Sales prices for houses have been soaring across the country — by double digits in many metropolitan areas — and so are real estate property assessments. When assessments go up, so do taxes, unless city councils and county boards lower tax rates. In the current environment, holding a tax rate steady amounts to a tax increase. Even a 5% reduction in the tax rate can amount to a tax increase if assessments are up 10%.

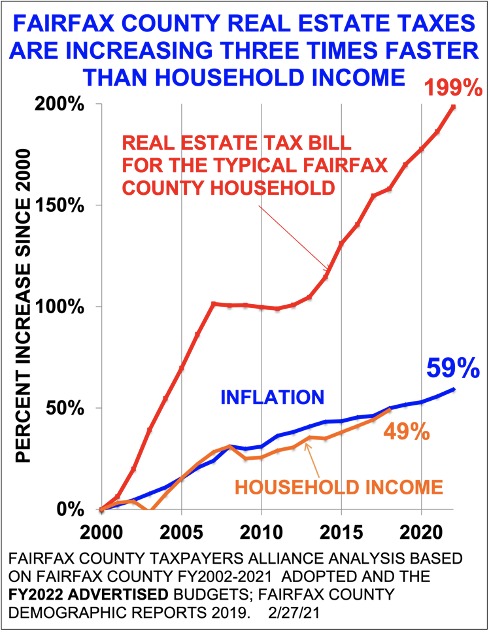

The Fairfax County Taxpayers Alliance has a few things to say about the long-term trend in Virginia’s most populous locality:

On March 9, the Fairfax County Board of Supervisors, which is deciding on next year’s county budget, advertised a 4.25% real estate tax hike, which would cost the average homeowner $293.

This continues a two-decade trend where the supervisors have increased real estate taxes three times faster than homeowner income, which has barely kept up with inflation. The average homeowner real estate tax next year would be $7,200. If real estate taxes had increased at the same pace as inflation since 2000, the average tax would be $3,800.The $293 increase would be the largest real estate tax hike in five years.

It is easy for the supervisors to mislead taxpayers about real estate taxes. In his March 9, 2021, newsletter, county chairman Jeffrey McKay (D-At-Large) stated that the advertised real estate tax rate for next year is $1.15 per $100 of your home’s assessed value, the same as this year’s rate. While he acknowledged “… that many residents’ assessments are on the rise …,” he did not acknowledge that the average increase in residential assessments is 4.25%. While many homeowners will have tax hikes of 4% or more and others less depending on their individual assessments, most will have a tax increase, and the average increase will be 4.25%.

Virginia, love it or leave it.

More and more people are deciding they’ll leave it.

— JAB

Leave a Reply

You must be logged in to post a comment.