About

Bacon's Rebellion is Virginia's leading politically non-aligned portal for news, opinions and analysis about state, regional and local public policy. Read more about us here.Fund the Rebellion

Shake up the status quo!

Your contributions will be used to pay for faster download speeds and grow readership. Make a one-time donation by credit card or contribute a small sum monthly.

Can't wait until tomorrow for your Bacon's Rebellion fix?

Search Bacon’s Rebellion

Content Categories

Archives

The Jefferson Council: Protecting Thomas Jefferson’s Legacy at the University of Virginia

Want More Unfiltered News?

Check out the Bacon’s Rebellion News Feed, linking to raw and unexpurgated news and commentary from Virginia blogs, governments, trade associations, and advocacy groups.

Submit op-eds

We welcome a broad spectrum of views. If you would like to submit an op-ed for publication in Bacon’s Rebellion, contact editor/publisher Jim Bacon at jabacon[at]baconsrebellion.com (substituting “@” for “at”).

Forgot Your Password?

Shoot me an email and I'll generate a new password for you.-

Recent Posts

- Extensive Plagiarism Alleged for UVA PhD Dissertation

- Some Rural Localities Hit With Big Jump in Local Composite Index

- The Budget Do-Over: A Game of Chicken?

- Jason Miyares–Judicial Activist?

- State Legislatures Control Budgets — Virginia’s More Than Most

- Jeanine’s Memes

- Bacon Meme of the Week

- Ready for Taxes on Netflix, NFL Sunday Ticket?

- Keffiyehs, Yarmulkes and “Belonging” at UVA

- Public School Enrollments Still Declining

- The Incredibly Shrinking Newspaper

- Diamonds Aren’t Forever

- Will Democrats Shut Down State Over Tax Hike?

- Fairfax Spends More, Teaches Less

- Jeanine’s Memes

Bacon Meme of the Week

Posted in Bacon and pigs

Will Consumers Come First in VCEA Review?

By Steve Haner

“If we always keep as our focus what is best for consumers, in getting them reliable power for the least cost, then I think that’s the main guidepost we ought to follow.”

That was Federal Energy Regulatory Commissioner Mark Christie’s opening quote on a PBS broadcast on energy issues due to air April 9, but the 26- minute program can already be found on the network’s website and Christie distributed it via X today. Continue reading

Posted in Energy, Environment, General Assembly, Utilities

Tagged Stephen D. Haner, VCEA

Jewish Parents Decry Double Standards at UVA

by James A. Bacon

A half year after Hamas terrorists assaulted Israel, hostility at the University of Virginia toward Israel and Jews is unrelenting, according to parents of Jewish students there. In collaboration with other parents, Julie Pearl complained in a letter Tuesday to Rector Robert Hardie that a “blatant double standard against Jewish students persists at UVA.”

Pearl’s letter was prompted in part by the administration’s response to a recent incident in which a truck with digital billboards rolled through the University displaying messages critical of Hardie. One screen said, “Rector Robert Hardie won’t confront antisemitism” while another said Hardie is “unfit to lead U.Va.” The administration’s reaction was to criticize the slogans and investigate who was behind the stunt, Pearl said.

Pearl’s letter was prompted in part by the administration’s response to a recent incident in which a truck with digital billboards rolled through the University displaying messages critical of Hardie. One screen said, “Rector Robert Hardie won’t confront antisemitism” while another said Hardie is “unfit to lead U.Va.” The administration’s reaction was to criticize the slogans and investigate who was behind the stunt, Pearl said.

“How does the billboard incident directed at you merit outrage, an immediate statement of condemnation, and investigative action … while the ongoing harassment and intimidation faced by Jewish students receive no such response?” she asked. Continue reading

Posted in Civil Rights, Culture wars, Education (higher ed)

Tagged James A. Bacon, University of Virginia

Yes, MSNBC Morons, Virginia IS a Border State.

by Kerry Dougherty

by Kerry Dougherty

Remember back on the night of Super Tuesday when MSNBC’s far-left host Rachel Maddow and former Biden mouthpiece Jen Psaki convulsed in laughter as they reported that the number one issue for Republican voters was the border?

“Well Virginia does have a border with West Virginia,” Maddow cackled, sending the panel of unserious pundits into more gales of laughter as they mocked both conservative Virginians and West Virginians.

It was a leftist twofer! The only thing missing was a crack about “deplorables.”

I guess it never occurred to these mindless cable creatures that 1,951 Virginians died of fentanyl overdoses in 2022, up 30% from the year before. In fact, according to the Secretary of Health and Human Services, more Virginians die every year from drug overdoses than motor vehicle accidents and gun-related deaths combined.

Drug overdoses are now the leading cause of unnatural death in Virginia.

And how do most illegal drugs get into our country? From China, via Mexico and the drug cartels running our border.

But go ahead and yuck it up ladies. We’re such a bunch of rubes down here. Continue reading

Remembering Larry Maddry

by Kerry Dougherty

by Kerry Dougherty

What happens when corporate bean counters drive out all of their experienced workers and replace them with fresh-faced kids right out of school?

Bad things.

In the case of newspapers, it means hiring reporters who are unfamiliar with the area. It means all of the curmudgeonly grammarians are gone and there’s no one around to catch mistakes in copy.

And it means that when beloved newspapermen from an earlier era die, no one in the newsroom remembers them.

That may explain why it took The Virginian-Pilot — where I worked for 34 years — about a week to mourn the loss of Marvin Lake, the first black reporter ever hired by the Pilot and a man most of us admired and found to be a thoughtful sounding board for story ideas.

It also means that as I write this it’s been five days since the death of beloved metro columnist Larry Maddry — who retired in 2000 — and the newspaper has yet to print a word about him.

Maddry’s family shouldn’t have to buy an obituary from the newspaper where he delighted readers for more than 30 years to note his passing.

I’m hoping to wake up this Wednesday morning, find a front-page story on Larry and feel a little foolish for writing this.

Even if that happens, this little tribute is what I want to offer:

It’s rare that a person who worked for decades in a bustling newsroom with its over-sized egos and terrible tempers leaves with no enemies. But it was impossible not to like Larry Maddry, the columnist with a soft Southern drawl, dry wit, and the ability to write like an angel.

I don’t believe I ever heard anyone — even the most hard-bitten journalists — gripe about him. Continue reading

Small Parcel; Significant History

by Jon Baliles

There was some great news last week as the Capital Region Land Conservancy (CRLC) scored another big win on behalf of the city when it announced the successfully negotiated purchase of 4.5 acres along the James River from Norfolk Southern near Ancarrow’s Landing. The parcel will be placed into the James River Park System conservation easement, transferred to the City of Richmond, and become part of the park system.

According to the CRLC, the property is 130-feet wide and 2,300-feet long with more than a quarter mile of frontage along the river, and much of the property is part of the Richmond Slave Trail. As part of the Riverfront Plan in 2012, the acquired property was noted as an essential parcel that was shown on some maps as part of the James River Park System and included part of the Slave Trail that was formally dedicated in 2011; but it was still owned by the railroad, and users technically (and legally) were trespassing. Norfolk Southern had owned the property since 1849 through its predecessors, the Richmond and Danville Railroad Company (1847-1894), and Southern Railway (1894-1982).

The transfer will now guarantee public access to this part of the Richmond Slave Trail, which was born from the Richmond Slave Trail Commission begun in 1998 and is a three-mile path with 17 historical markers between the Manchester Docks from which slaves disembarked and were led to the slave jails in Shockoe Bottom, most notoriously Lumpkin’s Jail. Continue reading

Dominion Program to Bury Lines Halfway to Goal

By Steve Haner

Just over a decade ago, Dominion Energy Virginia announced plans to spend about $1.75 billion of its ratepayers’ dollars on a program to bury about 4,000 miles of its residential service lines underground. As of the end of last year, the tally was just over 2,000 miles buried at a total cost of $994 million.

The original goal was reported by Jim Bacon, who was initially favorable to the idea. The update comes from an annual report dated March 29 and posted by the State Corporation Commission. This reporter, who admittedly already lived in neighborhoods with underground lines installed at the cost of the developer, was skeptical of paying to bury somebody else’s lines, and this new report doesn’t ease the irritation. Continue reading

Proposed Tax for Leave Pay Guaranteed to Grow

From tiny acorns, massive tax-fed government benefit programs grow. Case in point, the pending Virginia paid leave bureaucracy.

By Derrick Max

Sitting on Governor Glenn Youngkin’s desk is a paid family and medical leave bill that would provide eight weeks of paid leave per year for most employees in the Commonwealth. The program would pay employees 80 percent of their weekly salary up to an amount equal to 80 percent of the regional average salary for their qualified leave. Interestingly, teachers, state employees, and constitutional officers are not covered under this program — presumably, these employees already have paid leave benefits and the General Assembly did not want to tax their allies. Continue reading

Posted in Business and Economy, Entitlements, General Assembly, Labor & workforce, Taxes

Tagged Derrick A. Max

Anarchy Visits Another School

by James A. Bacon

Teachers don’t feel safe in Albemarle High School, reports The Daily Progress. Within one recent week, a student punched a teacher in the face so hard he (or she) required medical treatment, while another student issued threats against teachers and classmates via social media and email. The newspaper reports other incidents such as a student slapping a language teacher in the face, a student throwing a chair at a teacher, and a student throwing an uncapped water bottle across the room.

“Students are roaming halls unchecked,” a teacher told The Daily Progress in an email. “Students are regularly cursing teachers out with NO repercussions. Consequences are inconsistently applied, if applied at all.”

“I want to assure you that we take the safety and security of our students and staff seriously, and such incidents will not be tolerated in our school,” Principal Darah Bonham communicated to parents.

Perhaps Bonham is serious about “not tolerating” violence. But how did the situation deteriorate to the present condition? Continue reading

Max: Youngkin Right To Veto Minimum Wage

There is a near-universal consensus among economists that increases in the minimum wage harm low-skilled workers the most. Originally designed to mimic racially discriminatory laws elsewhere, the minimum wage continues to be a means of picking certain classes and geographic locations over others. For example, the minimum wage benefits the high-cost-of-living areas in the Northeast over the lower-cost-of-living areas in the South. Continue reading

Posted in Business and Economy, General Assembly, Labor & workforce

Tagged Derrick A. Max

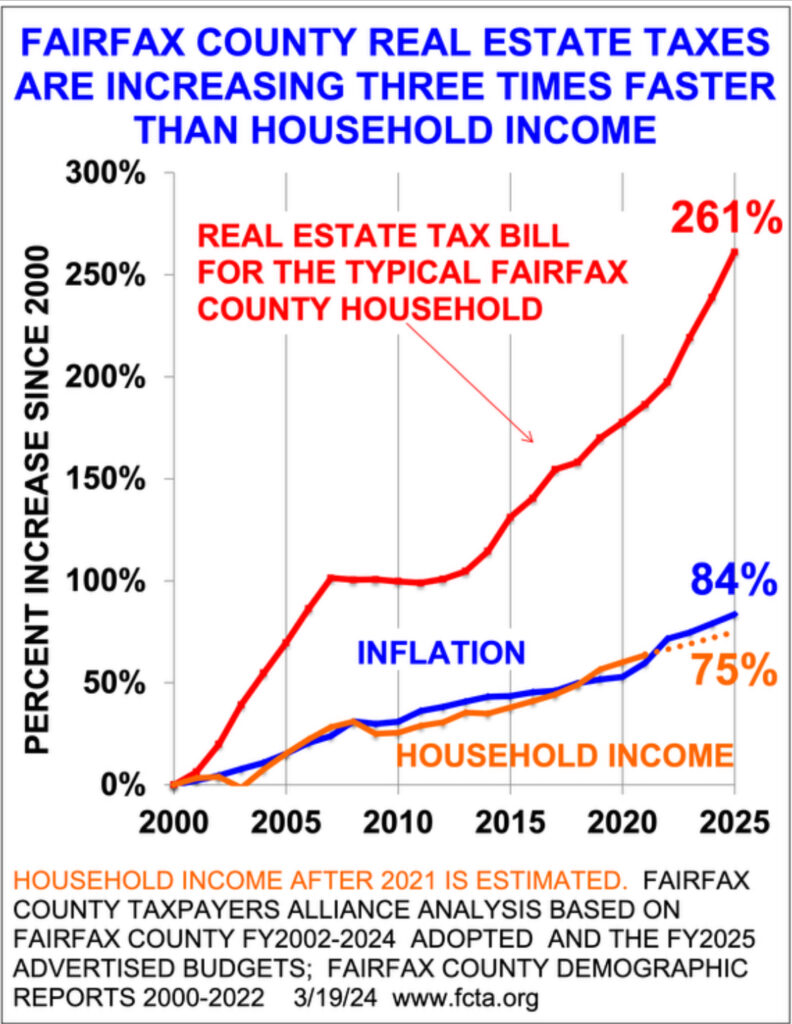

Time for a Fairfax County Salary Freeze

by Arthur Purves

Local government compensation is better than private sector.

On April 30 the Fairfax County Board of Supervisors will vote on next year’s (FY2025) tax increase. The supervisors have advertised a 7% increase in real estate and car taxes to help pay for $360 million in raises for 38,000 school and county employees.

School raises are 6% and county raises range from 4% to 10%. By comparison, the county says that inflation is 2.5%. For next year, the Fairfax County Board of Supervisors, under Chairman Jeff McKay, is proposing a 7.1% or $618 tax increase for the typical residential household. This is the second largest tax hike in ten years, exceeded only by last year’s 8.9% increase.

Next year’s tax hike is made up of an average 6.5% or $531 increase in the combined real estate and stormwater tax, both of which are based on household assessments, plus a 16% or $87 increase in the car tax.

This continues the supervisors’ quarter-of-a century habit of increasing residential taxes three times faster than household income. They are advertising a 4-cent increase in the real estate tax rate, from $1.13 to $1.17 (includes the 3-cent stormwater tax), on top of a nearly 3% average increase in residential assessments.

Unless they hear from homeowners, the supervisors will probably adopt a rate of $1.16 when they finalize the budget on April 30, in hopes that homeowners will be relieved that the rate increased 3 cents instead of 4 cents. Continue reading

Posted in Finance (government), Taxes

VMI Eschews Standards of Excellence, Devalues Diploma

by Joseph D. Elie

by Joseph D. Elie

As an alumnus living in Florida, I have a dearth of information about what is happening at the Virginia Military Institute on a day-to-day basis.

I see the superficial social media postings from the public relations department, the Superintendent, and the Commandant; but I crave the scuttlebutt that tells the truer story.

The recent editorial, “Class of 25: The Elephant in the Room,” in The Cadet was very enlightening, provided much-needed insight and served, in effect, as a detailed report on the Institute.

The editorial also revealed why the administration didn’t want a student newspaper committing acts of journalism – as it validated my own suspicion that Breakout and the entire Rat Line itself have been rendered much less difficult.

From this year’s Breakout videos, the Rats seemed to merely be going through the motions when compared with videos from past Breakouts. The energy, enthusiasm, and the spirit were gone.

The Cadet editorial outlines how VMI’s core standards have been made less rigorous for the sake of maintaining the enrollment retention rate, particularly with regard to the nature and rigor of the Rat Line.

The Rat Line energizes the entire Corps of Cadets. It is an annual rite of passage that the upper classes have historically zealously preserved.

The Rat Line was once extremely difficult to complete and doing so resulted in justifiable pride and a tremendous boost of self-confidence.

Posted in Culture wars, Education (higher ed)

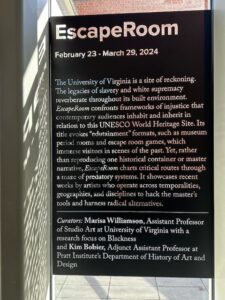

UVA As a “Maze of Predatory Systems”

by James A. Bacon

by James A. Bacon

If you visit the latest exhibit at the University of Virginia’s Ruffin Gallery, “EscapeRoom,” it takes no more than five or ten seconds for the artists’ message to sink in — the amount of time it takes to read the signage at the entrance:

The University of Virginia (UVA) is a site of reckoning. The legacies of slavery and white supremacy reverberate throughout its built environment. EscapeRoom confronts the frameworks of injustice that contemporary audiences inhabit and inherit in relation to this UNESCO World Heritage Site. … EscapeRoom charts critical routes through a maze of predatory systems.

Inside, the exhibits contributed by multiple artists elaborate upon the white-supremacy theme. Five 3D-printed pieces of porcelain, for instance, are described as giving “materiality, scale and dimension to the many ‘tools’ that mediate state violence visited upon Black victims: horses, batons, guns, tear gas, and more.”

A mobile made of steel sheet metal “examines violence visited upon Black people at the hands of the American state. It attends to the paradoxes of Black life and death in this anti-Black world.”

To set foot in the EscapeRoom is to enter a world of victimhood that would have been entirely justified a century or two ago but seems tragically out of date 60 years after the passage of Civil Rights legislation, the enactment of the Great Society’s war on poverty, and the dramatic transformation of attitudes toward race in America — not to mention the implementation of Racial Equity Task Force recommendations at UVA itself that made the exhibit possible in the first place. Continue reading

Posted in Culture wars, DEI, Race and race relations, Virginia history

Tagged James A. Bacon, University of Virginia