By Steve Haner

When the General Assembly was briefed on the state’s financial status last week, the $412 million in unexpected revenue growth was dismissed as potentially misleading because of some new quirk in Virginia tax law called the Pass Through Entity Tax or PTET. PTET keeps coming up in these discussions.

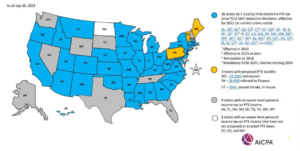

Approval of the Pass Through Entity Tax in 2022, with some tweaks to the rules in 2023, has indeed scrambled the state’s financial forecasting. Virginia is one of 36 states now offering this tax strategy. The Senate Finance and Appropriations Committee got a briefing on it October 17. Before the boring nuts and bolts, here are the headlines.

First, PTET is popularly seen as a way to undermine the 2017 Tax Cuts and Jobs Act’s limitation on the deductibility of state and local taxes (SALT). If you seek itemized deductions on a federal tax return, the limit for state and local taxes paid is $10,000. Now that Virginia and so many other states have adopted PTET, the big loser is the federal government. PTET adds to the federal deficit.

Second, this “work around” to circumvent the SALT cap is only available to some taxpayers. To qualify the income must come from a business entity that passes its profits through directly to its owners. It might be a family business set up as an S-corporation, or multiple owners in a law partnership or medical limited liability corporation.

Third, the taxpayer does not need to be claiming itemized deductions to benefit from this. It really has little to do with the SALT cap. The taxpayer can now claim a federal deduction for all the state tax on the pass through income as a business expense, and still claim the standard deduction. Business expenses are not capped.

Fourth, this went through the 2022 General Assembly like you know what through a goose, passing unanimously. Sometimes that means legislators didn’t understand what they were voting on.

This is not a tax break for the little guy earning a weekly check. These are owners of businesses, who owe enough income and real estate tax that the $10,000 deduction limit was costing them money. How this escaped the usual whining about tax breaks for rich businesses or business owners is hard to understand but roll over to the Commonwealth Institute for Fiscal Analysis (my favorite lefty money guys) and you find not one raised eyebrow about PTET.

The standard liberal complaint about the 2017 tax cut favoring the better off was belied by the SALT deduction cap. It was one of the provisions that provided a major increase in the tax many paid, especially those living in high-tax cities or states. Before 2017, the federal tax code was providing huge subsidies to high-tax and high-spend jurisdictions, and the SALT cap set them to howling immediately.

The fiscal impact statement for House Bill 1121 insists the state treasury loses nothing, but is clear that there will be disconnects in the timing, since many taxpayers are now due refunds. Many taxpayers take advantage of the rule allowing them to file their returns months later than the usual deadline, so those refund claims come much later in the year.

As this new situation evolved, many of those individual taxpayers have been cautious and continued to make their same quarterly tax installment payments. They were worried about underpaying, which is punished with interest and a penalty. They are waiting to file for refunds instead, and it is the unknown size and timing of those refunds that has the Department of Taxation worried.

The tax dollars could be collected in one fiscal year and refund paid out in the next. The legislator who brought the bill in 2022, Delegate Joseph McNamara (R-Salem), believes the Department of Taxation is over estimating the risk that massive refunds will be demanded. Time will tell.

Virginia did not invent this PTET workaround, although McNamara’s bill was one of the first nationally. Given all the other states going in that direction, the likelihood Virginia would not follow suit was very low. But the tax policy implications are substantial. The federal tax code is once again subsiding state and local taxes, and once again, not all taxpayers are treated equally. The pressure will build to remove the SALT cap entirely. Many will cheer.

How PTET works is very simple. If a partnership has 10 partners and earned $2 million in profits (before tax), each equal partner would normally be disbursed $200,000 and would owe state tax on that income. But if the state 5.75% tax on the $2 million is paid by the entity, each partner gets a deduction for his or her share of the distribution that wipes out the state tax liability.

The individual taxpayer can still claim the state income tax paid on the federal return as a business expense. That provides the big hit to the federal treasury. Often it might be a very large reduction in federal tax. An 2020 Internal Revenue Service ruling on how that tax liability is passed through set up this tax avoidance process.

If the pass through income amount is relatively small, many CPAs are advising taxpayers not to take the PTET route, McNamara said. There can be other circumstances where the taxpayer would still like to take the distribution pre-tax.

The traditional purpose of a pass through entity is to avoid income taxes at the entity level and pass that liability to the individuals. They are an alternative to traditional corporations. Corporate net income is taxed twice, first by the corporate income tax and then as individual income when shareholders get their dividends. Pass through entity income is taxed only once.

Now the business owners can choose to pay state tax at the entity level and avoid the individual liability, or not, whichever causes the lowest tax bill.

Yes, this is special treatment for a certain class of income, McNamara agreed. He argues that other forms of income get special treatment. Dividends and carried interest income are taxed at lower rates. On wage income, the employer pays half of the Social Security tax but on pass through income, the taxpayer pays the higher self employment rate.

The money these taxpayers are not sending to Washington stays and gets spent in Virginia, he argued. That he was able to persuade all the liberal tax hawks in the General Assembly to go along with this is astounding. Many Republicans may not understand just what this does, either.

At the end of the Department of Taxation presentation last week, a hopeful legislator noted that at least the state is earning interest on all that money sitting around waiting for the refunds. No, responded the Tax Department’s Kristin Collins. The state will pay interest on those refunds once paid, currently something like 9%. They have no incentive to rush.

Leave a Reply

You must be logged in to post a comment.