Bill Gross, the head of PIMCO, the world’s largest bond manager, has published a jeremiad that makes my “Boomergeddon” thesis look Pollyanna-ish by comparison. To avoid an economic meltdown, says the money mogul, the United States needs to close its fiscal gap by $1.6 trillion, equivalent to 11% of the GDP. In my book, I anticipated the need to close the budget gap by a measly $1 trillion — and found the task to be so daunting as to be almost impossible.

My thought in trimming spending and/or raising revenues by $1 trillion a year was to create a U.S. budget surplus over the course of a normal economic cycle, factoring in modest surpluses during boom years and modest deficits during recessions. But Gross looks beyond the current business cycle, emphasizing crushing long-term obligations to Social Security, Medicare and other entitlements that are only beginning to kick in and will become more onerous in the decades ahead. Scarily, in his most recent essay, he doesn’t even mention the debilitating burden of paying interest on a national debt that recently passed $16 trillion and is growing relentlessly higher.

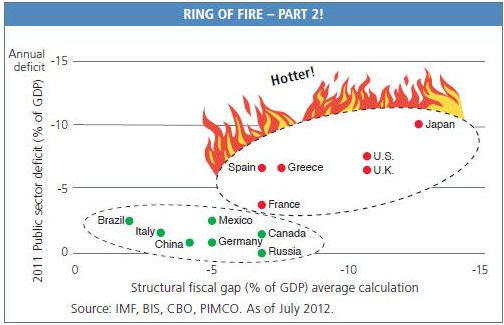

Looking at the fiscal balance sheets of the world’s major economies (as well as Greece for a point of comparison), Gross shows the U.S. in a fiscal “ring of fire” in the company of the United Kingdom and Japan. As seen in the chart above, the current deficits of all three countries are as high as Greece’s and their structural (long-term) fiscal gaps are larger.

Armageddon is not “around the corner,” Gross opines, but he does see the possibility of a “fiscal train wreck over the next decade.” It is often said that the U.S. is the cleanest of the dirty shirts, implying that we have less to fear than others do. Gross disagrees. “When it comes to debt and to the prospects for future debt, the U.S. is no ‘clean dirty shirt.’ The U.S., in fact, is a serial offender, an addict whose habit extends beyond weed or cocaine and who frequently pleasures itself with budgetary crystal meth. Uncle Sam’s habit … will be a hard (and dangerous) one to break.”

Bacon’s bottom line: Like some 50 million other Americans, I watched the presidential debate last night between Barack Obama and Mitt Romney. Obama struck me as not the least bit serious about the nation’s fiscal gap. Cutting defense spending and raising taxes on millionaires and billionaires won’t get close. Romney, for his part, was more emphatic last night about what spending he would not cut than what he would. For his plan to work, his formula of lower tax rates (coupled with closing loopholes), more fossil fuels production and less regulation must spark an economic boom that grows the U.S. out of its malaise. While I do believe that his proposals would have a positive impact, it’s an act of faith to think that growth would surge strongly enough to close the fiscal gap. I fear that we’re in too deep. Obama and Romney both fall short.

Unlike our political leaders, Bill Gross isn’t running for office, so he is not averse to telling American the truth. He is in the business of making money for his investors, which requires viewing the world with steely-eyed realism. As Virginians, we would be better advised to heed Gross than the pandering of national politicians. And we should conduct our state and local budgetary affairs with the expectation that a fisc storm is coming.

— JAB