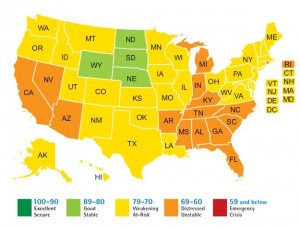

CredAbility, a nonprofit credit counseling service, regularly updates its Consumer Distress Index, which tracks the financial condition of the average American household. The index combines such metrics as unemployment, credit scores, net worth, spending vs. income, and performance in paying rents and mortgages.

Nationally, the consumer economy is slowly improving. Reports CredAbility in its Aug. 22 press release:

Slowly but surely, consumers have worked to repair their finances during the past four years by paying down debt and better managing their credit, said Mark Cole, executive vice president of CredAbility. They are more in control of their household budgets, increasing their savings even as gasoline prices have risen and the drought has started to affect food prices. While millions of people continue to battle unemployment, the majority of households with stable jobs and housing has made wise financial choices and are moving in the right direction.

Unfortunately, the Richmond and Hampton Roads Metropolitan Statistical Areas remain more stressed than the national average. Virginia out-performs the national average only because the Washington MSA is so much better off.

The Richmond MSA received a 69.7 score (distressed, unstable), just shy of a (weakening, at-risk) status. A relatively low unemployment rate was the region’s only comparative strength. The region lagged national indicators for housing, credit, household budget and net worth.

Hampton Roads (Virginia Beach MSA) received a 69.0 score, also bolstered by a relatively low employment rate while impaired by the other indicators. The score for mortgage/rental performance was particularly below the national average.

The Washington MSA, which includes Northern Virginia, received a 77.1 score, significantly out-performing in all categories except net worth, where it came within a hair of the national average.

— JAB