by James A. Bacon

Henrico County’s governing class justifies a proposed 4% meals tax, expected to raise $18 million a year, as necessary to ward off calamitous budget cuts. The revenues are needed, county officials say, because stagnant tax revenues aren’t sufficient to pay for rising pension liabilities and environmental mandates.

There may have been a basis to that logic a year or so ago when the county administration began pushing the idea of a tax increase. But it doesn’t withstand scrutiny today.

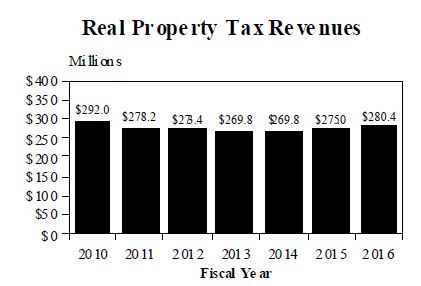

I refer readers to Henrico’s FY 2014 budget. On pages 47 and 48, you will find the following graph and commentary:

Assessment information for January 2013 indicates real estate assessments total $30.8 billion, reflecting an increase of approximately $109 million, or 0.36 percent from the January 2012 assessed values. The real estate market appears to have become relatively stable with a slight decrease in residential values offset by an increase in commercial values. …

Out-year projects on movements in countywide assessments are based on a forecast model factoring in changes in both residential and commercial values as well as the addition of new residential and commercial construction. The FY2015 and FY2016 projections assume increases to the County’s real property tax collections of 2.0 percent in each year respectively.

I’m all in favor of governments using cautious economic forecasts for budgeting purposes. Better to be safe than sorry. But I also expect administrators and elected officials to acknowledge reality when it clobbers them on the head. Indeed, the reality of property values in Henrico County has diverged so far from the budget forecast that it causes one to question the good faith of meals tax proponents by failing to acknowledge it.

Property values are surging this year. States a July 18 article in the Henrico Citizen: “The average sale price of Henrico single-family homes in 2013 is $243,608, according to data compiled by the Richmond Association of Realtors. This is almost $19,000 higher than the average sale price to date in May 2012.”

“The market overall in Central Virginia is trending upward,” Laura Lafayette, CEO of the Richmond Association of Realtors, told the publication. “Henrico is certainly one of the brightest spots.” Lafayette, it is worth noting, has defended the meals-tax proposal in numerous public forums.

Let me do the math for you: Between May 2012 and 2013, the average sale price of Henrico houses increased 11.8%. Not 2%… 11.8%. (It is possible that commercial property values, which account for a bit more than 30% of the county tax base, increased by a similar amount, although we cannot know that from the Realtor data.)

Let me do some more math for you. Henrico County’s FY 2014 budget forecasts real property tax revenue of $269 million this year. Because we don’t have any data demonstrating otherwise, we’ll assume that commercial real estate revenues increase only 2% next year, as forecast. But let’s assume that residential real estate revenues increase 11.8% in line with higher housing prices. That results in a $23.2 million increase in revenue. That’s $17.8 million more than forecast –– a sum, coincidentally enough, almost exactly equal to the revenues anticipated from the meals tax.

If anything, my assumptions are extremely conservative. Housing prices are expected to continue climbing across the Richmond region. Reports the Richmond Times-Dispatch today: “Richmond-area home prices are projected to rise 3.3 percent through the first quarter of 2014, according to a quarterly CoreLogic Case-Shiller Home Price Indexes report released Thursday.”

In other words, the gap between forecast revenue and actual revenue could be even higher next year.

There are two conclusions to be drawn from this data. First, there is no longer a justification for the meals tax. Second, Henrico officials aren’t leveling with Henrico County taxpayers.