by James A. Bacon

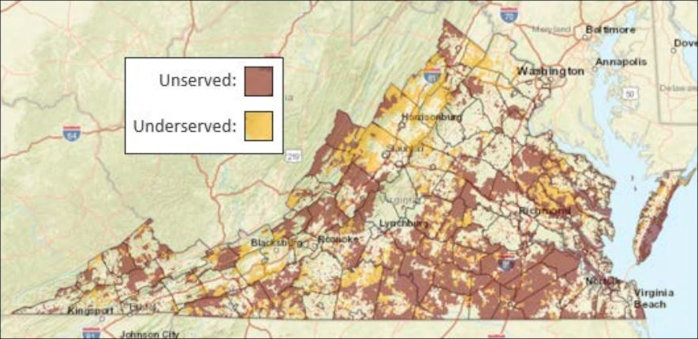

Virginia’s investor-owned utilities, Dominion Energy and Appalachian Power Co., could become key players in the Northam administration’s push to extend broadband access to rural communities.

A State Corporation Commission ruling is expected today on an Apco proposal to extend “middle mile” broadband in partnership with Bluefield-based GigaBeam Networks, which will provide “last mile” connectivity to retail customers in Grayson County.

And last month, Dominion announced a partnership with Prince George Electric Cooperative’s RURALBAND subsidiary to provide Internet connectivity to 3,600 customers in Surry County. Dominion’s “middle-mile” service would link Prince George local network with high-capacity fiber-optic trunk lines.

The logic behind these partnerships is that, spurred by the Grid Transformation and Security Act of 2018, Dominion and Apco are already spending tens of millions of dollars to install broadband in their electric distribution systems. They can add enough additional capacity to serve nearby rural communities at marginal additional cost.

As part of the grid-modernization efforts, Dominion and Apco are installing smart meters to more precisely track electricity consumption and are deploying sensors and devices to create smart, self-healing grids. These grids are designed to improve reliability by identifying failures in the distribution system, isolating the faults, and re-routing power without human intervention.

The Apco initiative in Grayson County is tied to the installation of 238 miles of 96-strand fiber optic cable. In parallel initiatives, Dominion is installing miles of fiber-optic cable along the backbone of its electric-distribution system extending deep into many rural communities.

“Grid modernization is coming one way or the other,” Nathan Frost, Dominion’s director of new technology and energy conservation, tells Bacon’s Rebellion. “We’ll be in some of these rural communities. We’ll take the broadband to a hand-off point, and a local Internet Service Provider will deploy their own cable at that point. We’ll provide the highway. The ISPs will provide the local roads.”

Who pays for the marginal costs? Last year, HB 2691, introduced by Del. Israel O’Quinn, R-Bristol, authorized the SCC to establish pilot programs to make broadband capacity available to nongovernmental Internet Service Providers in under-served areas. The costs to Dominion and Apco were capped at $60 million annually each. Rural broadband was declared to be in the “public interest,” and utilities were to recover their costs through rate adjustment clauses (project-specific cost recovery over and above the base rates).

In the Dominion-Prince George Electric Cooperative partnership, RURALBAND will pay to lease a portion of Dominion’s fiber capacity, allowing Dominion to recover some of its costs.

While the exact charge for that particular lease has yet to be determined, the idea is for lease charges to “offset” Dominion’s incremental added expenses, says Frost. This is not a dollar-for-dollar offset, he added, nor is it a revenue-generating scheme. “It’s about bridging the digital divide.”

Assuming Apco wins SCC approval, the utility’s Grayson County pilot project will last for three years. The company hopes to have the fiber-optic delivery system built by December this year.

“Broadband service for Grayson County helps guide us toward solving one of the problems holding back economic development in rural Virginia,” said Chris Beam, Appalachian Power’s president and chief operating officer, as quoted by the Galax Gazette. “This proposed pilot will also benefit our power customers with increased electric reliability from fiber infrastructure supporting advanced metering and distribution automation.”

The proposed Surry County project, which also will require SCC approval, will cost an estimated $16 to $18 million in investment by Dominion, PGEC, and RURALBAND, as well as state and federal grants.

Dominion laid out its vision for the middle-mile strategy in a 2018 “Broadband Feasibility Report.” The report described Dominion’s proposed Model 1 “Substation” model for deploying fiber-optic cable.

Dominion Energy has envisioned bringing fiber to all stations that are geographically located within an unserved broadband area and that do not currently have fiber. These 160 substations would serve as access points for third party providers. … Combined with the work contemplated by the GT (Grid Transformation) plan, the Company estimates costs for Model 1 up to approximately $310 million. This cost would be approximately $75 million higher without the planned Telecommunications Strategy investments proposed in the GT Plan.

Dominion’s Model 2 approach would build upon Model 1 by providing additional access points along fiber paths between substations. These would provide more opportunities for local broadband providers to connect, decreasing their fiber deployment and reaching more residents.

Other deployment models would bring Dominion Energy fiber lines even closer to the rural customers. Any proposal will require SCC approval.