One of the more controversial forecasts contained in Dominion Virginia Power’s 2016 Integrated Resource Plan (IRP) is a projection that average electricity demand and peak demand in its service territory will increase at an annual rate of 1.5% annually over the next 15 years. If that forecast pans out, demand will outstrip the company’s 12.5% reserve margin when the current round of building projects is complete around 2021, and would create a supply shortage of 4.6 million megawatts by 2031 if no new capacity were added.

Setting aside questions of whether or not Dominion should include more renewable energy in its generation mix, environmentalists find the growth forecast problematic, arguing that electricity consumption is decoupling from economic growth nationally as new technologies become available, industries invest more capital in energy-efficiency, and some states adopt policies that promote efficiency.

I am agnostic on the issue but I believe this is one of the most important debates taking place in the electricity policy arena today. A higher demand forecast would justify a bigger investment by Dominion and Virginia’s other electric utilities, Appalachian Power and the Old Dominion Electric Cooperative, in new generating capacity. A lower demand forecast would support a more constrained approach to capital spending. The debate also raises the question of whether Virginia’s power companies should be moving more aggressively to implement energy-efficiency measures.

With this blog post I present the findings from Dominion’s 2016 IRP. I think it’s fair to say that Dominion has spent more man-hours and more dollars analyzing electricity demand in Virginia than anyone else. That’s not to say its forecasts are more reliable. Dominion concedes the enormous uncertainty regarding Clean Power Plant regulation, and the company may have institutional biases favoring faster demand growth. But it’s the best analysis we’ve got at the moment. I summarize Dominion’s discussion with the aim of stimulating discussion.

Dominion’s econometric model utilizes hourly DOM Zone data — the DOM Zone is the PJM Interconnection-designated zone inside which there are relatively few transmission constraints) and simulates both time-trend variables (electricity demand over time) and weather variables such as wind speed, cloud cover and precipitation. The model factors in time of day, day of week, holidays and seasonal effects, as well as unusual events such as hurricanes.

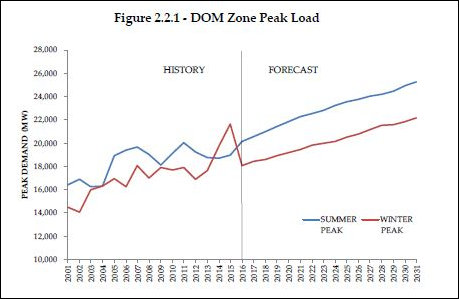

Overall, Dominion’s service territory is a summer-peaking zone, meaning that the highest demand is normally experienced during the summer. However, Dominion also has a weaker, winter peak, which on rare occasions such as the polar vortex a couple of years ago, is stronger than the summer.

While electricity demand has slowed in some sectors as energy-efficiency makes inroads, Dominion expects growing consumption in other areas — PCs, laptops, tablets and other digital devices; electric vehicles (primarily during evening hours); and data centers. Consolidating data storage in hyper-efficient cloud facilities work to reduce overall overall demand, but the trend displaces consumption from scattered locations in the East Coast to Northern Virginia, which may be the most competitive location in the world for data storage due to its access to high-capacity fiber cable. While data centers do not create many jobs, economic developers like them because their enormous capital investment in servers contributes millions of dollars in local government tax revenue.

Moreoever, the Virginia economy is more dynamic than the national average. Going forward,” states the IRP, “the Virginia economy is expected to rebound considerably within the Planning Period. The 2015 Budget Bill approved by the President and the U.S. Congress has significantly increased the level of federal defense spending for fiscal years 2016 and 2017, which should benefit the Virginia economy.” All other things being equal, a more vibrant economy means higher electricity consumption.

Dominion makes its 1.5%-per-year forecast despite committing to a 2007 Electric Utility Reregulation Act goal of reducing retail electricity consumption by 10% (based on 2006 consumption levels).

To advance that goal, the company has put into place energy-efficiency measures ranging from air conditioner recycling and residential low-income energy assistance to demand-response tariffs for households using smart meters. Also, to curb increases in peak demand, Dominion has instituted a Standby Generation rate schedule providing incentives for businesses to switch to backup generators if demand is overwhelming supply. The size of the standby program is relatively small, however. According to an IRP table, there were 16 events in the summer of 2015 and 12 in the winter, reducing demand by on average by two megawatts. (That compares to about 24,400 megawatts of generating capacity across the utility’s fleet.)

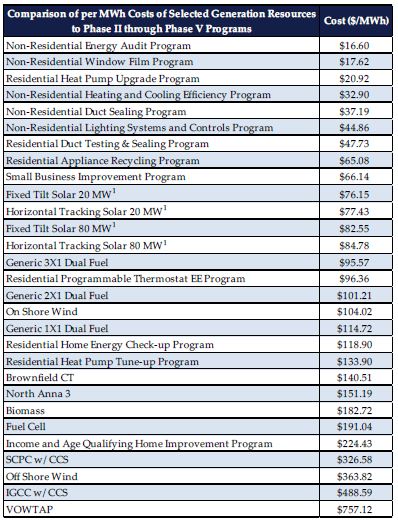

In the chart above, Dominion displays its calculations of how much various energy-efficiency and alternative-energy programs will cost on a per-megawatt of power conserved or generated. In many cases, the energy-efficiency programs provide the most bang for the buck. But they are limited in scale.

Moreover, it is difficult to calculate the benefits of investments in energy efficiency, states the IRP, because the pilot programs are under-enrolled and small numbers make it difficult to extrapolate to a larger scale. The analysis for one program showed a negative impact on consumption from an energy-efficiency program, while another suggested that for every 1% increase in the price of electricity, household cut consumption by 0.75%. The company considered both to be outliers. More typical is a finding that 1% increase in price leads to a 0.1% cut in consumption — a ten-to-one ratio.

Despite the uncertainties, Dominion stated in its “short term action plan” that it will “continue to implement cost-effective DSM programs in Virginia and North Carolina.”