Rendering of Columbia Pike streetcar system.

by James A. Bacon

Investing $284 million in a streetcar system along Columbia Pike would generate between $3.2 billion and $4.4 billion in net tax revenue for Arlington and Fairfax Counties, over and above capital and operating costs, over 30 years, according to a new analysis by HR&A Advisors prepared for Arlington County.

The street car system — 14 streetcars stopping every quarter- to half-mile — would run between Bailey’s Crossroads in Fairfax and Pentagon City in Arlington. Travel time between the two points would be 23 minutes, only one minute longer than for the buses, but the street cars would carry 3,200 more passengers daily and would generate more real estate investment along the corridor, concludes “Columbia Pike Transit Initiative: Comparative Return on Investment Study.”

“This study further demonstrates that streetcar is the right investment for Arlington,” said Arlington Board Chairman Jay Fisette in announcing the study.

Streetcar opponents had argued that the streetcar would cost far more than upgrading the bus system to 60-foot, articulated buses. The capital cost (in 2014 dollars) would be only $67 million for the buses compared to $284 million for the streetcars, while buses would cost only $140 million to operate and maintain over 30 years compared to $230 million for the streetcars. Total difference between buses and streetcars: $217 million over 30 years, averaging $7.1 million a year (assuming no adjustment for net present value).

But HR&A’s survey of the literature and in-depth analysis of four streetcar case studies suggests that the perceived permanence and desirability of the streetcar would induce significantly more real estate investment along the corridor and create more jobs. Currently, properties in the corridor have a total assessed value of $7.8 billion and generate $78.2 million a year in property tax revenue. While improved bus service would bolster property values, a streetcar line would boost them even more, yielding a 6% differential in residential property values for streetcar over bus, a 5% premium for retail property and a 6% premium for office property after 10 years.

While the Pentagon City sub-market is likely to be fully built out within 30 years under any transportation scenario, a streetcar line would turbo-charge construction along Columbia Pike and in Bailey’s Crossroads, where current property values do not support the more expensive concrete construction required for higher-density infill and redevelopment.

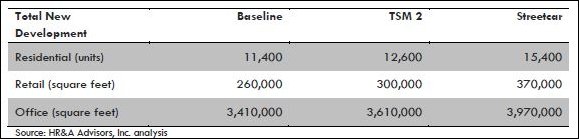

The chart below compares the baseline development (no transportation investment) scenario with the improved bus line (TSM 2) and streetcar scenarios:

HR&A interviews with 10 developers and property owners and six retailers active in the corridor found that a majority (“most”) confirmed that a streetcar would appeal more to riders, lead to a growth in rental and lease rates, and support greater development density. Some (“a smaller number”) worried that only a Metro-level investment would have a meaningful impact on property values, and that fragmented property ownership along the corridor would pose a major obstacle to redevelopment.

The study pointed to another big advantage of streetcars.

Transit has the potential to not only increase the value and quantity of real estate development, but alter its form by promoting compact development and walkability. Recent research from the George Washington University School of Business has found that walkability is a critical neighborhood amenity in the DC region; areas identified as “WalkUPs” because they are walkable command significant premiums over non-walkable places (as high as 75 percent for office and 71 percent for for-sale housing) and are also attracting an increaseing share of the region’s development. …

To the extent that transit is recognized as a visible, valuable place-making amenity that provides uniqueness to the surrounding area, new development will be oriented toward it. This orientation may be in the form of pedestrian-oriented design (engaging, varied ground floors that abut the sidewalks), pedestrian amenities (such as trees, sidewalks, and benches), or clustering of new development at transit nodes.

However, the study also points to risks, particularly the uncertainty of future demand for office space from the federal government and federal contractors, and the impact of competition from transit-oriented development elsewhere in Northern Virginia, especially in Tysons and Potomac Yards in Alexandria.

Of perhaps greater concern, while the study calculated the tax revenue from new development into its cost-benefit calculations, it did not take into account the increase in services demanded by new residents and businesses. Four thousand new housing units (with perhaps 6,000 people living in them) would create additional demand for schools, public safety and other local government services. Nor did the study take into account sums that Arlington and Fairfax Counties might expend on streetscape improvements to make the corridor more walkable.

Bacon’s bottom line: No doubt skeptics will subject the study to closer scrutiny, as well they should. But my quick-and-dirty reading suggests that its broad conclusions are supportable: A streetcar line will accelerate the evolution of Columbia Pike into a walkable, transit-oriented community, it will grow the tax base, and the ensuing tax revenues will greatly exceed the cost of building and operating the system.

That raises a logical question: If the streetcar system will have the impact that the consultants say it will, why not use “value capture” as a financing technique? Instead of asking county taxpayers generally to bear the cost and shoulder the risk of the project while billions of dollars of economic value flow to lucky property owners, why not structure the financing so that property owners pay for a large part, perhaps all, of the cost? Establishing special tax districts around the proposed streetcar platforms, or up and down the entire corridor, could raise revenue from the anticipated surge in property values to pay off the bonds used to finance the project.

As it stands now, streetcars would be all gain, no pain, for Columbia Pike property owners. They would reap a huge gain in the form of higher rents and leases without expending any of their own resources or taking any risk. Why would any of them oppose the expenditure of public money? (The fact that any even a small number of property owners were dubious of the project, I find quite telling.) Ask them whether they would favor paying for the streetcars by means of a special tax district and see if they are willing to back up their words with hard cash.

If they are, political opposition to the streetcar line would evaporate. If they aren’t, political leaders should ask themselves why local government should assume all the financial risk.