by Steve Haner

Virginia’s Air Pollution Control Board is continuing through the necessary steps to repeal Virginia’s participation in the Regional Greenhouse Gas Initiative (RGGI), a regional compact that imposes an allowance cost (carbon tax) on fossil fuels used in generating electricity.

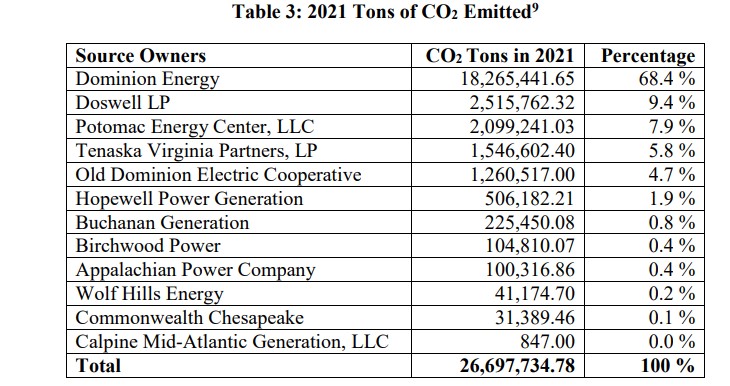

During 2021 and 2022, the tax collected about half a billion dollars from power producers, most if not all of that cost passed on to customers. Almost 70 percent of the allowances for 2021 were used by Dominion Energy Virginia, which is in the process of adding that cost back to its monthly customer bills. The next allowance auction, number nine for Virginia, is March 8.

RGGI also imposes caps to slowly ramp down the maximum amount of fossil fuels allowed to big generators within the region, but other Virginia laws actually require a more rapid retirement in the state. RGGI does not prohibit or tax electricity imported from outside the member states, even if generated from fossil fuels.

It was a regulation adopted by an earlier Air Board that entered Virginia into RGGI, so a regulatory process is underway to repeal that. One requirement is a public comment period, open until March 31. So far, the comments have been dominated by supporters of the carbon tax. Today the Thomas Jefferson Institute commented in support of repeal.

If so inclined, file your own comment here. Then see what you wrote and read what others have filed here. The Jefferson Institute comment also linked to a longer document on our website, which follows:

The Thomas Jefferson Institute for Public Policy is an independent public policy organization focusing on crafting and promoting public policy solutions that advance prosperity and opportunity for all Virginians. Our goal is to ensure a Commonwealth with a thriving economy where Virginians have the opportunity to succeed because economic and regulatory barriers are low, and individuals and parents are empowered to make informed choices for themselves and their families.

The Thomas Jefferson Institute supports Virginia’s proposed withdrawal from the Regional Greenhouse Gas Initiative. The program is just a carbon tax, which has cost Virginia energy generators and their customers half a billion dollars in two years with more costs to come for 2023.

The makeup of Virginia’s atmosphere has not been changed by one molecule because the state belongs to RGGI and collects this tax. It has thus had zero impact on the world’s atmosphere, which continues to see rising levels of carbon dioxide and other targeted emissions from fossil fuels. In the United States, the market was moving away from coal and other fossil fuels long before RGGI came to Virginia, but worldwide demand for coal set a record in 2022, according to the International Energy Agency.

Absent any impact on the air we breathe, or the level of greenhouse gases it contains, RGGI remains simply a tax to fund two spending programs important to large constituency groups. The beneficiaries include, and in fact may be dominated by, the government bureaucracies and private contracting entities that actually get to spend the tax dollars.

About half of the money is to be spent on public works projects to improve flood control or coastal storm resilience, addressing long standing needs in that area. The proceeds from RGGI dedicated to these purposes represent a small amount of the total program spending – state, federal and local — and the 2023 General Assembly just approved additional dollars toward those purposes from the state’s general fund. The work will continue if RGGI goes away.

The rest of the money is to be spent on various programs to improve energy efficiency or conservation in buildings, mainly in homes. Again, such programs have been supported by the taxpayers for decades and indeed the electricity ratepayers of Virginia’s two largest electric companies pay another monthly surcharge to subsidize such programs.

A body of contractors make their living doing this work and the individual recipients often do see substantially lower personal costs. But the utility-run programs have a long history of failing broader cost-benefit analyses, especially tests of any benefit to general ratepayers. There is no evidence the RGGI-funded programs are even evaluated or measured on these tests. Regardless, with billions being spent just in Virginia on new wind, solar and battery assets, claims that such programs reduce the need for new generation are without foundation.

The General Assembly likely will continue to impose that other “energy efficiency tax” on customers. One tax to subsidize those questionable activities is enough. The work will continue if RGGI goes away. The RGGI tax for that purpose is just adding insult to injury.

At some point the courts will likely be asked to rule on whether the Air Pollution Control Board, which adopted RGGI through regulatory action, has the ability to repeal it through the same grant of authority. We believe such a step is lawful. Chapter 1219 of the 2020 Acts of Assembly dictated certain elements of that regulation (overriding the normal Administrative Process Act) and directed which programs would benefit from RGGI tax proceeds, but then merely authorized the executive branch to proceed. No language indicated that this regulation, unlike others, could not be repealed later.

Thank you for this opportunity to enter these comments on your record.

First published by the Thomas Jefferson Institute for Public Policy.

Leave a Reply

You must be logged in to post a comment.