|

Here

is the political reality today in many parts of

Virginia:

If you want to develop a major real estate project,

you'd better find a way to pay for the public

investments yourself.

Roads, schools, libraries,

parks, fire stations, you name it... Voters don't

want to foot the bill for newcomers. They're already driving on

congested roads, sending their kids to crowded

schools and paying ever-higher property taxes -- and

they're taking none too kindly to anyone who might add to

their problems.

Over

the years, local governments have been shifting an

increasing share of the cost for public

facilities to developers, who in turn pass on the

cost to home buyers and tenants. Now, in Loudoun

County, things have reached the point where a major

developer, Greenvest, could pony up a mind-boggling $1

billion in public improvements over the 20-year

life of a project.

Greenvest,

based in Tysons Corner, wants to develop 4,200 acres

in the Dulles South area of Loudoun County, building

15,000 housing units and more than one million

square feet of retail and commercial space. To

offset the impact of all those new residents, the

company expects to chip in $200 million for the

improvement of local roads and some $46,000 per

house in proffers for public facilities -- another $860 million. By any measure, it's an

extraordinary contribution.

What's

more, instead of delivering the public improvements

towards the tail end of the development cycle,

Greenvest is promising to phase in many of the improvements up front. That way Loudounites don't

have to wait 20 years for the benefits, says Packie

E. Crown, vice president planning/zoning and manager

of the South Dulles project.

If

self-funding growth, like self-sustaining cold

fusion, sounds too good to be true, it probably is,

counters Ed Gorski, the

Loudoun County land use officer for the Piedmont

Environmental Council. Greenvest

may have good intentions, but Gorski is skeptical that the economics of the project

will work. If the developer takes on too much debt, and

if it fails, he asks, who holds the bag?

Loudoun County does. It makes far more sense, he

argues, to develop those houses, stores and offices in

areas where much of the infrastructure already

exists.

For

Virginia, the

Dulles South battle is shaping up as the titanic planning/zoning struggle

of the decade -- of importance not only for its

impact on the fastest- growing region in the state

but its implications for the wider debate over how

Virginia should handle growth.

On

the one side is Greenvest, a deep-pocketed developer

with financial backing for a $1.3 billion project,

backed by an array of consultants, architects,

engineers, investment bankers and other specialists.

On the other side are the Piedmont Environmental

Council and local citizen groups

determined to block the runaway growth that

threatens their picturesque lifestyle of hamlets and

horse farms in the western reaches of the county. Arbitrating the conflict is the county

government of Loudoun, whose political leaders have

flip-flopped between growth and anti-growth boards

three times in recent elections.

Loudoun

cannot hide from the problem or avoid the hard

decisions. The county stands smack in the path of

growth generated by cauldrons of IT innovation in

Reston, Herndon and Chantilly right across the

Fairfax County line. Business is growing, it's

hiring employees, people are moving to the

Washington metro area, and they need somewhere to

live. The Washington Council of Governments

estimates that Loudoun alone will add 110,000 households

-- not people, but households -- by the year

2030.

The

question is not if development will occur.

The questions are: Where will it occur, what pattern

will it take, and who

will pay for it?

Greenvest

was formed in the early 1990s, in the aftermath of

the Savings & Loan crisis. The two principals,

Jeffrey Sneider and Ahmad Abdul-Baki perfected a

business taking over non-performing loans from

the banks, reactivating the projects and

getting home builders back to work. Starting on

small scale in Fairfax County, they took a big leap

mid-decade when they acquired the Cascades property in

Loudoun County from Chevy Chase Savings Bank.

At that time, Jim Duszynski, now president, left Chevy

Chase and joined the company.

Greenvest

owns 4,200 acres in the Upper Foley and Broad Run

subareas of Dulles South. Located just beyond the

frontier of suburban development encroaching from

Fairfax County, the properties are currently zoned

for very low-density development. But Greenvest is

urging Loudoun County to revise its comprehensive

plan and rezone its three tracts to accommodate a

more "suburban" pattern of

development.

Even

under the Greenvest plan, Dulles South would

represent a density buffer zone between

the conventional suburban development to the east

and the countryside to the west. Densities would

range from about three dwelling units per acre south

of Braddock Road to four acres per unit to the north.

Plans call for ample open space -- wetlands,

flood plains, creek valleys, even "significant

tree stands" -- with buildings clustered in

four separate projects rather than smeared

in large lots over the

landscape.

During

his Chevy Chase banking days, Duszynski had worked with New

Urbanism guru Andres Duany on the famous Kentlands

project in Maryland. To develop ideas for South

Dulles, he visited

several notable New Urbanism projects in the

Southeastern U.S. as well as old urban classics such as Charleston, S.C., and Savannah, Ga.

He hired Stephen Fuller, an Atlanta architect

renowned for his neo-traditional work, to develop

the project's look and feel.

Although

Duszynski sees a place for New Urbanism design

principles in parts of the development, he plans to

offer a variety of architectural styles.

"You've got to provide chocolate, vanilla and

strawberry," he says. "It shouldn't be all

neo-traditional or all cul de sacs. There should be

a variety of housing types and layouts to meet all

the different market segments out there. You don't

want it to be monolithic."

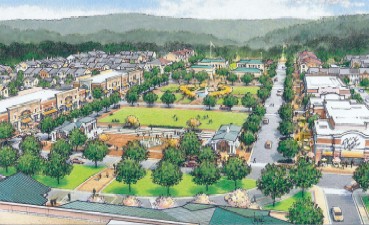

Conceptual

rendering of the Greenfields Town Center

The

proposed Lenah community, one of the four mixed-use projects,

illustrates the way Greenvest plans to blend

traditional and contemporary design elements. The

streetscapes all will be walkable. There will be an

architecturally prominent neighborhood school serving as a visual

focal point -- two

stories tall, with a bell tower -- along with a pedestrian-friendly

neighborhood commercial center. Houses will be set

back from the sidewalks by varying distances but, in

a New Urbanism no-no, will have garages facing the

street. In another departure from neo-traditional

design, there will be no alleyways.

In

what the Greenvest team hopes will be a big selling

point, the project will include 12.5 percent

"workforce" housing, that is, units

affordable to working and middle class residents.

The price of housing in Loudoun has gotten so

expensive that newcomers earning the median income

can't afford to buy, says Crown, the Greenvest

project manager for South Dulles. "Two teachers

making $50,000 a year earn more than the median

income. But they can't afford to buy a

million-dollar home."

The

principal of one Loudoun elementary school told her

that 80 percent of the teachers live outside the

county, says Crown. Loudoun is experiencing similar

problems finding sheriffs, healthcare providers,

fire fighters and rescue workers. "They're hard

to recruit."

The

solution is remarkably simple: Build smaller housing units.

Greenvest proposes about one-third of the affordable

houses to be detached, one-third attached and

one-third townhouses.

From

the inception of the project, Duszynski says, the

goal has been to design a project where "growth

pays for itself." Greenvest has taken a

holistic approach, designing its projects with an

eye toward other projects planned or zoned for the

area west of Dulles airport. Paying particular

attention to the local transportation network,

mostly two-lane country roads, Greenvest has

proposed some $200 million in road improvements

funded through Community Development Authorities.

That financing platform, combined with proffers and

privately-funded road projects by other developers, will amount to a

total private investment in the area of more than $700 million

in the road network.

Greenvest

isn't making those improvements out of pure,

philanthropic motives. "We've got to market our

projects. We can't market them unless people can get

to them," explains Crown. "All these roads are

substandard today. Without some level of

development, they're going to remain

substandard."

Greenvest

also proposes making significant contributions

toward the development of public facilities and

amenities. The Arcola project calls for donating

land to George Mason University for the construction

of a Loudoun County campus. Greenvest also would

build an elementary school in an early phase and

deed it to the county to operate -- providing immediate

schoolrooms for the

fast- growing

county and bypassing the long, cumbersome government

process for getting a school built.

|

Conceptual

design of Arcola Town Center |

"We

fully anticipate paying a lot of

proffers," says Crown. Facilities would

include schools, recreation, fire and rescue.

Capital expenditures for public amenities are expected to average

about $46,000 per housing unit. Part of that

sum includes a $500-per-house contribution

towards implementation of a Traffic Demand

Management plan. |

Greenvest's preference

is to purchase some 15 transit buses and erect a

regional transit-transfer station to create a

serious mass transit option for eastern

Loudoun.

What's

distinctive about the Greenvest proposal is the

creation of three Community Development Authorities

-- two for roads, one for the elementary school --

that will issue bonds for construction of critical infrastructure up front.

Traditionally, developers would phase in proffers over the 20-year life

of a project. As contemplated in Greenvest's

original filing, by contrast, the CDAs would raise $192

million immediately. (Crown acknowledges that inflation has

driven that number north of $200 million since the

filing.)

The

purpose of building infrastructure up front,

explains Crown, is to avoid problems encountered elsewhere in which an influx of

new residents

overwhelmed local roads and public facilities before

the proffers were paid and the improvements were

built. "Looking across the country for models

for how to get these things done, we found that CDAs

are proven in high-growth areas," says

Duszinski. "There's not another way to finance

something of this magnitude."

Ed

Gorski, a former Loudoun County planner, now works

for the Piedmont Environmental Council as Loudoun

County land use officer. He's taken the lead for the

PEC in analyzing the Greenvest project. He doesn't have much

good to say about it. It's the wrong project in the

wrong place at the wrong time, he says. "The infrastructure’s

not there," he says. "The infrastructure will be inadequate for

years if they get the land rezoned."

In

Gorski's assessment, the Greenvest projects have three major

problems. First, they will overwhelm the local road

network. Second, Loudoun should promote growth in

areas where infrastructure already exists. And

third, the project is financially risky; Loudoun

County could be on the hook if it fails.

Bacon's

Rebellion addressed the first set of issues -- adequacy

of the local transportation system -- in the July

24, 2005 edition. In

a nutshell: Greenvest says that private developers

have proffered or are planning $700 million in road

improvements in the area west of Dulles airport; PEC

cites a Virginia Department of Transportation study

indicating that development of South Dulles would

send ripples of gridlock running for miles to the

south, east and north. (See "Loudoun

Lightning Rod," July 24, 2006, for

details.)

Greenvest

is part of a bigger problem, Gorski says.

Northern Virginia is projected to experience

tremendous population growth over the next 20 years,

and Loudoun is positioned

geographically to absorb the brunt of that growth:

110,000 households between 2000 and 2030, according

to Washington Council of Governments projections.

That's a 184-percent increase. Under the best of

circumstances, such a surge would place an incredible strain

on roads and infrastructure of what had been a

county dominated by farms and villages.

Even

with that tidal wave of growth, Gorski says, Loudoun is

massively over zoned. "The plan calls for non-residential build-out of between four and five

Tysons Corners. There's never going to be that level

of [commercial construction] here." The county also has

planned "vastly more residential planning than

they can afford. ... They're not going to be able to

build enough lanes on the three main east-west

arteries to handle the traffic. There just isn't the

room."

If

growth must occur on that scale, says Gorski, it

should take place along Route 7 and Route 28 where

it has been anticipated ever since Loudoun began

planning in the early 1980s, and where the county

has made infrastructure improvements. Zoning has

been approved for 37,000 more homes, a seven- or

eight-year supply, assuming a continuation of recent

growth rates of 6,000 new homes per year. If home

building slows -- as it seems to be doing -- that

could stretch into a 10-year supply.

Which

leads to the next objection: Gorski thinks there is

a significant risk that the Greenvest project could

flop. "In

30 years, I've seen only one development project do

significant infrastructure improvements up

front," Gorski says. "And they went

bankrupt."

That's

of concern to more than just Greenvest. Once thousands of families have moved into

the area, he argues, they would clamor for Loudoun County to

step in and fulfill Greenvest's commitments.

When

developers pay for improvements of the magnitude

Greenvest is offering, they typically phase them in

over the life-time of the project. But

building $200 million or more in improvements up

front will entail significant financial carrying

costs. As lots are sold, home owners will assume the

burden for paying off those bonds eventually, Gorski says, but

early in the project the developer is at serious

risk. "The problem is those first three to five

years. If they can't generate the occupied rooftops,

they're not going to get the money to pay off the

CDAs. There's going to be an issue as to whether

they'll generate enough revenues to pay the

bonds."

If

Greenvest fails, who will pay the bond-holders? Says

Gorski: "You'll have schools and roads. Who's in the

market to buy schools and roads? ... The bond-rating

agencies anticipate Loudoun stepping in to fill the

fiscal gap."

Gorski's

fears are unfounded, Greenvest officials insist. Greenvest

will deed the elementary school to Loudoun County,

so there's no possibility of bond-holders taking it

back. As for the roads, they aren't at risk either

-- it's not as if bond-holders could roll them up

and take them back to New York. The collateral

spelled out in the Community Development Authority

bonds will be the land, now much more valuable

thanks to the improvements. If potential bond

investors say there's not enough collateral to

provide them the margin of safety they want, the

deal won't get done. End of story. No risk to the

county.

But

Gorski raises other objections. He believes that

Greenvest's proposed road improvements fall way

short of what's needed. They won't come close to

paying for needed improvements. Greenvest's

investments will help meet the needs of the existing

county road plan -- but that road plan is predicated

on 5,000 households not the 15,000 that Greenvest

wants to build. The county transportation plan would

be obsolete the day Greenvest got its rezoning.

Gorski

also raises ticklish issues of fairness. Greenvest

home buyers will be paying some $2,000 a year to pay

off the CDA bonds while neighbors outside the CDA

districts will not. "What happens if the county

redistricts the school districts, and little Johnny

isn't going to the school the family is paying for?

And what if kids from outside the boundary start

attending that school but the parents aren't

paying? That'll create an issue."

Round

and round the arguments go. But the big picture gets

lost in the dust. The Washington metro

area is forecast to have tremendous growth over the

next 30 years. Where should it go? If not in South

Dulles, where? And what form would the development

take?

"We're

not having the right debate," contends George K.

McGregor, Greenvest director of community

planning. Should Loudoun turn down the Greenvest rezoning plan,

is the status quo -- development of 5,000 houses on large lots, with developers

contributing nothing for new roads and public

facilities -- any more attractive? Are Loudoun citizens, concerned about

the traffic

impact, going to be happier if growth hops over

Loudoun to the next county -- and all those people

clog Loudoun roads driving to work in Fairfax

County?

Bottom

line: There are no simple solutions for Washington's

runaway growth. Every alternative poses an element of risk.

Someone always ends up holding

the short end of the stick. If planning for growth

were easy, someone would have stumbled across the

formula by now. But no one has. If we can avoid monumental fiascos, we're doing about as well as

we possibly can do.

--

August 7, 2006

|