More great analysis from Terry Maynard! In a memorandum to fellow members of the Reston Master Plan Special Study Task Force, he tracks the incredible deflating population growth projections for Fairfax County and explores what it means for transportation and land use planning.

As recently as 2008, the sky was the limit. As the federal government had grown and prospered over the decades, so had Fairfax County. Northern Virginia, and Fairfax in particular, had boomed without let-up through the Reagan defense build-up, the S&L fiasco, the Internet boom and 9/11. The region even seemed resistant to the 2007-2008 recession.

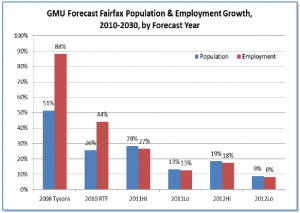

But economic recovery has been more sluggish than predicted, and the future for government spending — especially the defense, intelligence and homeland security spending that fueled Northern Virginia’s growth — is looking grim. While population and employment are still expected to expand, they will not do so at the torrid pace expected only a few years ago. The existing 17% vacant office space in Reston, suggests Maynard, could accommodate two-thirds of all forecast non-residential growth through the year 2030. He concludes: “We need to discuss what to do about adapting to the region’s new economic reality.”

Sadly, that discussion is not taking place.

Much of the massive infrastructure investment occurring in Northern Virginia was predicated on pre-2008 growth forecasts. I’m not as worried about the Capital Beltway HOT lanes project, in which private-sector investors will share the financial pain if forecast traffic does not materialize, as I am about the Rail-to-Dulles project, which has no private equity investment to cushion any shortfall in traffic and revenue.

Rail-to-Dulles is essentially a bubble project. The economics of it worked only as long as Northern Virginia’s economy continued to boom. There are three levels of analysis that need scrutiny. The first and most obvious need is to re-examine the traffic and revenue forecasts for the Silver Line itself, which is already projected to lose money on an operational basis. If population and business growth forecasts fail to materialize, will revenue fall short? Will operational deficits increase? And what impact will that have on Fairfax and Loudoun budgets?

A second set of questions arises about the Dulles Toll Road, the toll revenues of which will be siphoned to pay for roughly half of the up-front capital costs for Phase 2 of the heavy rail line. What will lower population growth mean for traffic and revenues? If toll fares fall short, who gets first dibs on the revenue– bond holders or the construction/maintenance needs of the toll road?

Thirdly, what does this mean for the re-development of Tysons Corner? The Fairfax County Board of Supervisors approved massive increases in density around four Tysons station stops under the expectation that the resulting increase in property values would enable landowners to finance a transformation of the hodge-podge business district into a walkable, mixed-use urban center — Fairfax’s answer to Arlington’s Metro corridor. But if office vacancies remain stubbornly high and if population and employment projections are wilting, property owners will be in no hurry to re-develop their assets. If the higher densities and walkable streets take decades longer to materialize than originally thought, there could be a lot of half-empty trains rumbling through Tysons Metro stations.

The Fairfax County board has done its best Hear No Evil imitation, voting to confirm its financial commitment to Phase 2. If the federal spending machine slows, if 2008 population and economic growth forecasts prove too optimistic, if Silver line revenues fall short of projections and operating deficits exceed them, and if Dulles Toll Road revenues fall short and if the Metropolitan Washington Airports Authority defaults on its bonds, the county — indeed, the whole region — will be in a world of hurt.

Of course, I am looking at worst possible outcomes. But that’s what intelligent deal makers do — they examine worst-case scenarios to see if they can live with the results. They certainly don’t base multibillion-dollar investments on years-old economic and demographic forecasts that are known to be outdated. Not one dime should be sunk into Phase 2 until the implications of slower growth for Silver Line and Dulles Toll Road revenues are fully understood. Failure to perform that fundamental analysis is not simple folly. It’s not mere blindness. As far as I’m concerned, it’s criminal negligence.