climate essentially at no cost because they don’t live or work here.” The paper continues:

If we pay for the tax cuts by reducing incomes for people right here in the commonwealth — by laying off teachers, cutting worker hours, or raising taxes on low-income people and the middle class, for example — then people will have less money to spend in their communities, and that will hurt the state’s economy.

There’s just one little problem with CI’s argument…. Cuccinelli’s tax overhaul plan would not cut income tax rates by “laying off teachers, cutting worker hours or raising taxes on low-income people and the middle class.” Far from raising taxes on individuals, his stimulus proposal would aim to cut the top personal income tax rate from $5.75% to 5.0%.

Cuccinelli, the Republican candidate for governor, would pay for the lower corporate rates by expanding the tax base — eliminating outdated tax exemptions and loopholes that, in his words, “promote crony capitalism.” (See my coverage of his proposal here.) Admittedly, he has not specified what those loopholes are, and there is no guarantee that he can find enough to offset the loss of a couple hundred million dollars in lost corporate income tax revenue. If he cannot find enough loopholes, then he might not be able to cut the corporate tax rate as much as he would like. But in that case, CI wouldn’t have much to criticize.

The Cooch also advocates limiting the growth in state spending to the rate of inflation + population growth. While I am skeptical of such Tax and Expenditure Limits (TELs), curtailing increases in spending is hardly the same as “laying off teachers,” who are paid by local governments in any case.

The only substantive argument CI makes is that lowering the corporate tax rate really won’t stimulate business investment. It is fair to say that the tax rate is only one factor among many (see the chart above)…. But it is a factor. While a lower tax rate might not prove decisive very often, it might make a difference, as economists might say, “on the margin” — in instances when the decision to invest in Virginia is a very close call.

As a general principle, Virginia should strive to create (1) a balanced tax structure that is not overly dependent upon any one revenue source, (2) a broad tax base with a minimum of exemptions, deductions and credits, and (3) tax rates that are as low as possible. Cuccinelli’s proposal would move us in the right direction.