By Steve Haner

A circuit court judge in Floyd County may soon order Virginia to rejoin the Regional Greenhouse Gas Initiative and to reimpose the related carbon tax on Virginia’s electricity consumers.

Judge Kenneth “Mike” Fleenor Jr. ruled earlier this month that a suit seeking reinstatement of RGGI could continue and held a hearing on February 5 on the question of “immediate relief.” The plaintiff, a group of energy efficiency and insulation contractors using the RGGI tax dollars for their programs, has claimed it will suffer immediate and irreparable harm unless Virginia returns to collecting a carbon tax on coal and natural gas used by utilities.

The main impact of RGGI membership is on Virginia’s largest electricity provider, Dominion Energy Virginia, which simply passed the carbon tax directly on to customers on their monthly bills. It stopped buying carbon allowances last year, but the bills had accumulated, so it is still charging customers.

Virginia’s Solicitor General Andrew Ferguson pointed out that the state bank account holding proceeds from the carbon tax collected in 2021, 2022 and 2023 still held $350 million and was only being expended at $30 million or so per month. There should be enough to keep the plaintiff’s program going through 2024 as the case proceeds, he told the judge, according to a transcript of the hearing.

The plaintiff is the Association of Energy Conservation Professionals, with members who have been operating programs to insulate and weatherize properties using donated and government funds for almost 50 years. It claims the RGGI dollars are the sole support for a particular program, but there are other funding sources for this work, including other money collected from utility customers.

Can an entity that benefits from a government spending program assert a right to maintain that spending program? Once a tax funding a particular program is created, can it ever be repealed? The contractors’ reliance on this stream of tax revenue has been recognized by two circuit courts now as sufficient standing to sue and demand reinstitution of the tax.

Recapping the key timeline: Governor Glenn Youngkin (R) upon his election announced his intention to withdraw from RGGI, which was imposed under his predecessor by a regulation from the Air Pollution Control Board. Youngkin was able to make several changes on that citizen board, and the new majority, after a full review process under the Administration Process Act, voted to withdraw.

The RGGI interstate compact is run on three-year contract cycles, and Virginia withdrew at the end of the last contract period on December 31. A new cycle without Virginia is now underway.

Whether or not the judge grants the requested immediate relief and orders RGGI reinstated, the underlying case will continue. To order the return to RGGI before a final decision, the judge would have to believe the plaintiffs are likely to ultimately prevail in the end.

Along with the challenge to the plaintiffs’ standing, the judge also denied two of three other grounds for dismissal of the case asserted by the Office of the Attorney General. The plaintiffs can continue to argue that a 2020 General Assembly law mandated that Virginia be part of RGGI and that the Air Board action was illegal, while opponents of RGGI maintain the law authorized Virginia to participate but did not mandate it. The interpretation of that statute is the heart of the case.

The plaintiffs can also proceed with a claim that the Air Board’s decision, even if within its discretion, was unsupported by sufficient evidence.

The plaintiffs initially sued in Fairfax County and filed the first petition for a stay of the regulation’s repeal well before the contract period expired. But the Fairfax judge rejected the standing claim on that set of plaintiffs, with the exception of the contractors. To sue, however, the contractor association had to go to its home court in Floyd County.

That delay made a motion for a stay of the regulation’s repeal moot. Repeal is a done deal. The court is being asked to reinstate the previous regulation and instead repeal the new one. But to rejoin RGGI, the court is also being asked to order a Virginia governor to enter into new contract negotiations seeking to rejoin RGGI after a new contract period has begun. It would be only temporary participation since it is still possible the suit will fail a few months down the road.

“It is difficult to imagine a more intrusive form of mandatory injunctive relief,” Solicitor General Ferguson argued in the hearing. A brief filed in opposition to the plaintiff’s request noted the state’s share of RGGI’s overhead costs was about $600,000 per year under the previous contract. The Office of the Attorney General’s brief rested heavily on arguments that such an order would violate the separation of powers.

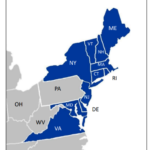

“We are aware of no precedent by which a court of this Commonwealth has ordered a governor…to enter contract negotiations with foreign governments,” Ferguson added. Other states are considered foreign governments in legal parlance, and RGGI is a compact of about a dozen states.

The Virginia House of Delegates has now proposed amendments to the state budget that would mandate a return to RGGI. But those provisions are not yet approved and face a possible gubernatorial veto if they are. The real political decision on this matter will flow from the next election. A new Democratic governor would likely seek to rejoin RGGI in 2026 and a new Republican would not.

There is also no guarantee that even if more RGGI dollars begin to flow from future carbon allowance auctions, those particular contractors will be paid to continue their particular programs. The current Democratic majority in the General Assembly might be inclined to approve such an appropriation, but the prior spending authorization ran out in 2023 as well, and a new one (also proposed by the House now) would also need the governor’s approval.

Unless a rural circuit court decides to order otherwise, of course. If it can order Virginia to enter an interstate agreement and impose a tax, why should it not also dictate appropriations?

Leave a Reply

You must be logged in to post a comment.