The Numbers on Interstate 81: Tax First, Explain Later

When you approve a major tax increase with amendments proposed just a few days before the General Assembly’s reconvened session, as happened last week, discussion is limited and there is almost no hard data on the financial impact available to the public. You tax first and explain later.

The details appeared at this week’s meeting of the Commonwealth Transportation Board, which was given some charts on the six-year revenue and spending projections behind Governor Ralph Northam’s successful amendments. About 41 percent of the anticipated $1.5 billion over six years will support Interstate 81 projects, just a start on the $2 billion in planned improvements to that congested artery. Almost 60 percent is not for I-81. This is not a fix for I-81, but is something bigger than a Band-Aid.

The full information was probably circulating among legislators, state staff and lobbyists. It does not differ much from the legislation considered and defeated during the regular session, or from a sub rosa effort to insert these taxes into the final state budget conference report, which also failed.

The full slide presentation to the CTB details the four revenue measures (here): higher statewide registration fees and road use taxes on commercial trucks, higher statewide diesel fuel taxes, and the addition of the localities around I-81 into the zone collecting a regional supplemental gasoline tax. It also breaks down where the money will go (here).

So that’s tax increase number five for Governor Northam. The new state budget he drops into the legislative hopper in eight months will be a whopper.

The other four tax hikes? Substantial provider taxes on Virginia hospitals to fund Medicaid expansion and Medicaid payment increases, the carbon tax about to be approved by the Air Pollution Control Board, the bulk of the state revenue windfall produced by conformity with federal tax changes (and not returned by tax reform) and the expansion of the state sales tax to more online retail transactions. A fair argument can be made that the fourth one is just an enhanced collection method for a tax which already was on the books, but not doing it was an option and it did produce more revenue.

VCCS Enrollment Decline Unpacked

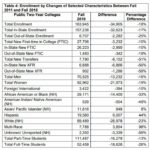

The board book for the State Council of Higher Education for Virginia always has some great data tidbits, and this chart on the declining enrollment at the Virginia Community College System is a good example. It has some good news, but mostly bad news.

Comparing Fall of 2011 with Fall of 2018, total enrollment is down 18 percent.

But look at the categories where enrollment as dropped further than that:

- Full-time students, down 26 percent

- White students, down 23 percent

- African American students, down 33 percent

- Out-of-state students, down 25 percent

- Transfer students, down 51 percent

Some of the drops in the demographic categories are explained in part by an almost 100 percent increase in the number of students self-categorized as multi-racial. And the enrollment of Hispanic students showed a very positive 44 percent growth, a good sign for the future. Asian students also bucked the trend and increased.

The baseline year of 2011 was still seeing the effect of the recession, with many unemployed persons using that as an opportunity for education and training. But this is not encouraging data for a state seeking to become the best educated in the country and facing many demands for trained workers promised to technology employers.

Spotsylvania Solar Approved

The Spotsylvania County Board of Supervisors voted 5-2 Tuesday to approve the largest portion of a massive solar generating facility planned for that county, having delayed the decision a while back due to opposition from a neighboring subdivision.

Some of the economic and tax angles of the dispute were discussed earlier on Bacon’s Rebellion. The project, largest proposed so far east of the Mississippi, had generated national coverage and was a lightning rod for opponents of renewable energy. It is being built by a private developer, and financed by various power purchase agreements, but like many solar projects is heavily dependent on favorable tax treatment.

Approval of this huge solar field, along with a number of others moving forward in Virginia, may signal a difficult challenge to anybody seeking to stop others in the approval pipeline around Virginia. Virginia’s agricultural growth crops are hemp and solar panels.

Leave a Reply

You must be logged in to post a comment.