With the stock market taking a beating, all of a sudden economists are uttering the “R” word — recession. JPMorgan Chase & Co. has put the odds of a U.S. recession beginning within 12 months at one in three — up from an 8% probability a year ago, reports the Wall Street Journal.

Central Banks in Europe, Japan and the United States are walking back quantitative easing policies designed to fight the past recession, and interest rates are rising. Germany and Japan both reported negative growth in the past quarter, and the Chinese economy is slowing. The expansion of global trade has diminished to a crawl. The dollar is increasing in value, putting developing countries that went on a borrowing binge — in U.S. dollars — under heavy pressure.

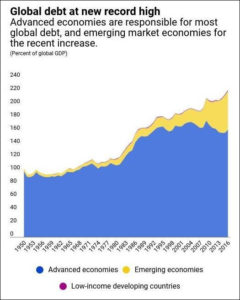

The U.S. economy remains strong for the moment. But if developing nations start going Venezuela on us, it’s not entirely clear which banks, hedge funds, and other investors might go belly up, launching investors worldwide into risk-avoidance mode and sending cascades of fear ripping through the global economy in unpredictable ways — just as the subprime-mortgage fiasco did in 2007. The governing authorities did not foresee the last recession, and it’s like that the masters of the universe won’t see the next one coming until it’s upon us. One thing you can count on: With global debt as a percentage of global GDP at record highs, the unwinding of trillions of dollars of banking, corporate, government, and consumer debt will be frightful.

As I reported three weeks ago, Secretary of Finance Aubrey Layne conducted a sensitivity analysis of the Virginia budget to see what would happen if a recession comparable to the last one occurred. General Fund revenues would decline from $21 billion a year by $9 billion a year over three years. Admittedly, no one is predicting such a scenario… at the moment. But we would be fools to ignore the possibility, given the fact that the Commonwealth has set aside reserves utterly inadequate to help it through a 40% downturn in General Fund revenue. The impact on state governance would be catastrophic.

Against that backdrop, Virginia is flush with revenue right now from better-than-forecast economic growth and a series of potential windfall gains resulting from federal tax cuts, a Supreme Court ruling on Internet sales taxes, proposed entry into a regional carbon cap-and-trade system, and a Medicaid tax on hospitals. The big question is, what do we do with this money? Do we crank up new spending programs? Do we give some of the money back to taxpayers? Or do we build up our financial reserves to spare Virginia some of the trauma stemming from a possible reprise of the last recession?