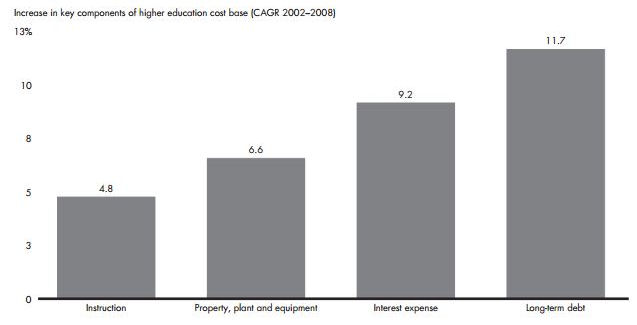

Building boom: the explosion in higher ed facilities and debt expense. Source: "The Financially Sustainable University."

by James A. Bacon

The affordability crisis in higher education has seized the public imagination for good reason. Student loan debt now exceeds $1 trillion, millions of college students have mortgaged their personal futures, and Americans are questioning for the first time whether a college education is worth the price. This consumer backlash creates a huge problem for the higher ed industry, which has enjoyed decades of freedom from fiscal discipline and has evolved an organizational culture resistant to change.

Now comes a study that suggests higher ed’s problems are even worse, and more deeply rooted, than commonly perceived. Not only has the higher ed market reached the saturation point, according to “The Financially Sustainable University,” the financial picture for most universities is deteriorating as well. Argues the report, published by Bain & Company, a consulting firm, and Sterling Partners, a private equity firm:

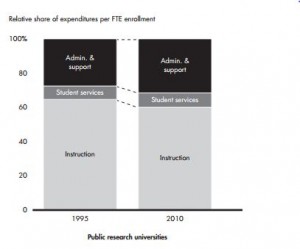

Many institutions have operated on the assumption that the more they build, spend, diversify and expand, the more they will persist and prosper. But instead, the opposite has happened: Institutions have become over-leveraged. Their long-term debt is increasing at an average rate of approximately 12% per year, and their average annual interest expense is growing at almost twice the rate of their instruction-related expense. In addition to growing debt, administrative and student services costs are growing faster than instructional costs. And fixed costs and overhead consume a growing share of the pie.

While universities do engage in strategic planning, the study says, they are focusing on the wrong thing: moving up to the next level and gaining greater prestige. “As a result,” write the authors, “most of the strategic planning that happens in higher education is on the margins and not focused on making the hard decisions that will ultimately lead to success.” (University of Virginia pay heed!)

The report provides some of the best management advice to higher-ed management that I have yet seen. Here are some of the highlights:

Define the core mission. Many universities are unclear about the value they add. Trying to accomplish too much, they spread themselves too thin. Focusing on the core is difficult — authority is diffuse in a university culture and people don’t like to be told no. But universities cannot be all things to all people. “The worst-case scenario for an institution is to be relatively expensive and completely undifferentiated. Who will pay $40,000 per year to go to a school that is completely undistinguished on any dimension?”

The increase in administrative overhead. Graphic credit: "The Financially Sustainable University." (Click for more legible image.)

Bring administrative costs under control. As universities think about where to cut expenses, they should start with administration, not the core of teaching. The reasons for the growth in overhead are often legitimate, the authors write. “But as new programs are added, old programs often are not curtailed or closed down. The resulting breadth of campus activities creates too much complexity for staff to manage with any efficiencies of scale.”

In the decentralized university community — universities are like federations of schools, and schools are like federations of departments — fragmentation is endemic. The study cites decentralized and redundant procurement and data center management as particular problems. Also, most institutions have too many middle managers. Before an administrative reorganization, Berkeley managers had an average of only four direct reports, compared to more than six for companies and closer to 10 for best practice companies.

Divest inessential assets. Universities can strengthen their cash positions by better managing assets: selling real estate holdings such as lodging and restaurant facilities; engaging in sale-leasebacks of IT assets, power plants and cogeneration facilities; and improving the performance of their intellectual property portfolios. U.S. higher ed spends $92 billion each year in R&D and realizes a $2 billion yearly return, a fraction of what technology corporations generate.

Define your online strategy and invest in it. Colleges are acutely aware of the online challenge. They just haven’t figured out how to respond.

For some institutions, rushing into the online space too rapidly to grow enrollment and create new revenue is another me-too strategy. There are already too many entrenched players and new entrants with significant capital in the market for an undifferentiated strategy to succeed.

As online courses enter the market and employers begin to accept “badges” and other credentials (further decreasing demand for traditional degrees), the price students will be willing to pay for undifferentiated brands will continue to fall. While this won’t be a problem for elite institutions like Harvard and MIT, it represents a significant challenge for most colleges and universities.

Managerial mayhem. The collegial, faculty-empowering environment so beloved of academics makes it difficult to drive coordinated institutional change. There are multiple levels of decision making, with the result that it’s unclear who’s responsible for such critical items as classroom technology. While faculty members tend to hold themselves to high academic standards, they don’t apply the same rigor to the administration of their own departments.

Too many university stakeholders think that current crisis mentality will subside when the economy improves, as it has in the past. But this time is different. Concludes the study:

Universities simply cannot afford to increase costs in nonstrategic areas and take on more debt, if they want to survive. It is imperative that universities become much more focused on creating value from their core. That will require having a clear strategy, streamlined operations, a strong financial foundation, trust and accountability, and a willingness to invest only in innovations that truly create value for the institution.