Richard Florida, the man who brought us “The Rise of the Creative Class,” is back. After his unfortunate second book, “The Flight of the Creative Class” (read why I panned it here), he has more than redeemed himself with “Who’s Your City?” This volume is vintage Florida: spitting out original ideas and backing them up with thought-provoking research. Once again, he has elevated the study of regional economic competitiveness to new peaks of understanding.

I will explore several of those ideas in later columns and posts. Today, however, I want to revisit a previous post, “The ‘Mega-Region’ and the Creative Class,” in which I questioned the utility of one of Florida’s concepts: the emergence of mega-regions as the driving units of economic develompent. Because I based my comments upon a column he wrote in the Wall Street Journal, I hedged my conclusions, subject to reading his full treatment in the book.

Well, I’ve read the book. And while I will have great things to say about much of it, I stand by my earlier conclusions regarding mega-regions.

Florida opens “Who’s Your City” by taking issue with Thomas Friedman, author of the now-classic volume on globalization, “The World Is Flat.” A far better metaphor, Florida contends, is to say that the world is spiky. Yes, globalization is spurring the outsourcing of manufacturing and back-office operations to developing nations, but scientific research, innovation and the most value-added economic activity remains concentrated in a relatively small number of large urban clusters, Florida argues. (So far, so good. I totally agree.)

To map those agglomerations, Florida drew upon the work of Timothy Gulden at the University of Maryland’s Center for International and Security Studies. Gulden had published maps in Atlantic Monthly in 2005 that showed, in 3-D spikes overlaying a map of the globe, where the world’s population was concentrated, and then, based on light emissions detected by space satellites and calibrated with World Bank estimates of Gross Domestic Product, where the world’s economic activity was concentrated. This visual analysis showed that the world remains very spiky indeed. (So far, so good.)

Working with Florida’s research team, Gulden went on to map innovation, using patents and scientific R&D as proxies. The global map of innovation became even spikier, with towering spires set amidst vast plains of Business As Usual. Two dozen or so of the biggest spikes, according to Florida, account for an overwhelming percentage of the world’s innovation. (So far, so good.)

From this, Florida then created an economic model to emulate the real world. Here’s what he sees going on: “These city-regions expand outward until they are forced to combine with other city-regions. Through this process of nucleation, these city-regions merge together as a mega-region.” Large mega-regions, he says, have more economic staying power; smaller mega-regions rise and fall at a faster clip. “Our model … forecasts a world increasingly dominated by massive mega-regions.” (Hmmm…)

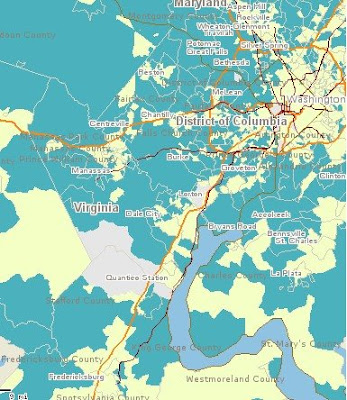

What Florida’s model lacks is any support for the idea that mega-regions comprise meaningful units of social or economic interaction other than the fact that they have spilled out of their original urban nucleii and run up against one another. As I argued in my first post, the Boston-Washington “mega-region” is comprised of very distinct metropolitan regions, each with its own urban core at the center of a commuter-shed, or labor pool. The economies of these metro regions have very different industry mixes, and their workforces have very different competencies. Florida presented no evidence whatsoever that there is any more economic or business integration between, say, Philadelphia and Washington, D.C., than there is between Los Angeles and Washington, D.C.

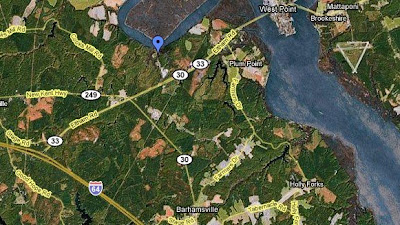

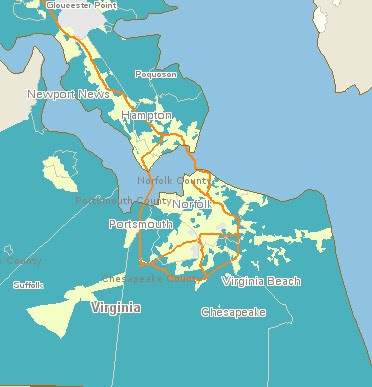

The evidence does exist to test Florida’s proposition. Richmond economist Chris Chmura has measured the level of economic integration between Charlottesville, Richmond and Hampton Roads. Many companies conduct business in multiple locations. Presumably, companies that spend money to maintain offices, factories, warehouses or other facilities in a location have a greater economic presence there. As I recall, Chmura mapped the number of technology companies that maintained locations in two or more of the three regions to demonstrate the extensive economic linkages between them.

This would be a useful follow-up phase in Florida’s research: Map the business linkages between metropolitan areas within a “mega-region.” If metro regions within a mega-region interlink with one another more than they do with other nearby metro regions, there may be some basis for Florida’s economic model. If those business regions are strongest among primary industries, as opposed to McDonalds, Wal*Mart, Office Depot and other retail chains, then his case becomes even stronger.

It would be equally interesting to see the linkages between metropolitan regions that are not geographically proximate. To what extent, for example, is Northern Virginia’s IT sector inter-linked with Silicon Valley’s or Boston’s? To what extent is New York’s financial sector interlinked with Charlotte’s? Such a map, I think, would be far more revealing. Richard Florida, call Chris Chmura.

We’re all familiar with the housing crisis, and we’re all familiar with the transportation crisis. And readers of this blog understand that the two phenomena are hopelessly entangled because many households seeking less expensive housing are willing to trade longer commutes for lower mortgages.

We’re all familiar with the housing crisis, and we’re all familiar with the transportation crisis. And readers of this blog understand that the two phenomena are hopelessly entangled because many households seeking less expensive housing are willing to trade longer commutes for lower mortgages.