by Steve Haner

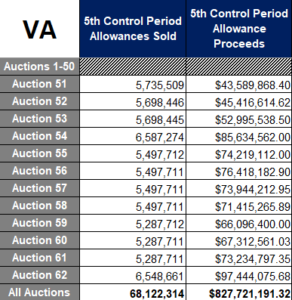

Virginia has participated in its final (for a while anyway) Regional Greenhouse Gas Initiative auction and the proceeds on the carbon tax set a new record, with Virginia collecting more than $97 million in one swoop. The total carbon tax take for the state is just under $828 million in three years.

The clearing price on December 6 reached $14.88 per ton. It would have been higher but the demand for allowances was so high the RGGI organization released some of its “cost containment reserve” or CCR allowances to tamp down the price increase. The news release on the auction is here. A chart showing Virginia’s proceeds over the three years is attached.

Why the record price? Here’s a solid suggestion: Power producers fear another major winter stressing their systems and know full well that wind and solar are unpredictable and unreliable. They are stocking up on allowances to keep our lights on with fossil fuels.

Just four years ago when the Thomas Jefferson Institute of Public Policy produced this explainer on what RGGI was, the “carbon price” was $5.27 a ton and the prediction was Virginia would collect $150 million a year from electricity producers and eventually their customers. “There is no guarantee the price won’t rise,” we noted, and indeed a steadily rising price for carbon emissions is entirely the point of RGGI.

Pushed by Governor Glenn Youngkin (R) the Air Pollution Control Board voted earlier this year to rescind the state regulation that forces Virginia’s larger electric power plants to purchase allowances from RGGI for every ton of coal, natural gas or oil they burn. So far, efforts to reverse that decision in the courts have failed.

In Virginia the major consumer of RGGI carbon allowances, and thus the major payer of the carbon tax, is Dominion Energy Virginia. The monopoly utility is passing the cost of the allowances directly to its customers in a monthly special charge called “Rider RGGI.” All customers, even industrial customers, are paying $4.43 in RGGI tax for every 1,000 kilowatt hours of juice.

Dominion imposed, suspended, and then reimposed the charge and thus has not yet collected all the money is has paid out in RGGI carbon taxes to date. So, the rider on its customer bills will continue in place for the time being.

Environmental activists and the special interests which have been profiting off the RGGI tax proceeds are frantic to keep the tax in place, but their first effort at legal action ended with the case being rejected by a Fairfax County Circuit Court judge. In a decision handed down about a month ago, the judge rejected the petition on procedural grounds saying only one plaintiff had a valid reason to sue, and that plaintiff should be suing in its home county of Floyd.

The decision was reported by the Richmond Times-Dispatch but largely ignored by the rest of Virginia’s media. So far there has been no report of an appeal or an effort to file again in another jurisdiction, but then Bacon’s Rebellion is not on the press release distribution lists for the net zero industrial complex.

The one plaintiff the judge indicated might have a case was a non-profit engaged in using RGGI money to weatherize or otherwise lower the energy costs for individual’s homes. When the General Assembly authorized Virginia’s membership in RGGI in 2020 on a narrow party-line vote, the majority Democrats also directed half of the tax take be spent on such programs.

It is unlikely supporters of RGGI will relent in their efforts to restore it. Absent a judge overturning the Air Board’s action, or absent a change of mind by Governor Youngkin, Virginia will now sit out the next three-year RGGI compliance cycle beginning in 2024. But Democrats are back in full control of the General Assembly and Virginia chooses a new governor in 2025.

In the meantime, RGGI will probably continue to maintain its status as a kind of climate magical charm, a powerful imaginary bulwark against the coming climate catastrophe feared by so many. A letter to the editor in the Richmond paper this morning is an excellent example of the drumbeat for the tax which has continued all year. It is utter nonsense from start to finish.

Phoenix, Arizona’s summer heat spell could have been prevented from happening again if we just keep paying this tax? Then there were those burning Canadian forests. Rising seas which will swamp Norfolk in just a few short decades can be held back by RGGI? And while the seas are rising, the climate catastrophe is instead causing the Mississippi River to suffer from low water? No river is ever depleted by humans sucking out more water upstream, it must be a climate catastrophe, and if we keep RGGI, the river will rise.

No appeal to a historical record of actual weather data which shows that Phoenix is a major urban heat island, that forest fires are less common than a century ago, that rivers always fluctuate, and the sea has been rising for thousands of years, will change the mind of the folks writing all these letters. RGGI will magically end the use of fossil fuels and save us from destruction. It is a religion. The carbon allowances are how this religion passes the plate and don’t be shocked when it reaches the traditional 10% tithe.

Leave a Reply

You must be logged in to post a comment.