by James A. Bacon

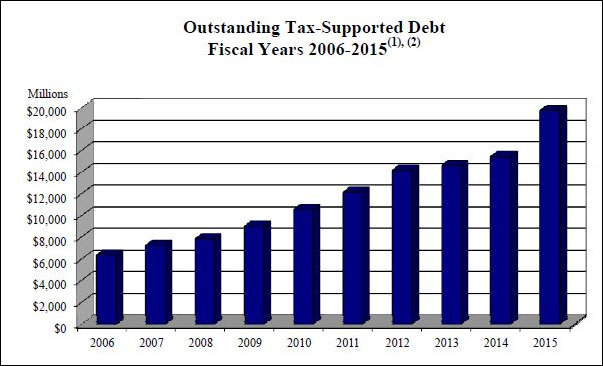

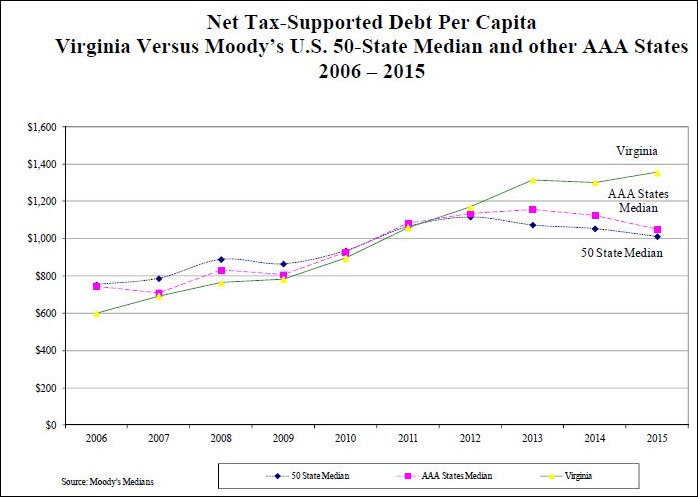

Virginia has more than tripled its tax-supported debt over the last decade, according to the December 2015 report of the Debt Capacity Advisory Committee, but the state still has enough capacity to support the issuance of another $603 million per year in added debt in Fiscal years 2016 and 2017 without undermining its AAA bond rating.

Long-term debt is necessary to pay for long-lived assets such as public buildings, university facilities and transportation projects, but higher debt payments, a fixed expense, make it difficult to respond to economic downturns and address other budgetary needs. It has been Virginia’s policy to limit debt payments to 5% of blended revenues.

While other states have been somewhat constrained in their borrowing in recent years, Virginia has continued to add to its debt. Net Tax-Supported Debt (NTSD) as a percentage of personal income increased to 2.8% — higher than the national median and 19th highest among the states.

Against this backdrop, Governor Terry McAuliffe has proposed issuing $2.43 billion in bonds for higher-ed R&D initiatives, Virginia ports, corrections, state parks and the environment. Assuming the bond issuances are staggered over four years, they would soak up the state’s projected added bond capacity over that period.

Complicating matters, McAuliffe has an appetite for even more spending that requires long-term financing. The administration’s signature transportation initiative is a $2 billion upgrade to Interstate 66, a key transportation artery in Northern Virginia. The project as currently envisioned is dependent upon highly unpopular tolls and toll-backed debt to finance the project. Unless offset by the maturation of old transportation debt, issuing bonds for the project could accentuate the crowding out of other priorities. As the committee report states:

Currently, debt service on debt paid by the TTF (Transportation Trust Fund) exceeds 5% of TTF revenues. Accordingly, to the extent the 5% measure is exceeded, capacity derived from the general fund is being utilized. This does not mean that general fund dollars are supplementing debt service payments on TTF debt; rather, it means that capacity derived from the general fund is being used to keep overall capacity for all tax-supported debt under the 5% target.

The General Assembly money committees have more than budgets to discuss this year.