The stock market correction has frightened the bejeebers out of investors large and small — and it ought to frighten the bejeebers out of state and local governments, too. As John Rubino, publisher of DollarCollapse.com, noted yesterday, falling stock prices will reduce the capital gains that have been fueling rising income tax revenues for state and federal governments. Writes Rubino:

A bear market-related sell-off in capital gains would cause a double crisis, cutting pension fund investment returns (and thus raising the level of underfunding) and cutting tax revenues, diminishing states’ ability to even keep up with their current pension funding schedule.

Progressive income tax rates are fun when asset prices are rising, as the Federal Reserve Board has engineered them to do with its near-zero rate interest policies: States reap an income tax bonanza in capital gains taxes. But they are a disaster when assets prices tumble and capital gains take a dive.

Virginia isn’t as vulnerable as some states, which rely more heavily upon income tax receipts. But the individual income tax is the largest single source of revenue for the General Fund. The commonwealth closed fiscal year 2015 in June with a $553 million surplus, which Governor Terry McAuliffe attributed mainly to a surge in individual income tax revenue, which increased 8.1%, ahead of the 4.7% forecast. Most of that increase came from people cashing in capital gains from the stock and bond markets, not from rising wages and salaries. With the stock selloff, a repeat of that performance is highly unlikely. Fortunately, the budget assumes only a modest increase in individual income taxes this year, so the exposure is modest.

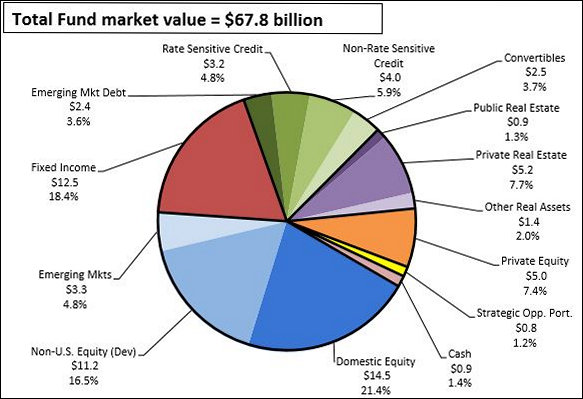

Less visible is the Virginia Retirement System’s exposure to falling equity prices. As of March 31, 2015, 21.4% of the VRS investment portfolio consisted of domestic equities. Another 16.5% consisted of non-U.S. equities — it would be interesting to know how much of that was invested in China, whose stock market meltdown has been cataclysmic. Another 3.6% was in emerging market debt, which is looking shakier and shakier as developing-nation economies take a beating from falling commodity prices, while another 4.8% was held in unspecified “emerging markets” assets.

In 2014, the VRS generated a 15.7% return on its investment portfolio, driven mainly by strong performance in its equity investments — and far above the 7% annualized return the VRS is aiming for. Given the state of U.S. and global financing markets today, it will take a minor miracle to meet that 7% goal this year. Of course, that’s only one year. Stock prices go up, stock prices go down, then they go back up again.

But Virginia faces another round of sequestration-driven cuts to the federal government, and the state economy will struggle to grow. Given the fact that we’re in the sixth straight year of a national economic expansion, our economic and budgetary outlook is surprisingly fragile.

— JAB